New challenge for brewers: sinking sales

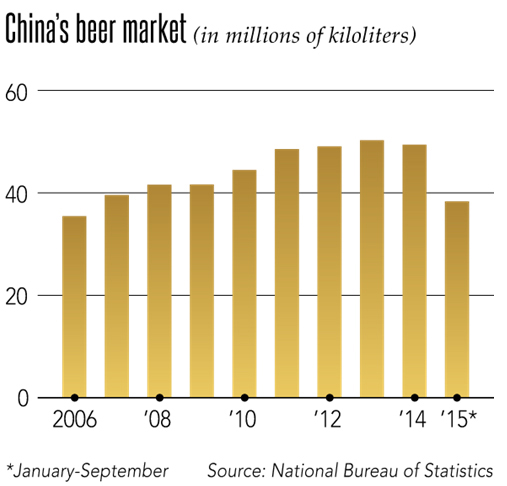

After decades of rising sales, brewers in China have to adjust to a new reality: beer sales in China fell 7.3 percent in the January to September period last year. Beer sales dropped for the first time in 2014 and the downtrend continued into 2015.

Brewers are responding to this decline by shutting down facilities and slashing advertising budgets, Asian media say.

In Chongqing, an inland industrial city, Chongqing Brewery, in which Carlsberg has a stake, decided to close two sales and production sites. The sites account for around 3 percent of its total sales. Decrepit facilities have made them money losers, it was reported.

Chongqing Brewery expects to post a net loss of 58 million yuan (USD 8.82 million) for fiscal 2015, which ended 31 December 2015.

Meanwhile, both the number one brewer CR Snow (the joint venture between SABMiller and CRE) and the number three player AB-InBev are said to be trimming ad spending.

For many brewers in China, this is the first time they have had to worry about declining sales. For decades, the market expanded steadily, thanks to the country’s economic growth. To capitalize on the surging demand, big players swallowed up small ones. At one time, China had some 800 brewers; today, the top four companies – CR Snow, Tsingtao, AB-InBev and Yanjing control 66 percent of the market.

After the acquisitions, large companies are stuck with local breweries that are too old and inefficient to make beer profitably. Many production lines at the smaller breweries are sitting idle. Allegedly, CR Beer is using only half of its overall capacity at its 98 breweries.

It seems that brewers are finding themselves under heavy pressure to scrap unprofitable breweries and scale down their workforces.

After the party the hangover

Keywords

China international beverage market statistics

Authors

Ina Verstl

Source

BRAUWELT International 2016