All eyes on China and CR Snow after the creation of MegaBrew

Most analysts seem to believe that once AB-InBev takes over SABMiller, it will have to sell SABMiller’s 49 percent stake in Chinese brewer CR Snow to appease China’s regulators. Combined, AB-InBev and CR Snow would hold a 38 percent market share. SABMiller, through CR Snow, holds a 23 percent share, while AB-InBev has a 15 percent share.

It will be remembered that following InBev's acquisition of Anheuser-Busch in 2008, the newly formed company fell foul of China's new anti-monopoly law. The regulator said the new drinks behemoth would be unable to increase its pre-existing stakes in Tsingtao Brewery and Zhujiang Beer, forcing AB-InBev to sell off its 27 percent stake in brewer Tsingtao.

This time round, however, some market observers argue that retaining Snow in China would be key for the new group’s future growth story because in China SABMiller has demonstrated so well its expertise in new market development.

While the world has been waiting for AB-InBev to make a formal bid for SABMiller, media have been wondering whether SABMiller’s greatest achievement to date – the growth of its business in China – is really worth the hefty premium which AB-InBev will have to pay for the job lot.

As the Wall Street Journal pointed out recently, China’s beer market slowdown is worsening a persistent problem for SABMiller. Despite the massive amount of beer consumed there, turning a decent profit is not easy.

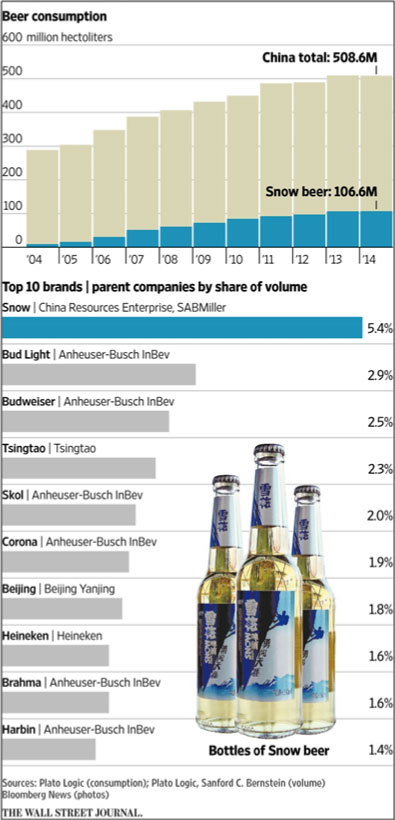

“China accounts for a quarter of the world’s beer volumes and a tenth of the revenue but makes up just 3 percent of the global profit pool, according to Deutsche Bank. SABMiller, whose co-owned Chinese brand Snow is the world’s largest-selling beer (106 million hl in 2014), gets just 2 percent of its operating profit from China, even though the region makes up fully 20 percent of its global beer volumes,” the newspaper says.

In China, the top five brewers - CR Snow, Tsingtao, AB-InBev, Beijing Yanjing and Carlsberg – together control 70 percent of the beer market, with EBIT margins ranging between 6 percent and 9 percent.

Now, after decades of robust growth, beer volumes in China are in decline and turning a profit will get even tougher.

Beer consumption, which had grown at more than 6 percent a year on average over the past decade, dropped for the first time in 2014. Beer executives blame the decline on a range of temporary factors like the economic slowdown and bad weather.

But analysts worry, says the Wall Street Journal that the slump could be longer-term as China’s population ages and per capita beer consumption declines.

Last year, consumption of Snow was roughly flat at 106.6 million hl, down sharply from the 9.8 percent rise logged in 2013, according to data firm Plato Logic. SABMiller in July said its volumes in China dropped 3 percent for the quarter ended 30 June 2015.

SABMiller has been struggling to squeeze more profit out of China for years. Back in 2006, the company promised that China would “become a meaningful contributor” to its profit in the next five years. Nine years on, the promise is, well, still a promise. SABMiller is forecast to earn around USD 300 million in EBITDA from China this financial year, which must be considered small fry in view of the fact that profits from its Australian unit (7 million hl beer) are estimated to be almost three times as big.

In recent years, SABMiller has been trying to sell more premium beers in China, embarking on a strategy long employed by AB-InBev, whose more premium portfolio of beers—including Budweiser—has allowed it to raise profits. In 2011, AB-InBev launched Stella Artois in China and last August took Corona back in-house, ending a distribution deal with Carlsberg.

CR Snow has attempted to sell more premium variants under its Snow umbrella brand over the past few years, raising average selling prices to improve margins. The company’s Snow Opera Lady and Opera Gent beers retail for 25 yuan (USD 3.93) a bottle, compared with 3 to 5 yuan (USD 0.79) for a bottle of the mainstream Snow brand, The Wall Street journal points out.

Whether this strategy is really the answer to everything is open to debate. Analysts have criticised the focus on Snow variants, saying SABMiller should introduce more of its international brands in China. SABMiller’s U.S. brand Miller Genuine Draft, reintroduced in China in 2012 after a luckless launch in 2006, sells in only one Chinese province, observers say. Ari Mervis, SABMiller’s Asia-Pacific head, announced SABMiller would start selling Peroni, Grolsch and Pilsner Urquell – but only online - to test consumers’ appetite for the brands.

The reason why SABMiller has been held back from launching its international brands in China may have something to do with its partner China Resources Enterprise, in which the state-owned China Resources Holdings own an indirect stake of about 52 percent. Investec analyst Anthony Geard was quoted as saying that SABMiller’s hands might be tied. “CR Snow is ultimately controlled by government thinking,” he said. “Perhaps the Chinese partner, which has ultimate control, has a much more nationalistic approach and wants to establish a suite of Chinese and home-grown lagers.”

In terms of volume sales, the Chinese’s approach may make more sense: launching a premiumised version of a local brand could be more economically appealing.

The jury is still out if AB-InBev will be comfortable letting go of the low-margin Snow brand. One thing is certain, though: If AB-InBev were to lose CR Snow's facilities it would mean they will miss out on the valuable distribution network through which to market its premium Budweiser beer to more towns and villages across China.

CR Snow owned around 100 breweries in China with a total annual production capacity of 155 million hl beer last year, according to Deutsche Bank.

Consequently, if SABMiller’s Chinese partner CRE decides not to buy-out SABMiller's stake, and China's antitrust watchdogs force a sale, then bankers expect huge interest from Chinese and foreign brewers. SABMiller’s stake in CR Snow has been valued at around USD 4 billion and bankers say any sale could lead to a full-blown auction.

Whichever way the Chinese beer market will head in the medium term, things could get really interesting.

China: the foam is collapsing