New turn in Asahi litigation case

Now comes the counter attack. The two private equity firms that are being sued for NZD 500 million (EUR 320 million) by Asahi over their sale of the beer-cum-alcopop company Independent Liquor have retaliated by filing a cross claim against two of Independent’s most senior Australasian executives, Australian media reported at the end of March 2014.

In August 2011, Japan’s Asahi bought New Zealand company Independent Liquor from private equity outfits Pacific Equity Partners (PEP) and Unitas Capital for USD 1.3 billion – a price tag many thought bloated even then.

Eventually, this began to dawn upon Asahi too and in February 2013 Asahi took PEP and Unitas to court, alleging they had inflated the earnings of the Independent Liquor business. Asahi claimed Independent's earnings were manipulated through a process of "channel stuffing" whereby sales – and hence earnings – are brought forward by pumping inventory through the system. They also alleged key information about declining earnings was kept from them.

The private equity sellers deny these claims and have previously said that Asahi and its team of advisers had access to all relevant facts during the three-month due diligence period.

With their cross claim, PEP and Unitas hope to torpedo Asahi's accusations by implicating the two executives who were responsible for preparing the estimates on which Asahi bought the business.

Court documents filed on behalf of PEP and Unitas show that the private equity firms have joined Greg Ellery and Julian Davidson, the heads of the Australian and New Zealand arms of Independent, in the case. The cross claim filed in the federal court alleges that both men were directly involved in the preparation of estimates that Asahi says overstated the company's earnings by more than 30 percent.

The legal move appears to be aimed at weakening Asahi's case by posing the question: if the accounts were misleading, why is Asahi continuing to employ the pair in senior roles in the business?

Days later, BRAUWELT International was told Greg Ellery had left Independent.

The case is set down for hearings to start on 21 May 2014, it was reported.

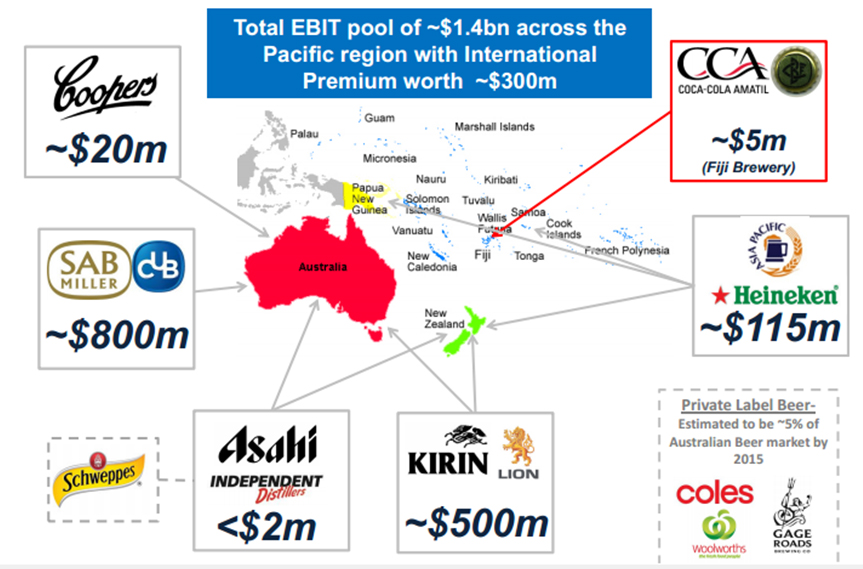

Independent was one of a series of major acquisitions by Asahi, which also purchased Schweppes and P&N in Australia, as it tried to follow in the footsteps of rival Kirin in acquiring investments in Australasia to boost its offshore earnings.

Besides, from what BRAUWELT International has heard, Independent was to become Asahi’s vehicle through which it was hoping to do big international acquisitions. According to rumour, the now-gone Mr Ellery was given an AUD 12 billion (EUR 8.2 billion) war chest. What’s to become of these plans now?

The Asahi versus PEP and Unitas litigation case is one of the largest and most closely watched in recent times in Australia. If Asahi were to succeed, this would have massive reverberations across the whole of the private equity world. After all, the buying and selling of companies is private equity’s bread and butter business. Getting the legal stuff right is what they excel at.

Therefore, it’s hard to imagine that PEP and Unitas will be convicted of any wrongdoing. It will also be remembered that in 2013 AB-InBev locked horns with private equity firm CVC over the sale of their central European unit which later became the brewer StarBev and was sold to Molson Coors. From what BRAUWELT International has heard, Anheuser-Busch lost their case against CVC.