Heineken and Efes end their partnerships in Kazakhstan and Serbia

They probably call it an amicable separation. In late December 2012 Heineken and Efes terminated their partnerships in Kazakhstan and Serbia. The divorce did not come unexpectedly. Following the tie-up between Efes and SABMiller in 2011, it was just a matter of time before Heineken would walk away from this marriage of convenience with Turkey’s brewer Efes.

Dutch Heineken rightfully worried that, as a consequence of Efes’s new corporate marriage with SABMiller, Efes would lose interest in their four year old liaison.

It was in 2008, when Heineken and Efes thought it best to overcome their disadvantageous positions in these two markets by throwing their lots in with each other. Putting economic sense before corporate pride they decided that by clubbing together they would stand a better chance of conquering these two markets.

As per agreement signed by the two brewers in December 2012, Heineken will sell its 28 percent stake in Efes Kazakhstan to Efes Brewing International (EBI), while Heineken will acquire EBI’s 28 percent stake in Central Europe Beverages (CEB), the holding company for the Serbian operations, thereby obtaining full ownership.

Selling the minority cross-holdings to each other will result in a consideration to be paid by EBI to Heineken of USD 161 million.

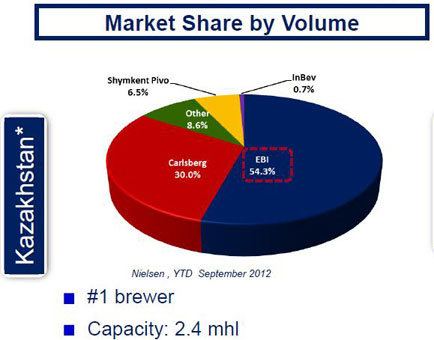

That Efes has to buy out Heineken indicates that Kazakhstan is a far more lucrative market than Serbia. Its 16 million people consumed just under 40 litres of beer per capita in 2011 says Efes. When Heineken and EBI formed their partnership in Kazakhstan, EBI ranked second with 25 percent of the market, while Heineken ranked fifth with 5 percent. Today EBI is the leading brewer in this Central Asian country, having overtaken BBH/Carlsberg since.

It’s an altogether different picture in Serbia, a Balkan country of 7.4 million people. Between 2005 and 2011, the domestic beer market has shrunk by 14 percent because of the country’s economic woes. Per capita beer consumption has dropped to 66 litres in 2011 from 77 litres in 2005.

In Serbia, today, the Efes/Heineken partnership is a distant third as the former InBev-, then StarBev- and now Molson Coors-owned brewer Apatin has over 50 percent of the market and Carlsberg around 28 percent according to estimates.

Incidentally, Carlsberg Serbia is the only brewer to have increased its market share to 28 percent in 2011 from 18 percent in 2005, it was reported.

Looks like Efes got a far better deal in the end than Heineken.