The Brewers Association released annual production figures for the U.S. craft brewing industry. In 2021, small and independent brewers collectively produced 24.8 million barrels of beer and realized 8% growth, increasing craft’s overall beer market share by volume to 13.1%, up from 12.2% the previous year.

Beer market Finland | Although Finland is part of the Nordic countries, it is not only its language that makes it stick out. The Finns also go their own way when it comes to beer and alcohol. As beer consumption is in decline and the pandemic has hit craft brewers particularly hard, the pressure is growing for further curbs on the state monopolist retailer, Alko.

75th anniversary | With a one-year delay, the 38th EBC Congress will take place in Madrid from 29 May to 2 June 2022. It also marks the 75th anniversary of the EBC as well as the centenary celebrations of the Cerverceros de España, the brewers association of Spain. BRAUWELT International talked with Benet Fité, EBC President, about the event, the current situation, changes in the programme and the topics presented there.

The changing world of craft beer | 2021 was a tough year for American craft brewers – between supply chain blockages, can shortages, competition from ever-new “Beyond Beer” drinks, shrinking retail shelf space, and, oh yes, that little problem of the pandemic. It’s truly a testament to the stick-to-it-ness of the brewers that the craft beer category, following a decline in 2020, accelerated to high single digit growth.

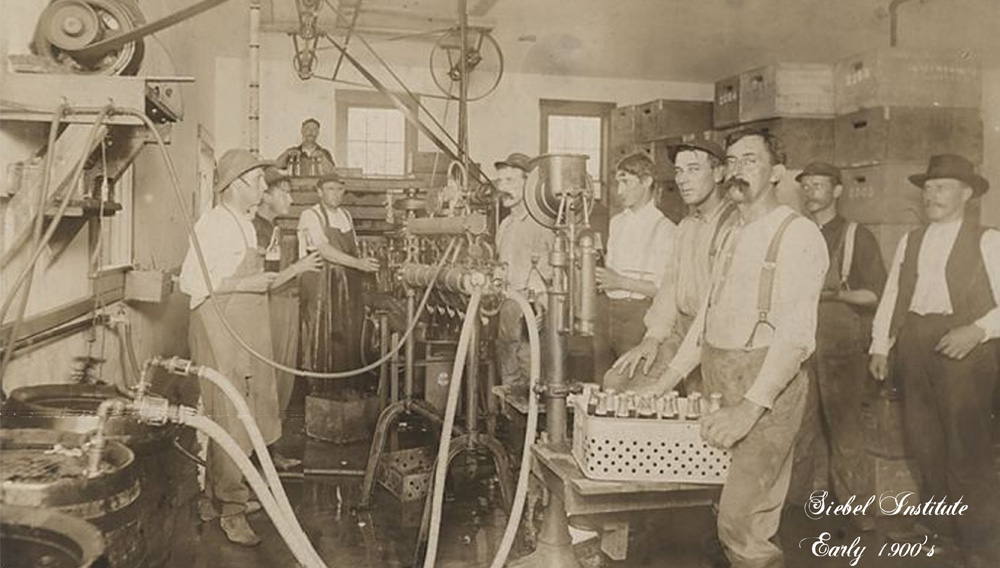

Services and education | As the Siebel Institute celebrates its 150th anniversary, it has much to look back on – right to its beginnings when a German immigrant saw an opportunity to offer services and education to US brewers. Over time, Siebel has grown into a leading institution for brewing education, defying industry consolidation, Prohibition and even its own financial troubles. Transformation and change have been part of its history, but there is one constant, though. As it evolves and progresses, it will always honor its legacy of providing the highest standards in brewing education.

Market overview | As 2022 begins, the brewing materials supply chain continues to face several challenges caused over the past two years, some related to the global pandemic, but several the result of non-pandemic related events. High market prices influenced by supply shocks in the face of strong demand have created a situation where it is hard to predict what to expect next, except we can be certain market volatility will remain well into 2022 and likely beyond. As Managing Partner for RMI Analytics, a market insights and networking platform provider for the brewing industry’s critical brewing materials supply chain, Brent Atthill gives an overview over the current situation.

New organics regulation | The market share of organic products in Germany and Europe continues to grow strongly. From 2010 to 2020, sales in Germany grew by 249 % from EUR 6.02 billion to EUR 14.99 billion, according to Statista. The new Organic Regulation by the EU will impose stricter requirements on the composition of flavourings. What does this mean for beverage producers?

Creative approaches | Part 1 of this two-part article series outlined the new strategic challenges faced by breweries in the current craft beer environment to get their products from the mash tun and fermenter to the consumer’s table. While part 1 dealt primarily with conventional, primarily off-premise, and mostly “Three-Tier”-conform channels into the trade, this part 2 focuses more on creative, micro-targeted, or segment-target approaches, including online, to moving beer to market in today’s modern, rapidly changing alcoholic beverage environment.

Digital platforms | In today’s climate, political issues – from public health to energy supplies and road planning – have become hotly contested. Stakeholder groups are dragging business leaders into debates that have little to do with their commerce. Breweries too have entered into the fray, willingly lending their names to causes by brewing special beers and making donations. But this year’s events have shown how easily Twitter and Instagram can be turned into public pillories, destroying reputations and skewering business plans in their wake.

A rocky road | American craft beer had to face some serious challenges in the past ten years: the corona pandemic; the rise of alternative beverages; a shopping spree by Big Brewers; and a shift in consumer behaviour. Part 1 of this new two-part article series on the challenges in a brave new craft world deals primarily with conventional, mainly off-premise, and mostly “Three-Tier”-conform channels into the trade. The second part will focus on some of the more creative strategies breweries employ in their many struggles to do well in the modern and rapidly shifting alcoholic beverage retail environment. It will be published in BRAUWELT International 1 2022.