Looks like selling US craft beer abroad has become more of a challenge. And it’s not because of unfavourable currency swings. As anyone will know who follows Brauwelt’s newsletter, there is more competition from local craft brewers in many of the markets that US brewers are exporting into.

The US rumour mill is working overtime that AB-InBev could buy out the listed craft brewer Craft Brew Alliance (CBA) from Portland, Oregon, with brands like Kona, Widmer Brothers and Redhook. AB-InBev already controls a 31.5 percent stake in the craft brewer, thanks to the old Anheuser-Busch having made an initial investment in Redhook in 1994 and in Widmer in 1998. Today the two are so enmeshed in each other’s affairs, analysts say, that it’s probably time the Big Brewer just took over the craft beer maker, lock, stock and barrel.

Greg Koch is not a happy man these days. He has to sue the number two brewer in the US, MillerCoors, because it has shortened the name of its beer brand “Keystone” to “Stone” in its recent 2017 rebrand.

In the years since 2013, when Constellation Brands added the Mexican brands Corona, Modelo Especial, Victoria and Pacífico to its portfolio, its beer market share in the US has tripled. Now the company plans to invest up to USD 600 million at its Mexican breweries during 2018 to keep its growth.

The 8th Ibero-American Symposium, organized by VLB Berlin, was held from October 23rd to 25th of 2017 in Guatemala City. The conference program included presentations on a wide range of topics, starting with the raw materials used in beer production, moving on to bottling and packaging, and culminating in a more global note with topics such as sustainability. VLB Berlin was supported by Cervecería Centro Americana and by the market researchers at Euromonitor International.

Tequila remains in demand. Bacardi has agreed to buy out Patron Spirits International in a deal valuing the high-end tequila maker at USD 5.1 billion. Bacardi, the world’s largest private spirits business, already owns 30 percent of Patron, which it purchased in 2008 from businessman founder John Paul DeJoria, 73, who is equally famous for co-founding the shampoo company John Paul Mitchell Systems.

It’s probably called flexibility. For the second time in as many years, Pabst Brewing Company has undergone a major restructuring, announcing on 18 January 2018 that it has eliminated a total of 70 positions or 18 percent of its workforce.

Don’t you sometimes marvel at the stories that are sold to the public to explain a deal’s rationale? The US soft drink maker Dr Pepper Snapple is to merge with coffee company Keurig Green Mountain to form Keurig Dr Pepper. The transaction was announced on 29 January 2018.

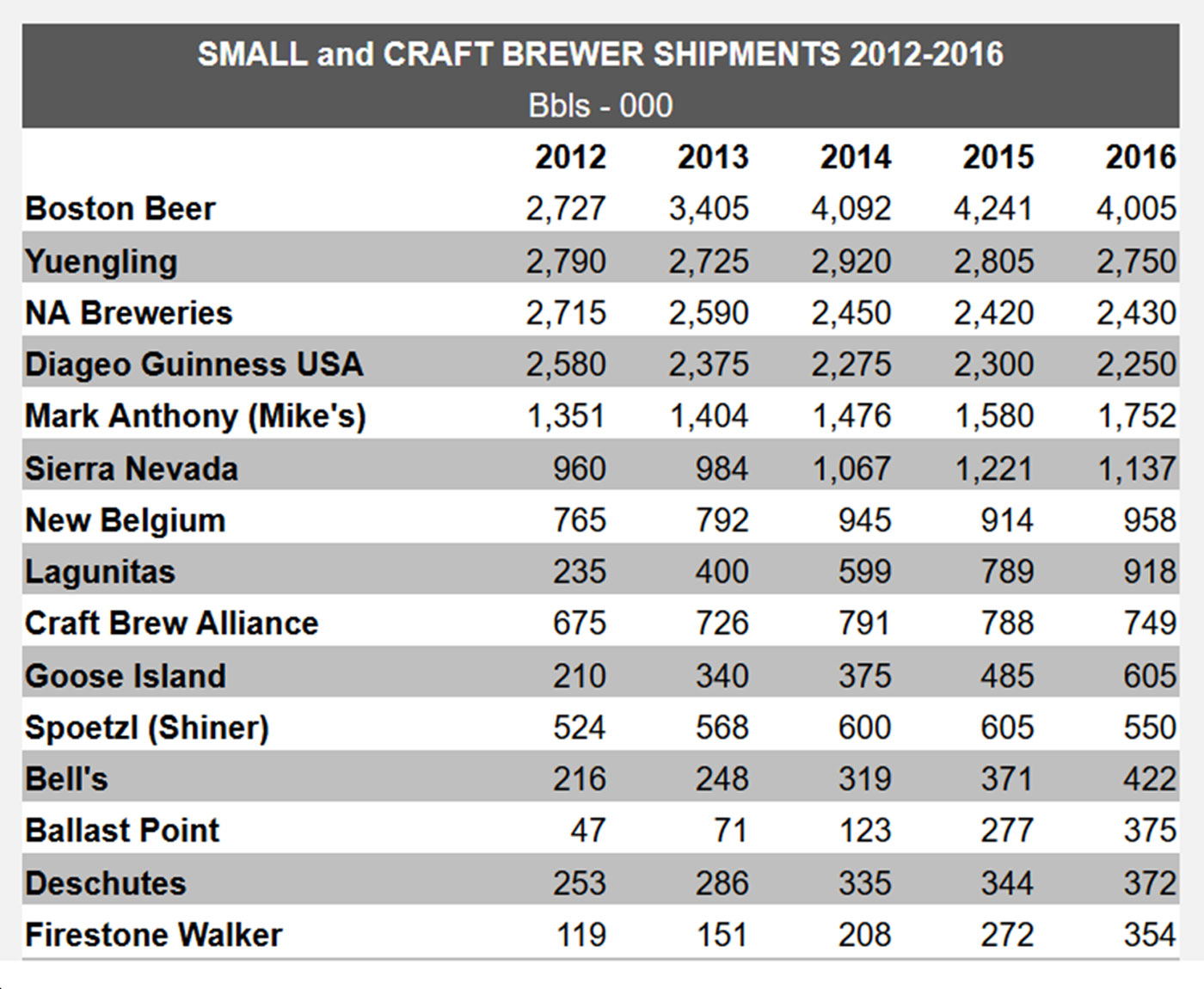

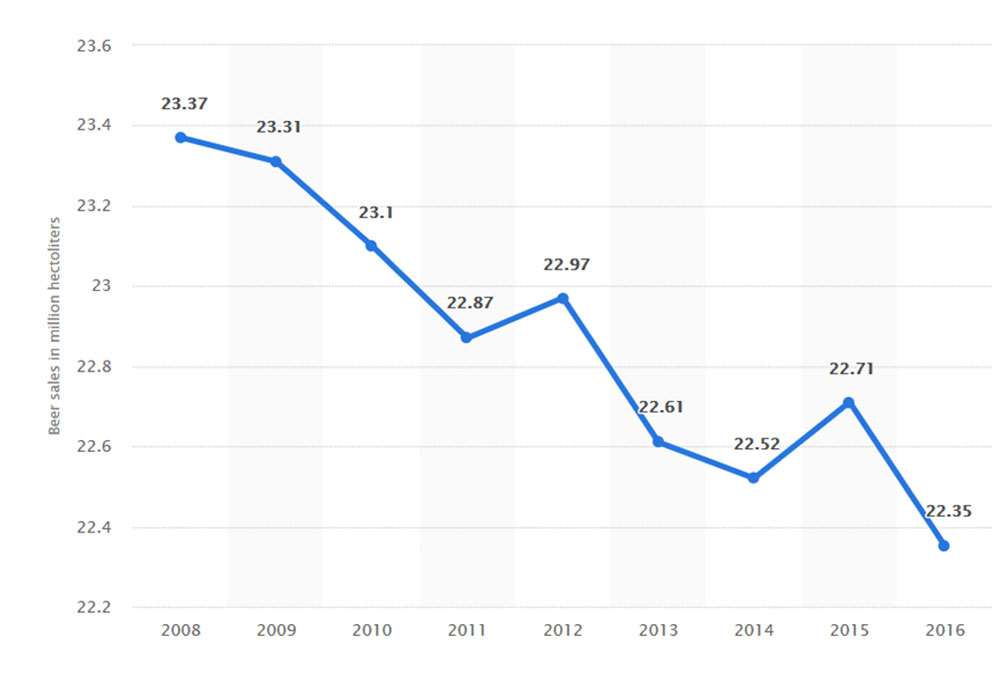

The distributor of Corona in the US had the best performance of any brewer in 2017, media say. While craft beer sales have slowed and the overall beer industry remains stagnant, if not in decline, Constellation Brands has continued to grow its business regardless.

The federal tax on domestic and imported beer rose by two percent last year as part of the 2017 budget. It will continue to increase every year in line with inflation starting this April, it was reported.