The three biggest beer trade organisations – the National Beer Wholesalers Association (NBWA), the Brewers Association (BA), and the Beer Institute (BI) – launched their “Beer Growth Initiative” on 24 September 2018, in an effort to fight against beer’s dwindling market share in the face of other alcoholic beverages.

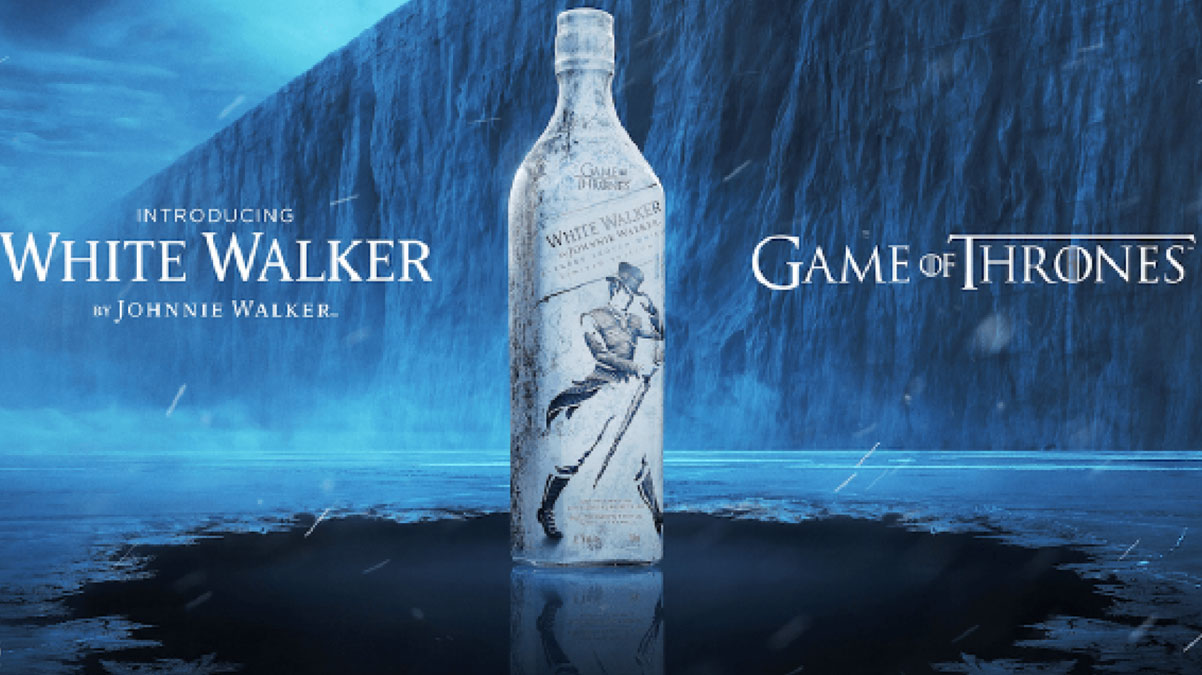

First, you got Game of Thrones beer (by Ommegang brewery). Then you got Game of Thrones wine. Now, spirits company Diageo and HBO have partnered on a new scotch dedicated to the humanoid creatures.

Don’t trust promises of “nothing changes”. In September 2018, Heineken-owned craft brewer Lagunitas not only announced a major round of redundancies affecting over 100 employees, it also will soon be brewing Heineken-owned Newcastle Brown Ale at its Petaluma and Chicago facilities, US media report.

Lagunitas Brewing, the fifth-ranking US craft brewer, is laying off 12 percent of its staff, blaming a softening US craft beer market. The brewer was bought by Heineken in two tranches in 2015 and 2017 for allegedly USD 1 billion. It sold over 1 million hl beer in 2017.

It was only a matter of time before Coke would show an interest in the cannabis market. Brewers like Molson Coors and Constellation Brands have already declared their interest in the billion dollar industry. According to a report by Bloomberg in September 2018, Coke is weighing its cannabis options as a possible alternative to its sugary drinks, which are becoming more and more discredited by consumers.

Jim Koch, the founder of Boston Beer, picked a side in America’s political wars when he accepted an invitation by President Trump to an elite gathering of a dozen or so industry bigwigs on 7 August 2018. The reason we know is because on the following day various media outfits posted a video of Mr Koch’s impromptu dinner speech on Facebook.

Having seen its beer sales drop for several years, the number two brewer in the US, MillerCoors, announced on 4 September 2018 that it will cut 350 jobs as part of a new restructuring plan aimed at getting its business “back on track”. The last time MillerCoors did a corporate reorganisation was in 2013.

Can you taste independence in a beer? Of course, not in a literal sense. But as taste is a matter of tastebuds and mind coming together, the Brewers Association (BA) has launched a national awareness campaign for independent brewers.

Why now? PepsiCo is splashing out a bubbly USD 3.2 billion for the Israeli company SodaStream, a manufacturer of sparkling water kits. The transaction was announced on 20 August 2018. By our read of the numbers the outlay is about 30 times SodaStream’s profits (EBITDA).

What was all that about? The number three US brewer Constellation Brands could invest up to USD seven billion into Canada’s Canopy Growth, a nascent marijuana company. Is this a departure from Constellation’s playbook of buying craft brewers to increase overall revenues and sales?