Government introduces annual inflation-linked tax increase on beer

The federal tax on domestic and imported beer rose by two percent last year as part of the 2017 budget. It will continue to increase every year in line with inflation starting this April, it was reported.

Beer Canada, an industry body, says almost half of what consumers pay right now for the average price of beer is tax.

At the moment, the federal tax on beer is CAD 31.84 (USD 25.52) per hl, and it will increase to CAD 32.32 per hl. The scheduled 2018 “escalator” tax amounts to a 1.51 percent increase.

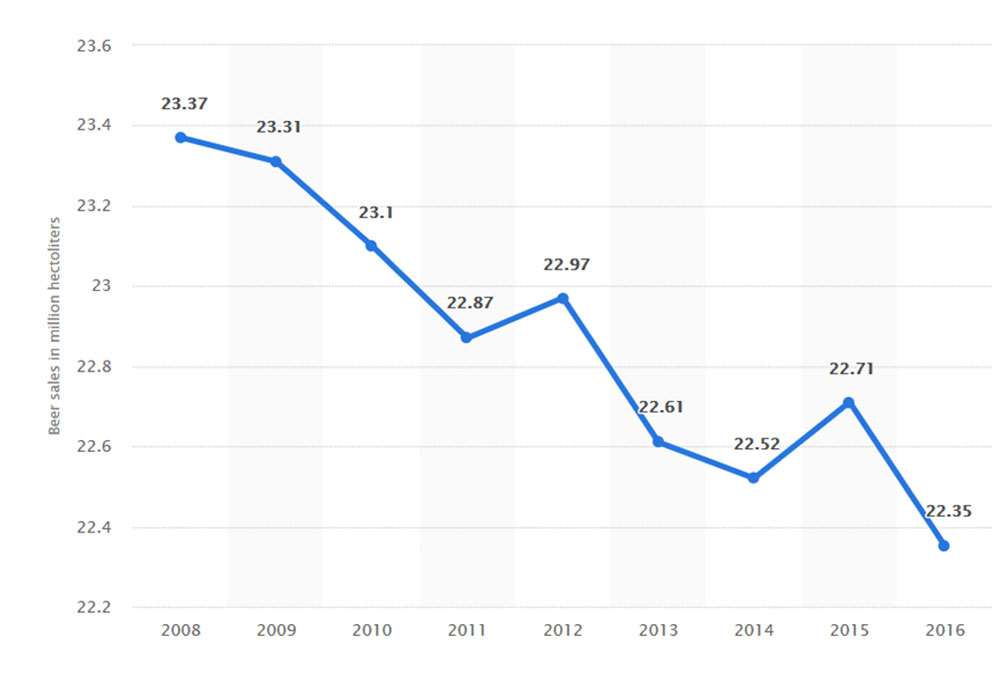

Canadian beer consumption per capita has fallen ten percent over the past decade.

Beer Canada, which represents the brewers that account for 90 percent of the beer made in Canada, launched a campaign in January 2018, asking consumers to sign a petition calling on Finance Minister Bill Morneau to scrap the tax increase.

The group says tax on beer in Canada is already among the highest in the world.

Canada ranked 3rd of 28 countries for taxing beer in 2012, according to market research firm Impact Databank.

A number of factors, such as demographic changes, more competition from other alcoholic and non-alcoholic beverages and rising prices, have contributed to the decline.

The average Canadian drank 77 litres of beer in 2016. Men are the largest consumer group. Figures show that around 24 percent of domestic beer consumption was by men aged between 18 and 34 years. More than half of consumers prefer to drink their alcoholic beverages at home, enjoying them with their spouses or small groups of people. Surprisingly, though, 20 percent of Canadians enjoy drinking alone.

But, even with a shrinking consumer base, the beer industry contributed an estimated CAD 13.6 billion (USD 10.9 billion) to Canada’s economy in 2016, apart from generating CAD 5.7 billion in tax and other revenues.

Beer continues to be the most popular alcoholic beverage in Canada, making up over 41 percent of alcohol sales. It supported nearly 149,000 jobs, generating a labour income of about CAD 5.3 billion. Almost 85 percent of beer sales in Canada were from a domestic brewery.

Defending the move to increase the tax, a finance ministry spokesperson was quoted as saying that small brewers pay decreased rates on the first 75,000 hl beer.

Beer sales in Canada 2008-2016 (million hl)