Europe/Russia

Thanks to Brazil rebounding after two tumultuous years in the region and the integration of SABMiller proceeding well, AB-InBev reported on 1 March 2018 that revenue increased 5.1 percent in 2017 to USD 56.4 billion (EUR 46.3 billion) while profits (EBITDA) rose 13.4 percent to USD 22.1 billion (EUR 18.1 billion). AB-InBev’s EBITDA margin stood at 39.1 percent in 2017.

Europe/Russia

Is it possible that AB-InBev’s job lot sale of the two breweries could be untied again? Insiders think that their new owner, the former banker and consultant Daniel Deistler, who acquired them from AB-InBev in January 2018 for an unknown sum (estimates range from EUR 150 million to EUR 200 million), might exactly do this.

Europe/Russia

Have the good times come to an end? Volatile markets and an acquisition in Brazil prompted the world’s number two brewer Heineken to forecast that its profitability in 2018 would improve by less than the target it had set for the previous three years.

Europe/Russia

Danish brewer Carlsberg reported 2017 profit well below analysts’ expectations, hit by a fall in sales and a large write-down in its key Russian market.

Brewhouse

Flora of the Fruktbygda | In the previous installment, we became acquainted with the “Fruktbygda”, the fruit-growing region around Gvarv, Norway, and the Lindheim Ølkompani, the family farmhouse brewery located there. In this installment, we take a closer look at the research presently underway at the Lindheim farm.

Market

Beer in Germany | Have a guess: how long do you need to work for a bottle of beer in Germany? Even on minimum wage it’s only four minutes. Our spectacularly low beer prices in the off-premise are great for consumers, but catastrophic for brewers. Nearly all brewers battle with declining volumes, aggressive retailers and dwindling profits. Premiumisation would be a way out but few have the courage to go down that path.

Market

Data provided by Morgan Stanley shows that the upcoming 2018 FIFA World Cup in Russia this summer could lift beer consumption. It estimates football fans’ impact on beer consumption at two percent. As a result, it expects that Russia’s beer market would grow during 2018, for the first time in a decade. Recently Anadolu Efes reported that beer consumption dropped in the low single digits in 2017.

Europe/Russia

It may be the world’s oldest brewery and owned by the Bavarian state government, but this does not mean that its people are retrogressive codgers. Weihenstephan Brewery, located outside Munich since monks began brewing there in 1040, has a new hefeweissbier. It’s a collaboration between the state-owned brewer and California’s major craft brewer Sierra Nevada.

Europe/Russia

Allegedly, Russians are consuming 80 percent less alcohol than five years ago. This figure was put out by the Minister of Health, Veronika Skvortsova, recently. The BBC did a reality check and published its own findings on 27 January 2018.

Europe/Russia

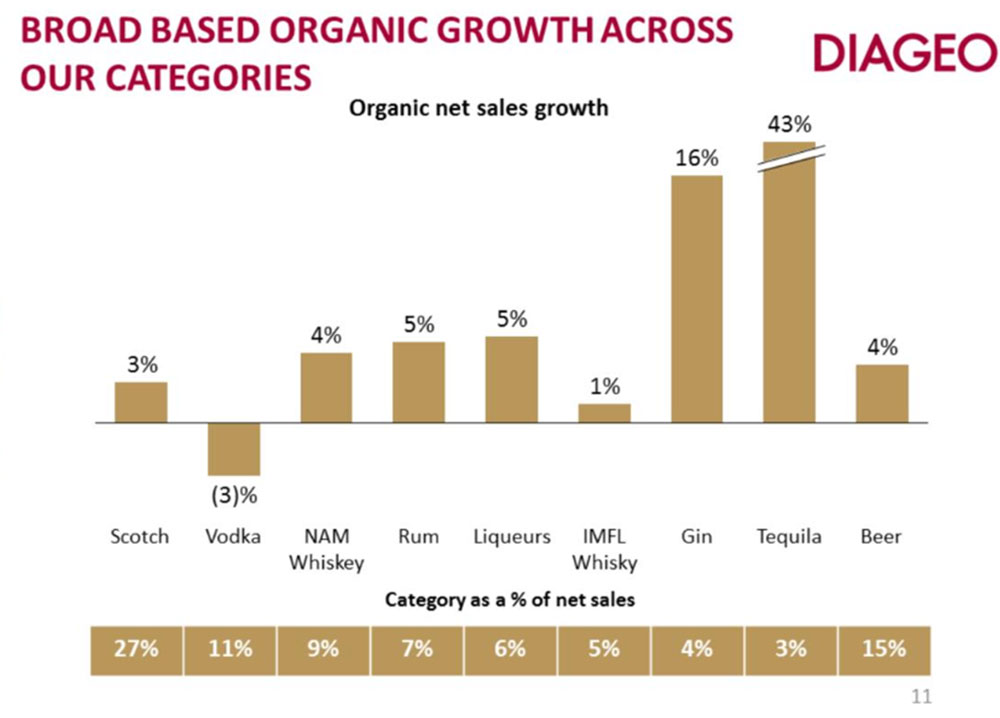

Global drinks company Diageo recently announced that its operating profit rose by over six percent to GBP 2.2 billion (USD 2.97 billion) in the six months to 31 December 2017. Net sales were GBP 6.5 billion (USD 8.77 billion), an increase of 1.7 percent, with all regions contributing to the company's sales growth.