Europe/Russia

The British Beer and Pub Association (BBPA) has predicted that England fans will drink 14 million extra pints (80,000 hl) at the pub during the World Cup group stages.

Europe/Russia

The Dutch brewing group Bavaria has changed its name to Swinkels Family Brewers to better reflect its product range, the family-owned firm said. “We are more than Bavaria”, Chairman Jan-Renier Swinkels said. Next year Swinkels will celebrate its 300th anniversary.

Europe/Russia

On 12 June 2018, one day before the start of the German beer cartel trial in Düsseldorf, the German Radeberger Group withdrew its objections to the fine imposed on the brewer by the Federal Cartel Office.

Europe/Russia

Beer promoters without their own brewery have been called various names: from beer firms, gypsies and virtuals to cuckoos, imposters, pseudos and fakes. The connotations attached to each name, ranging from the neutral to the pejorative, are far from accidental.

Europe/Russia

When is Netflix turning VJ Mallya’s colourful life into a TV series? The script could run to several seasons. The most recent development in the convoluted plot saw Mr Mallya step down as director of his Force India Formula 1 team at the end of May 2018.

Europe/Russia

If you were to cross Eataly with Denver’s Wynkoop brewery you will get – at least conceptually – LaM.U, La Manufacture Urbaine, a café-restaurant with a brewery, bakery and coffee roaster, which opened its doors in the Belgian city of Charleroi, south of Brussels, last year.

Market

Beer in Italy | When it comes to fashion, Italians go for the new and ultra-modern. Same with craft beer. Consumers tend to be on the look-out for the next big thing and craft brewers comply with imagination and experimentation. How come that the Big Brewers’ own craft beer offerings embrace a retro sentimentality for an imagined era when men were men and life was full of little wonders?

Europe/Russia

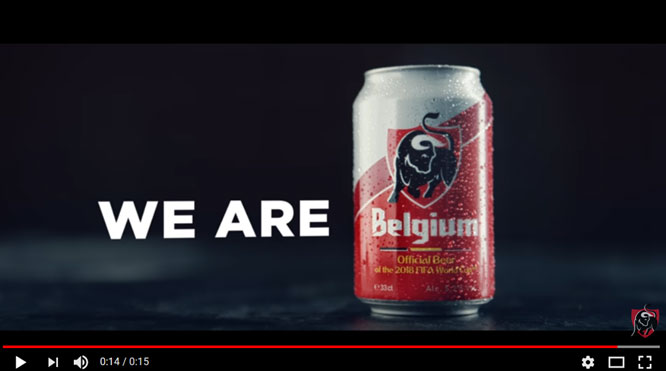

Jupiler may be Belgium’s major pils brand, but its new packaging, which it is hoped will boost sales during the FIFA World Cup, still raised a few eyebrows. Now, “Belgium” figures larger on the packaging than the brand’s name; actually, the name Jupiler does not appear on the front label.

Europe/Russia

It appears counterintuitive that Big Brewers, all the while trying to cut costs, are increasing their stock keeping units (SKUs). According to perceived wisdom, rising numbers of SKUs add complexity and thus costs. Therefore, traditional FMCG companies have often tried to eliminate SKUs in order to focus on bestsellers.

Europe/Russia

Beer and sports are such a great combo that more and more craft brewers are setting up shop inside sports stadiums. In May 2018, London’s Beavertown Brewery confirmed plans to open a brewery and taproom inside the newly developed stadium of Premier League soccer team Tottenham Hotspur.