Gin and tequila hike Diageo’s profits

Global drinks company Diageo recently announced that its operating profit rose by over six percent to GBP 2.2 billion (USD 2.97 billion) in the six months to 31 December 2017. Net sales were GBP 6.5 billion (USD 8.77 billion), an increase of 1.7 percent, with all regions contributing to the company's sales growth.

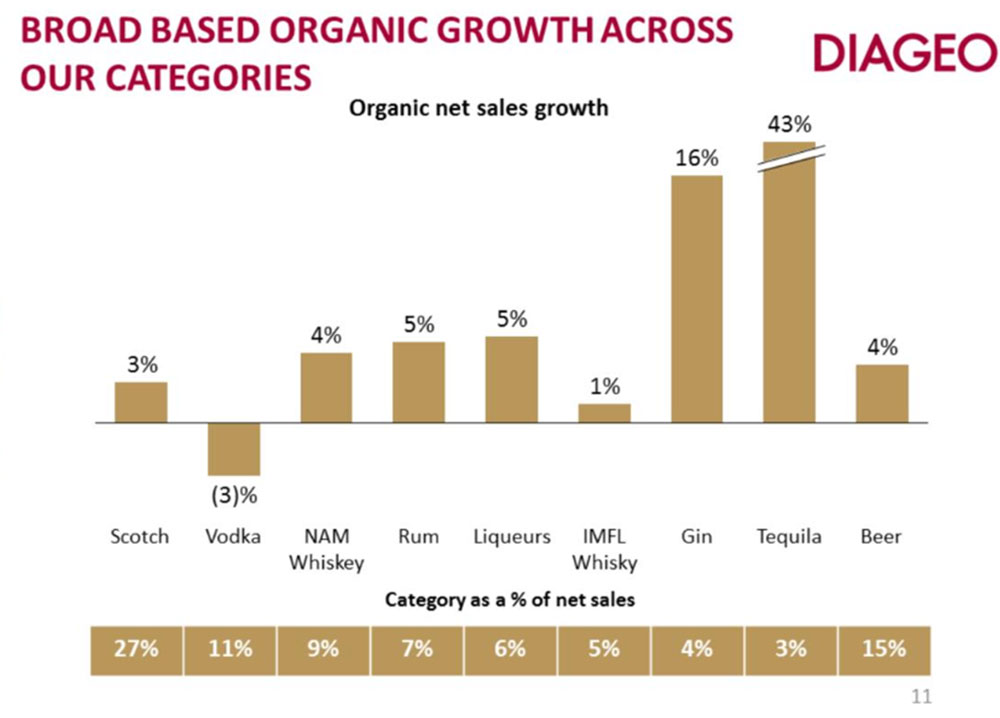

Beer accounted for roughly 15 percent of Diageo’s net sales in the half and is the second largest category for Diageo after scotch.

Growth was broad-based across all key categories, but primarily driven by gin, where the Tanqueray brand gained share in a growing category, and the Gordon’s brand benefited from the launch of its Pink variant.

Americans are leading a revival of the classic cocktail, thus boosting sales of brands such as Johnnie Walker, Bulleit bourbon and Don Julio tequila in North America, Diageo’s largest region for revenue. Only vodka sales in North America were a sore point, falling eight percent amid weak demand for the Ciroc and Ketel One brands.

Still, Diageo cautioned against too high expectations for the full year. It warned that exchange-rate movements – the rising sterling currency – for the year ending 30 June 2018 will cut net sales by around GBP 460 million (USD 620 million) and operating profits by about GBP 60 million (USD 80 million).

But it will take advantage from the US tax reforms, which will lower its tax rate by 20 percent from its previous guidance of 21 percent, it was reported.

It was pointed out that Diageo has also benefitted from productivity initiatives to increase its profitability. Like Unilever and Nestle, Diageo has felt the heat from activist investors to cut costs. Private-equity firm 3G Capital (aka the Brazilians behind AB-InBev) and hedge-fund investors Nelson Peltz and Dan Loeb have all lobbied for greater shareholder returns as the consumer-goods giants wrestle with slow growth.