Europe/Russia

The decline was only two percent, but beer production still dropped to 93 million hl in 2017, the German Brewers Association reported. This was partly due to a drop in beer exports. Full year 2017 figures for beer exports are not available yet. In 2016 beer exports stood at 16.7 million hl.

Europe/Russia

AB-InBev has sold its breweries Hasseröder and Diebels to the German financial investor CKCF for an estimated EUR 200 million (USD 245 million). The deal is to be completed during the first half of 2018. AB-InBev started sales proceedings in mid-2017.

Europe/Russia

After ten years, the Czech brewer Plzeňský Prazdroj has terminated the licensed production of its Pilsner Urquell brand at the Russian brewery Kaluga. From January 2018, the beer will only be produced in the Czech city of Pilsen, reports the online portal idnes.cz.

Europe/Russia

If pupils are fidgety and restless, teachers say, it’s often because they are on a legal high: energy drinks.

Europe/Russia

Doing their bit to save the planet from a deluge of plastic garbage, drinks companies Pernod Ricard and Diageo have announced plans to eliminate the use of plastic straws and stirrers.

Europe/Russia

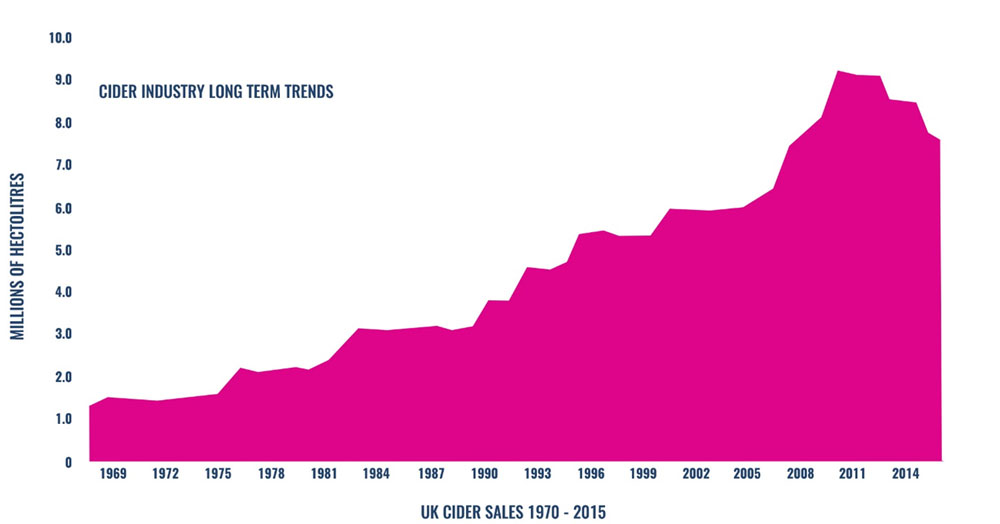

After twelve months of negotiations, Molson Coors announced on 8 January 2018 that it has bought Aspall, the British cider brand founded in Suffolk in 1728 by Clement Chevallier. The firm, which is still run by family members, had an enterprise value in excess of GBP 40 million (USD 55 million), it was reported.

Market

For AB-InBev, it may just be a measure to stop cheaper parallel imports of its brands. But the antitrust body of the European Commission disagrees. On 30 November 2017 the European Commission informed AB-InBev of its preliminary view that the company has abused its dominant position on the Belgian beer market, by hindering cheaper imports of its Jupiler and Leffe beers from the Netherlands and France into Belgium.

Europe/Russia

For the Big Brewers a London craft brewery has become a must-have. After AB-InBev bought Camden Town, Asahi took on the Meantime Brewery, and Carlsberg acquired the London Fields Brewery, it was finally Heineken’s turn.

Market

With Brexit negotiations to be resumed in December 2017, both the UK and the EU are accused of dragging their feet over an issue – an Irish border – which has emerged as the biggest hurdle.

Europe/Russia

Despite protests by the Scotch Whisky Association (SWA), the UK Supreme Court ruled on 15 November 2017 that Scotland can set a minimum price for alcohol.