Asia/Australia

Wooing those Millennial couch potatoes. After AB-InBev bought the online alcohol retailer BoozeBud in early August 2018, the 7-Eleven Group has acquired a majority stake in the alcohol delivery start-up Tipple. The transaction was announced on 14 August 2018. No financial details were disclosed.

Asia/Australia

The Beviale Family, NürnbergMesse Group's global network for beverage production, continues to grow. The most recent example is its presence at one of Asia's largest gourmet fairs, the Daejeon International Wine & Spirits Fair in South Korea (Aug. 31 - Sept. 02, 2018).

Asia/Australia

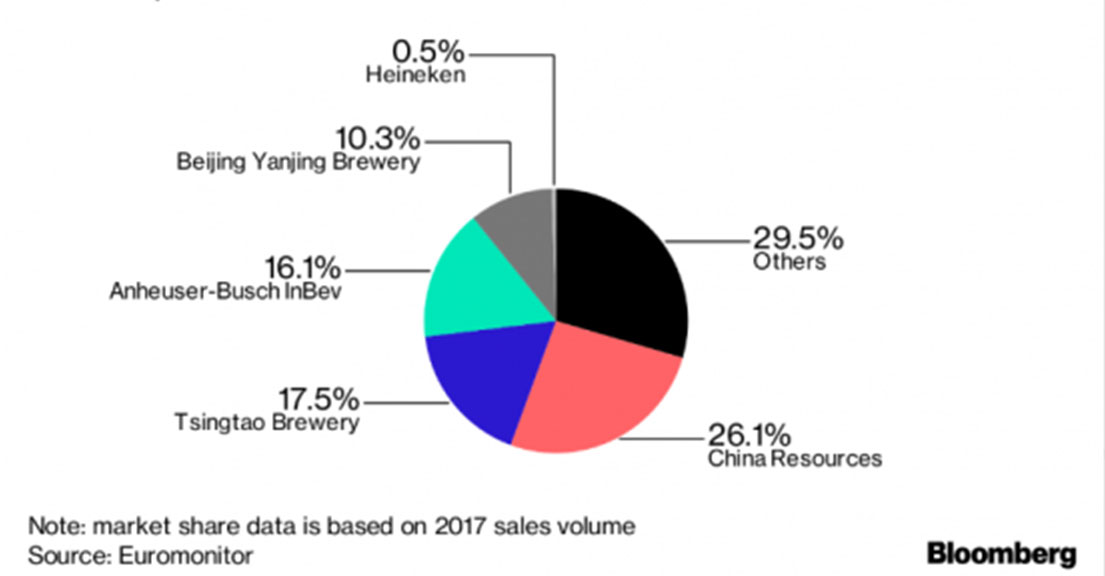

Heineken’s planned tie-up with CR Enterprise, valued at over USD three billion, has received mixed reviews so far. After years of declining beer volumes, China is a very competitive market, characterised by low prices and margins. Industry observers estimate that operating margins (EBIT) are around six percent at CR Beer, while they amount to 15 percent at Heineken and are as high as 30 percent at AB-InBev.

Asia/Australia

Two in need clinched a deal. The transaction, which has been discussed for months, was finally confirmed on 3 August 2018, when the world’s number two and three brewers, Heineken and CR Enterprise (CRE) – the parent of CR Beer – said they plan to establish CBL, a new holding entity, in which Heineken will have a 40 percent stake, valued at USD 3.1 billion. The holding will control CR Beer, the leader in the world’s largest beer market – China. Its main brand is Snow.

Asia/Australia

Australia’s big retailers will probably cry blue murder behind closed doors now that AB-InBev’s unit ZX Ventures has acquired the local online beer retailer BoozeBud. But there is nothing they can do about it. The transaction was announced on 1 August 2018.

Asia/Australia

Seemingly unhappy with Kirin’s efforts to market Budweiser in Japan, AB-InBev has decided to take the brand into its own hands from 2019. It has cancelled its licensing partnership with Kirin, which has produced and sold Budweiser domestically since 1993, media reported in July 2018. Allegedly, Kirin has struggled to increase the sales of Budweiser. Instead, it has focused on bolstering the sales of its own beer brands.

Asia/Australia

China Brew China Beverage (CBB) is Asia’s leading platform for the beverage and liquid food industry covering raw materials, processing, filling & packaging, and logistic products. This number one event features customized solutions for the booming South-East Asian region. It targets the specific needs of the market by matching supply and demand.

Asia/Australia

On 25 June 2018, the CEO of the Australian Beverages Council, Geoff Parker, and the Federal Health Minister, Greg Hunt, announced that Australia’s major soft drink companies had signed an agreement to reduce the sugar in non-alcoholic drinks by an average of 20 percent, in a move aimed to tackle the country’s obesity crisis.

Asia/Australia

Independent craft brewers have set themselves a lofty growth target: they seek to control 15 percent of the beer market by 2015, up from nine percent today. If the US can serve as an example, the target appears not all that ambitious considering that the current level includes all the “crafty” beers too. Australia’s 520+ indies only account for two percent of beer sales.

Asia/Australia

Several countries already have them and soon Australia will have one as well: an incubator brewery, that is, built specifically for start-ups, contract and gypsy brewers, including publicans seeking to create their own branded beers without wanting to invest in a brewery of their own.