Africa

It’s an interesting management change. Norman Adami, a 33-year veteran of SABMiller and currently Chairman plus Managing Director of the brewer’s South African unit SAB, will be promoted to the new role of Chairman, SABMiller Beverages South Africa with effect from 7 January 2013, SABMiller announced on 22 October 2012.

Africa

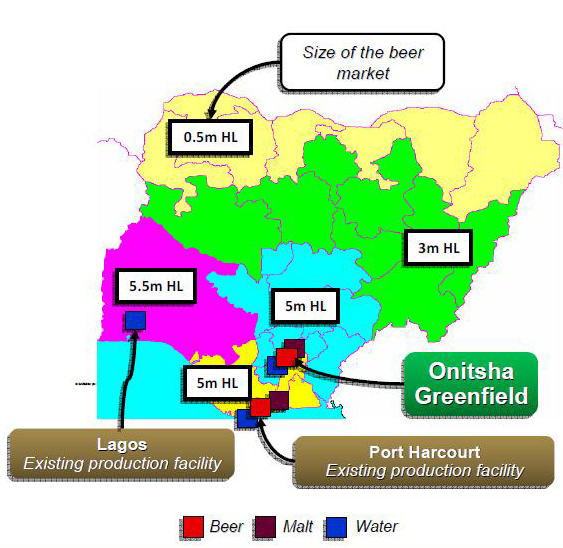

This would not be Nigeria if a new project did not immediately drown in a mire of alleged or factual corruption. Same with SABMiller’s new 500,000 hl brewery in Onitsha, Anambra State in southeastern Nigeria, which is the brewer’s first greenfield brewery in the country. It was officially opened on 30 August 2012, in the presence of Nigeria’s President Dr Goodluck Ebele Jonathan.

Africa

It takes some daring to put big money behind a new brewery venture in Nigeria if you happen to be a latecomer to the market like SABMiller. The market is basically a cushy duopoly by Heineken and Diageo, both of whom have been active in Nigeria for decades. Heineken entered in 1946, Guinness in 1962. The two heavyweights have the market cornered: Heineken’s market share is about 70 percent, while Diageo’s is 25 percent.

Africa

South Africa is crafting a new law to restrict alcohol advertising, raise the minimum drinking age to 21 from 18 and clamp down on drink driving, media reported in August 2012.The bill would also propose warning labels on alcohol containers, raising taxes and stricter licensing laws for alcohol outlets.

Africa

Why is Namibia Breweries Limited (NBL) buying a 15.5 percent stake in the Sedibeng brewery in South Africa, which is currently owned by Heineken (75 percent) and Diageo (25 percent)? The decision was made public by NBL’s majority shareholder Ohlthaver and List Group of Companies (O&L) in May 2012, without giving details of the purchasing price.

Africa

Is Nigeria really the promised land that international brewers Heineken, Diageo and SABMiller make it out to be? Or is the country a house that has fallen - whose roof may still be intact but shows many gaping holes, as risk consultancy Menas Associates, London, argues in a recent report?

Africa

It was to be expected that Heineken would not be content with owning two breweries in Africa’s second most populous country behind Nigeria. Early last year Heineken entered the Ethiopian beer market when the Dutch brewer acquired the Bedele and Harar breweries — both of which were publicly owned — for USD 78.1 million and USD 85.2 million, respectively.

Africa

SABMiller and EABL will not exactly be trembling in their shoes now that Heineken has opened a regional headquarter in Kenya's capital, as local media reported in March 2012. But it shows that global brewers are taking the East African market serious.

Africa

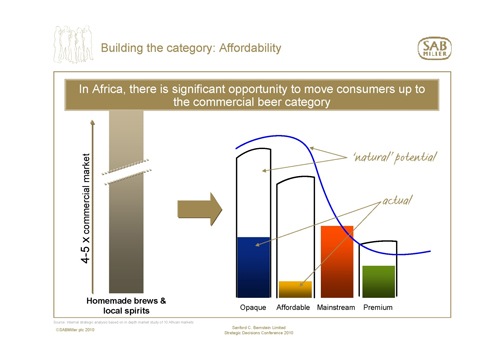

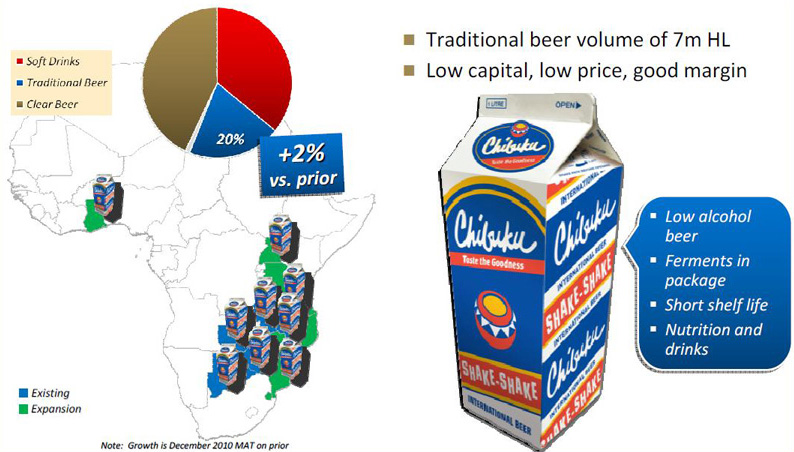

Given that volumes of homemade spirits and brews are estimated four times the volumes of commercial beer in Africa, it’s only logical that SABMiller is trying to woo beer drinkers across the continent to trade up to commercially-produced alcohol, i.e. their beers. The cheapest commercially brewed beers in Africa are sorghum beers and with Chibuku SABMiller think they have got a winner.

Africa

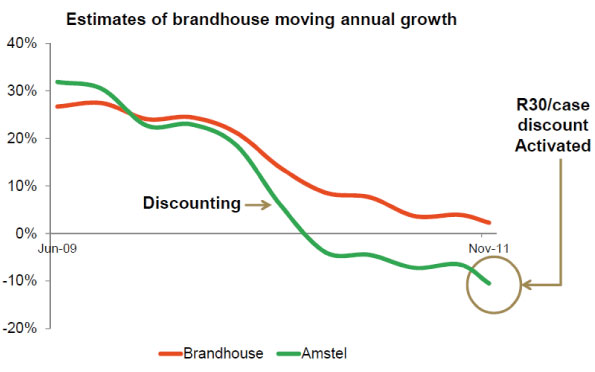

In the battle over market shares South African Breweries (SAB), a subsidiary of SABMiller, declared itself the winner. On 14 February 2012, Norman Adamai, Managing Director of SAB, said the brewer had recaptured the market it lost when one of its biggest brands, Amstel, was taken by competitor Brandhouse, the joint venture between Heineken, Diageo and Namibia Breweries.