Africa

Right. I know the world loves a beer out of a bottle. It’s safe, it’s clean, it’s convenient. But is drinking beer out of a bottle stylish? Classy? Do you want to be caught in the act? Not to mention – does it go with the image, the aspirations of a premium beer brand to be served in bottles which will end up in dirty crates behind the back door? Therefore I’d like to ask you: Isn’t it the ultimate act of cool to be served a freshly tapped beer in a glass?

Africa

The conference’s theme is well-chosen. The Sub-Saharan Africa’s economy will probably expand 3.8 percent this year as the global recession eases, though export demand may wane in the second half of the year, according to the World Bank.

Africa

Castel, traditionally the more secretive of the two, has not released any targets it set itself for Nigeria. So no one knows whether it fell short of them. But SABMiller reportedly wanted to increase the output of Pabod Breweries eightfold to 250,000 hl by February 2010. A good indication that it missed its mark is the brewer’s recently released third quarter statement which makes no mention of Nigeria at all.

Africa

According to media reports, John Ustas, Managing Director of ABI, said that the company has gathered evidence of 241 incidents of violence and criminal acts since the strike began on 22 December 2009, including the stoning and gasoline bombing of delivery vehicles, shootings, attempted murder and assault. He said there have been seven arrests by the South African Police Services on charges including intimidation and kidnapping.

Africa

The union has rejected ABI’s offer of an across-the-board 7.8 percent pay increase, which the company said marks an increase of 8.3 percent including benefits and is well above the current consumer inflation rate in the country of 5.8 percent.

Africa

Participants in the deal will include SAB’s employees, black-owned licensed liquor retailers and retail liquor licence applicants, as well as registered black-owned customers of ABI, the soft drinks division of SAB, and the broader South African community through a newly established SAB Foundation.

Africa

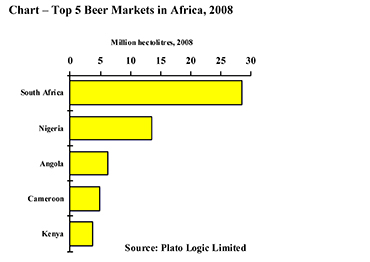

The African beer market has grown every year since 1995, with further growth projected for 2009 and 2010, despite the difficult global economic environment, according to Plato Logic’s latest Africa Beer Market Report. “We now expect beer consumption across the African continent to pass 100 million hectolitres by 2011, possibly even next year (2010)”, commented Ian Pressnell, Director of Plato Logic.

Africa

In the end, the Namibian Government probably ran out of reasons why SABMiller cannot build a brewery in the country. Initially, the Government will have tried to protect its then Namibian-owned brewery from competition. But after Namibia Breweries were bought by Heineken/Diageo in 2003 and the two partners were granted a license to build a 3 million hl brewery near Johannesburg, the Namibian Government had to do likewise and allow SABMiller to build a brewery in Namibia.

Africa

Ok, YOU may not like them but millions of people in Africa enjoy drinking maize or sorghum-based beverages, be they alcoholic or not. Because they have texture and a certain viscosity, many African consumers think these thickish, opaque and milkshake-type beverages a meal replacement. And often they are.

Africa

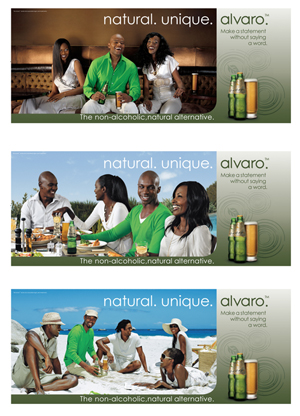

Let’s put it this way: You would be daft as a brewer not to try to take advantage of a sizeable and profitable beverage category especially if you consider yourself a total beverage company. For Diageo, Africa is the main driver to Diageo’s overall beer performance and is now its largest beer market, over twice the size of Ireland and Great Britain. In order to continue writing this success story Diageo/Guinness have been forced to innovate. If, like Diageo you sell everything from spirits to beer to RTDs, why not soft drinks too?