Africa

If they can brew a clear beer with sorghum, why can't they do it with cassava? Actually, SABMiller seem to have come up with a way of doing it. In an effort to provide consumers with an affordable beer, SABMiller at the end of October 2011 put the first cassava-based beer, called Impala Cerjeva, into the Mozambique market.

Africa

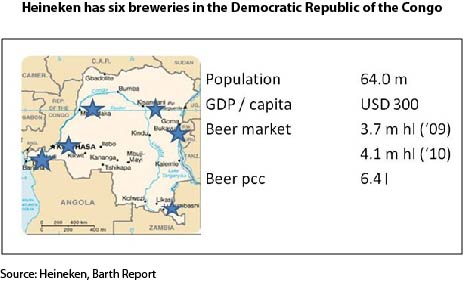

It’s good to know: should you plan to travel around the DR Congo by truck (some reckless tourists seem to do just that), pick a truck carrying bags of something soft like peanuts because sitting on top of them can be quite comfortable. Beer trucks are not.

Africa

Words fail us when looking at the prices paid by international brewers for Ethiopia’s privatised breweries. Early in September 2011 it was reported that Diageo, the world’s major spirits company, submitted the highest bid for Ethiopia’s state-owned Meta Abo Brewery.

Africa

It’s a big worry. Many Kenyans, especially Kenyan men, do not have any hobbies. All they enjoy doing is going to bars to drink. The African bloggosphere is full of complaints about male folk vanishing in the morning and staggering home in the evening, while leaving much of the work on the coffee farms to women and children.

Africa

In the latest round of privatisations, Pierre Castel did not get lucky. Two state-owned breweries, Harar Brewery and Bedele Brewery, went to Heineken for a reported USD 163 million. Now Mr Castel’s local unit BGI Ethiopia has secured a deal its managers believe will help them conquer the northern market.

Africa

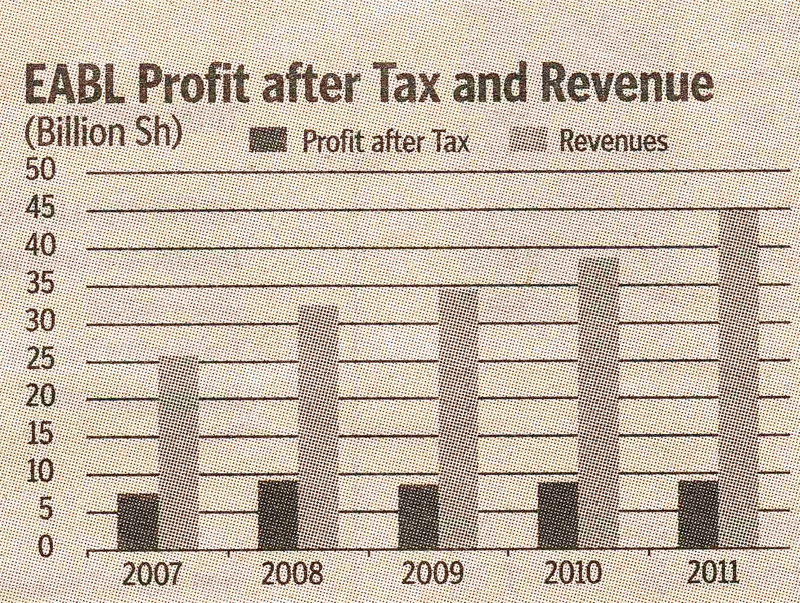

East African Breweries (EABL) has agreed to buy a 20 percent stake in its Kenyan unit from SABMiller’s African unit for 19.53 billion shillings (USD 225 million), EABL said on 6 June 2011.

Africa

Readers, hold on to your seats. Diageo is said to have offered USD 200 million for Ethiopia’s state-owned Meta Abo brewery which in its last financial year made a profit of USD 2.6 million on beer sales of perhaps 600,000 hl. That’s a multiple of … sheer madness.

Africa

ActionAid’s campaign against SABMiller struck target. After having been accused of tax dodging by the London charity ActionAid in November last year, the authorities in five African states have decided to work together to examine the brewer’s tax affairs. On 6 May 2011 SABMiller again rejected any claims of tax avoidance in Africa after officials from South Africa, Ghana, Zambia, Tanzania and Mauritius had come together in a South African-led African Tax Administrative Forum to look at the group’s tax payments.

Africa

Have they all gone mad? Or did global brewers suffer from a last minute panic attack in the scramble for Africa? According to Ethiopian media, Heineken, SABMiller, Castel and Carlsberg have submitted offers for the 290,000 hl state-owned Bedele Brewery, which many think blatantly over-valued. Heineken’s bid of USD 85.2 million exceeded those of Carlsberg Brewery (USD 68 million), Castel Ethiopia (USD 64 million) and SABMiller (USD 70 million). In January 2011 Ethiopia’s privatisation agency PPESA invited bids for Bedele Brewery. These are currently being reviewed.

Africa

So Diageo has made a bid for the Meta Abo brewery on its own. It’s another madcap offer – rumoured to run to USD 150 million, which is way over the top like Heineken’s USD 85 million bid for Bedele Brewery. But the interesting question is not why the world’s number one drinks group and brewer of Guinness beer is prepared to spend so much on a medium-sized brewery in a market where all the global big wigs will be stepping on each others’ toes. The more pertinent issue is: why isn’t Diageo going for Meta Abo in tandem with its Kenyan partner, East-African Breweries (EABL)?