SABMiller to build a new brewery

“Double and half the price of beer and go farming!” That’s how Mark Bowman, President of SAB Miller Africa summed up his company’s strategy in Africa at an investor conference in Florida in February 2011. What could he have meant by this cryptic remark?

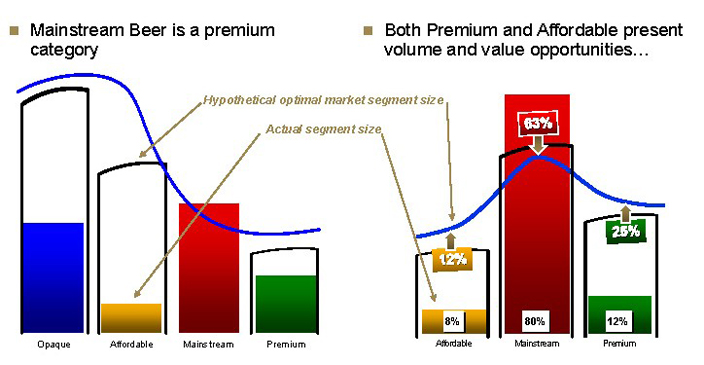

According to Mr Bowman, there are two price segments which promise the most growth. The first one is the “affordable beer segment”, sold at a price point about 20 percent below the mainstream segment. Beer offerings in this segment could lure consumers away from even cheaper traditional beers or moonshine, which are reckoned to be quite substantial in Africa. “Affordable beers” are often brewed with sorghum sourced locally and therefore aren’t only cheaper to produce, they also enjoy an excise cut that brewers pass on to the consumers. For example, in Uganda beers brewed with sorghum have an excise rate of 20 percent slapped on them whereas all-malt beers have an excise of 60 percent.

The other segment SABMiller focuses on is the premium segment, which is expected to grow as aspirational consumers will want to show off their new found wealth to their peers.

And lastly: “go farming” refers to the brewer’s efforts in several African countries to engage local farmers in providing them with raw materials. These farming initiatives, while distributing an income among the rural poor, decrease the brewer’s dependency on expensive foreign imports. Moreover, the brewer usually receives a favourable excise rate when brewing with local raw materials.

Drawing again on the case of Uganda, it costs Nile Breweries, the Ugandan SABMiller unit, about USD 1.30 per kg of extract if they use imported malted barley whereas using local sorghum costs them USD 0.50 per kg of extract, delegates were told at the IGB Africa convention held in Uganda in March 2011.

This strategy of “double and half the price of beer and go farming” SABMiller hopes to implement in Nigeria too where the brewer is to spend over USD 100 million to build a new brewery in Africa’s second largest beer market.

BRAUWELT International already reported on these plans last year, when they were just a rumour. At the end of February 2011 Africa’s biggest brewer officially announced it will build its new brewery on a greenfield site at Onitsha in southeast Nigeria, to expand its presence in the country after buying small beermaker Pabod Breweries Ltd in Port Harcourt in 2009.

Nigeria’s annual beer market of around 16 million hl is second only to South Africa on the continent and is dominated by Heineken, with around a 70 percent market share, and Diageo’s Guinness business with over 20 percent, leaving SABMiller a share of far less than 5 percent.

The fast-growing Nigerian beer market has grown at an annual rate of 9 percent in the last 10 years and Heineken acquired controlling interests in five breweries in January to expand its capacity there by nearly a third.

The new SABMiller brewery will produce local brands Grand Lager and Eagle and also Castle Milk Stout and will have an annual capacity of around 500,000 hl of beer and malt beverages, and be able to bottle water and other beverages.

Eighty percent of the new brewery will be owned by SABMiller Africa – itself 62 percent owned by SABMiller and the rest by privately owned French drinks group Castel – with the Anambra state government and other Nigerian investors holding up to 20 percent.

Which brings us to Mr Castel, whose breweries in Africa produce about 20 percent of the continent’s beers. Talks between SABMiller and Mr Castel about a sale of Castel’s African business seem to have come to a halt. Without addressing the much rumoured Castel sale directly, Mr Bowman told reporters at the Florida investor conference that the brewer was unlikely to make any big-ticket acquisitions on the continent in the near future.

The London-based brewer expects "organic volumes" for beer and other beverages to grow at about 8 percent a year in Africa, he said, referring to growth excluding the impact of acquisitions or divestments.