Africa

In much of the developed world, layoffs have become an increasingly common part of corporate life - in good times as well as bad. But for an economy like South Africa's, they don’t bode well. Not only does South Africa have the third highest unemployment rate in the world for people between the ages of 15 to 24, according to the World Economic Forum (WEF) Global Risk 2014 report (more than 50 percent of young South Africans between 15 and 24 are unemployed, with the official unemployment rate standing at 24 percent in 2013). The country also heads to the polls on 7 May 2014 for general elections.

Africa

The mills of the law grind slowly. On 24 March 2014 South Africa’s Competition Tribunal threw out a seven-year antitrust case against SAB, the South African unit of SABMiller, arguing there was not enough evidence to prove the brewing company is breaking the law.

Africa

East African Breweries (EABL), in which Diageo has a stake, took a surprise decision in February 2014 to end daily operations at its Nairobi plant after the brewer posted the slowest first-half sales growth in four years.

Africa

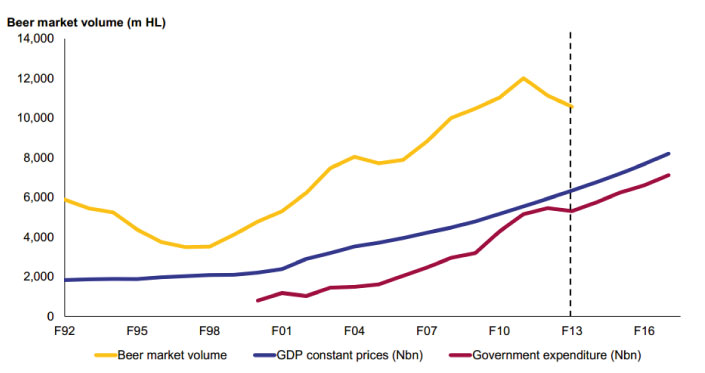

If Diageo is right, the Nigerian beer market declined in 2013 to perhaps 10 million hl from about 12 million hl in 2012. While Diageo and Heineken must be suffering from a bit of a headache given their excess capacities, rival SABMiller announced on 23 January 2014 that they need to expand their brewery in Onitsha, South Eastern Nigeria. The brewery only went on stream in August 2012 at an initial investment of over USD 100 million.

Africa

“The fear of terrorism continues to cast a long shadow across northern Nigeria,” The Economist newspaper wrote on 30 November 2013. Following Boko Haram’s bloody insurgency, foreign companies tend to avoid the north. But Guinness Nigeria is hanging on, The Economist reports, although one of their sales divisions is located in Jos, a city affected by Islamist terrorist groups. Even if Guinness Nigeria, which is partly owned by Diageo, wanted to decamp, they cannot as 20 percent of their sales are conducted in the northern half of Nigeria.

Africa

Another African beer wonderland about to emerge?

Africa

food and drink technology Africa will take place for the first time in Johannesburg on 18th and 19th March 2014. Following drink technology India in Mumbai and China Brew & China Beverage in Beijing, this is the third abroad-project of drinktec, the world´s leading trade fair for the beverage and liquid food industry. Messe München International (MMI) and its subsidiary MMI South Africa, based in Johannesburg, are organizing food & drink technology Africa. The professional association Food Processing and Packaging Machinery in the German Engineering Federation (VDMA) is acting as the conceptual sponsor. We spoke with Petra Westphal, Project Group Director of Messe München, and Elaine Crewe, CEO of MMI South Africa, about the new show in South Africa.

Africa

The fighters raped, tortured and killed and enjoyed a sundowner Primus beer afterwards. Did Heineken’s subsidiary Bralima pay taxes and toll to rebel troupes during the Congolese war to sell its beer? The political scientist Peer Schouten thinks it did. He was in the country to explore the role of the Dutch brewer Heineken in the war. His report “Fluid markets” was published in the September 2013 issue of the journal Foreign Policy. Strangely, it took until 9 November 2013 for the German magazine Der Spiegel to pick it up.

Africa

Fortunately, reason prevailed. After a five week-long battle over wages turned violent with more than 72 incidents of violence and intimidation, both sides in the dispute resolved on 5 November 2013 to call off the first strike to hit the brewer in 16 years.

Africa

A ban on alcohol advertising has been in the political pipeline for so many years now that many wondered if it would ever become law. But in September the