Africa

Although a court declared Pabod Breweries’ bottle not to infringe upon the Star bottle design, Star’s parent, Nigerian Breweries (NBL), which is controlled by Heineken, has decided not to let matters rest but to lodge an appeal against the verdict. The court has adjourned the matter until 23 October 2008. The upstart Pabod Breweries whose launch has been held back because of Nigerian Breweries’ actions by more than half a year, has suffered significant losses yet remains upbeat.

Africa

Norman Adami, previously President and CEO of SABMiller Americas, will return to SABMiller to assume the position of Managing Director and Chairman of SAB Ltd in South Africa. Tony van Kralingen, who currently holds this position, has been persuaded to sidestep. He will become Director of Human Resources and Supply Chain for the group.

Africa

The Egyptian Tourist Federation has announced it will shortly strip the Hyatt hotel of its five-star status, following the decision by its renegade Saudi owner to ban the sale of alcohol on its premises.

Africa

Amstel it ain´t. But it´s Dutch and that is all that counts. From the end of June Grolsch will be available nationally in on and off premises.

Africa

The resurrected Pabod Breweries scored a victory over its rival Nigerian Breweries (NBL) when on 30 June 2008 a Rivers State court ruled that NBL´s injunction over Pabod´s use of a contested bottle could not be upheld.

Africa

In a stunning display of religious orthodoxy, the Saudi owner of a five-star hotel in Cairo in May banned the serving of alcohol by reportedly dumping more than USD 300,000 of beer, wine and whiskey into the river Nile.

Africa

Apparently, Heineken does not want to take on SABMiller on its own. That’s why it has partnered with Diageo to build a brewery south of Johannesburg.

Africa

While the rest of the world is waiting for a super-deal to happen, Heineken is quietly expanding its reach into the Maghreb. Call it an “axis of appeasement” throughout predominantly Muslim countries or just a plain old-fashioned market conquest. In any case, Heineken definitely know what they are doing.

Africa

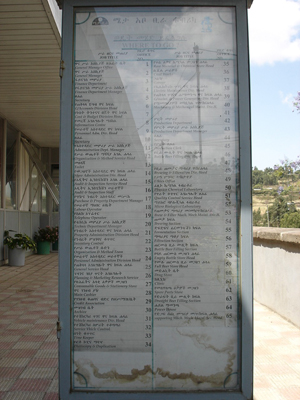

Competition is straining relations between Ethiopia’s s state-owned Meta Abo brewery and the privately-owned BGI which is controlled by the Frenchman Pierre Castel. Meta Abo, which is the largest of Ethiopia’s four government-controlled breweries, has launched a public complaint against the market leader, BGI (with 2 breweries in Ethiopia), claiming it has been the victim of unfair trading practices by BGI. According to reports in the local media, there is more at stake for BGI than its reputation because Meta Abo is also asking for compensation.

Africa

What used to be a shared monopoly is quickly, albeit stumblingly, turning into a highly competitive beer market. As the gap between Castel’s St George brewery and his state-owned rivals begins to widen, Ethiopia’s government-controlled breweries face the danger of falling behind.