Kenyan men don’t have a hobby

It’s a big worry. Many Kenyans, especially Kenyan men, do not have any hobbies. All they enjoy doing is going to bars to drink. The African bloggosphere is full of complaints about male folk vanishing in the morning and staggering home in the evening, while leaving much of the work on the coffee farms to women and children.

Well, no more.

In an effort to clamp down on men idling their days away in bars, an alcohol law came into force in November 2010 which prohibits the sale and consumption of alcoholic drinks before 5 p.m. and after 11 p.m. during weekdays and before 2 p.m. during weekends.

Obviously, the law has bitten into EABL’s beer volumes. That is why the leading East African brewer is looking at selling more beer in cans in a bid to boost home consumption and thus reverse the drop in volumes in the Kenyan market.

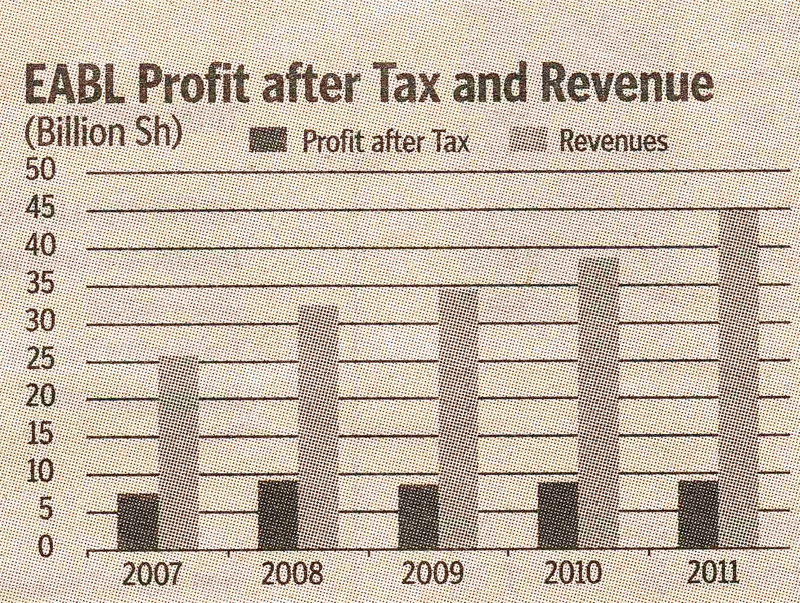

EABL still managed to nudge net profits up two percent in the year to June 2011. At the end of August 2011 EABL reported that net profits grew to KES 7.3 billion (USD 78 million) from KES 7.1 billion in the previous year.

The regional brewer is facing threats on its sales as the Kenyan market settles to the new alcohol law, generally known as Mututho law (named after the MP who introduced the bill), that reduces the number of hours bars can operate, while legalising traditional, often cheap, liquors.

This saw beer volumes in Kenya fall one percent, EABL said.

Thanks to having raised products prices of between KES 5 and KES 10 (USD 0.05 - USD 0.10) per bottle twice in the past year, EABL upped its sales 16 percent to KES 44.8 billion (USD 477 million).

Now, EABL is seeking to increase the volume of beer sold in cans in a bid to increase off-trade consumption and keep pace with global trends where more alcohol is being consumed at home than on premises.

The brewer will spend KES 5.5 billion (USD 59 million) on plant upgrades. It is also seeking a larger share of the Ugandan, Tanzanian and Great Lakes markets in an effort to reduce its over-reliance on the Kenyan market.

The Kenyan market generated about 85 percent of the company’s profits in the year ended June 2011, it was reported.

EABL hopes that investments in a new packaging line in Uganda along with reduced costs will help it defend and grab market share from its rival Nile Breweries, which is owned 60 percent by SABMiller.

In Tanzania, EABL stopped the manufacturing and distribution pact with Tanzanian Breweries (TBL), which is controlled by SABMiller, and bought rival Serengeti Breweries (SBL).

In response, SABMiller is going to build a greenfield brewery in southern Uganda and is looking to expand its Mbaya brewery in Tanzania which it opened only two years ago, while adding capacity to its other Tanzanian breweries in Mwanza and Dar Es Salaam, BRAUWELT International was told by people familiar with the matter.

The East African beer market is fast becoming a battle zone for the major brewers SABMiller, Diageo and Heineken. In the broadly defined East African region, beer consumption reached 18.6 million hl in 2010, having increased 12 percent per year over 2005-2010, says Renaissance Capital, an emerging markets investment bank.

Renaissance analysts expect this strong growth to continue, particularly in Uganda, Tanzania and Rwanda. Beer consumption is still low at 4 litres in Ethiopia, 7 litres in Tanzania, 9 litres in Uganda and 10 litres in Kenya.