Europe/Russia

Why would AB-InBev launch one Leffe spin-off after another, roll out zero alcohol beers and buy brands like Kwak and Ginette? The answer is: to claim more space on the beer shelf for its own brands.

Europe/Russia

Leadership is also about continuity. Heineken said on 26 October 2016 that it would seek a fourth, four-year term for its CEO Jean-François van Boxmeer, who has led Heineken since 2005 and whose contract was to expire in 2017.

Europe/Russia

On 1 January 2017, excise on beer could be hiked by 4 percent to reach USD 21.92 per hl. That’s among the highest duty loads in Europe. The association of Swedish craft breweries has voiced its objections to the excise increase, arguing that it will hamper their growth. There are currently nearly 250 small breweries in Sweden, most of them run by enthusiasts who already struggle with unpaid evening and weekend work.

Europe/Russia

In the village they call the brewery the “beer church” and, by the looks of the building with its arched windows, villagers are not far off the mark. Nor when it comes to size. It’s the largest structure in the village of Ingvallsbenning (50 permanent residents) in central Sweden. No doubt, the delivery trucks will have a fun time reaching the brewery which is 8 km away from the nearest town (Hedemora) and about 180 km from Stockholm.

Europe/Russia

When releasing its third quarter 2016 results on 28 October 2016, AB-InBev not only reported a surprise drop in profits, but the world’s number one brewer also cut its revenue forecast for the full year, saying it no longer expects sales growth to beat inflation in 2016 because of declining volumes in Brazil.

Europe/Russia

For the first time ever, in 2015, more beer was sold in supermarkets and off-licences than in Britain’s 145,000 pubs, clubs, hotels and restaurants. According to a recent report by the British Beer and Pub Association (BBPA), of the 44 million hl beer sold, 51 percent found its way to consumers via the off-trade channel. The remaining 49 percent was sold through pubs, clubs and other licensed premises.

Europe/Russia

It was only a matter of time. With Russian beer consumption in decline for the past eight years, Heineken said on 5 October 2016 that it will suspend production at PIT Company, its affiliate in the Russian city of Kaliningrad, from 1 January 2017. With a population of nearly one million people, Kaliningrad is a Russian enclave by the Baltic Sea lodged between Poland and Lithuania.

Europe/Russia

How could this happen? Heineken Ireland has claimed that some of its beers have been purposefully mislabelled and sold as fake craft beer in certain pubs in Ireland, fuelling consumer debate over what constitutes a ‘craft’ beer. The scandal broke in September 2016 and has had punters wagging their tongues since.

Europe/Russia

Millennials are seen as such a strange breed of consumers that the German discount retailer Aldi has decided to launch its own range of craft wines in 0.5 litre beer bottles with groovy looking labels and sealed with crown caps. The reason? Craft beer is setting the standard for the whole alcohol category.

Europe/Russia

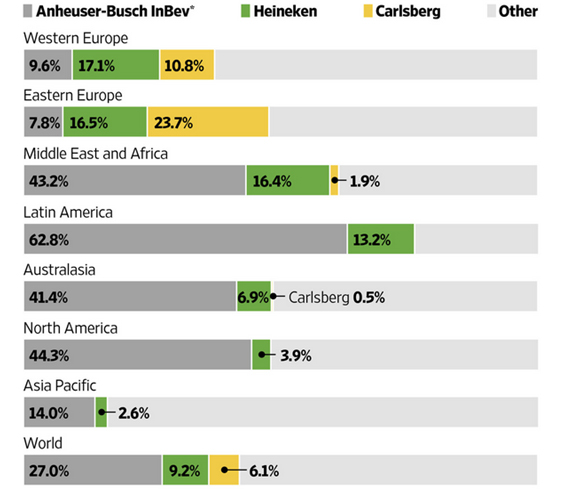

By the time you will be reading this, SABMiller will be no more. After winning shareholder approval on 28 September 2016, AB-InBev will drop the SABMiller name and begin trading as a combined company on 11 October 2016. SABMiller ceased trading on the London and Johannesburg stock exchanges on 5 October 2016.