Europe/Russia

Oh ye innocents. What do you think a takeover by a foreign company means? It means you end up being run by foreigners. So why the feigned surprise over AB-InBev’s new executive management board? Just because it does not have one single SABMiller veteran on the list?

Europe/Russia

Having followed closely the year-long saga of the world’s number two brewer SABMiller being taken over by the world’s number one, AB-InBev, I could not help but look at Edouard Manet’s painting Bar at the Folies-Bergère (1882) with different eyes. This iconic painting is widely available on the internet.

Europe/Russia

Worldwide beer production declined 30 million hl in 2015, the hop merchant Barth estimates in its latest report. It was as if Australia and The Philippines had suddenly run dry.

Europe/Russia

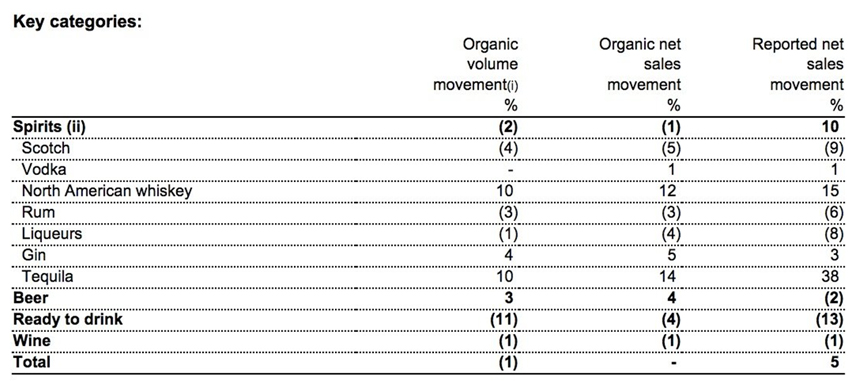

Which numbers shall we trust? On 28 July 2016, the leading drinks group Diageo reported like-for-like sales for the 12 months to 30 June 2016 that were 2.8 percent higher than the previous year, reversing a two-year trend in which growth was broadly flat because of a slowdown in emerging markets.

Europe/Russia

Perhaps it was a mistake to club Africa, the Middle East and eastern Europe into one unit. All these markets appear to be in trouble. Heineken reported on 1 August 2016 that second-quarter beer volumes dipped 5.9 percent on an organic basis across Africa, the Middle East and eastern Europe, hurt by a weakening environment in Russia and Nigeria, where low oil prices and falling currencies are denting growth.

Europe/Russia

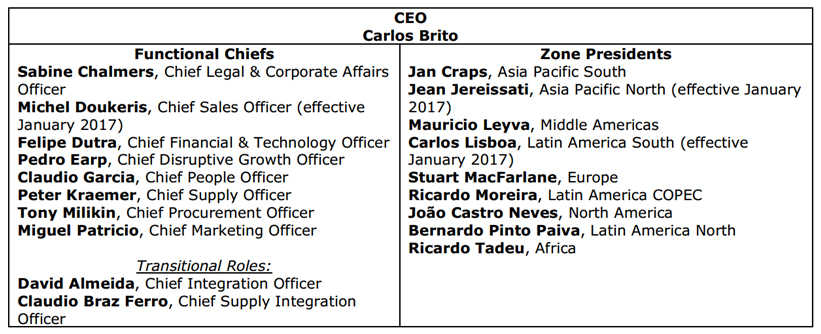

The good news is: The world’s largest brewer said on 4 August 2016 it would continue to be headquartered in Leuven, Belgium, while its global management team, including CEO Carlos Brito and Chief Financial Officer Felipe Dutra, would continue to work out of New York.

Europe/Russia

Carlsberg plans to build a new brewery in Hamburg

Europe/Russia

Long time, no hear regarding AB-InBev’s divestment of its central and eastern European assets, announced in April 2016. But at the end of July 2016 media reported that several US and European buyout funds are putting together bids, with some seeking to join forces to snap up assets worth up to EUR 7 billion (USD 7.7 billion).

Europe/Russia

Hello, what’s happened to risk? Why should AB-InBev have to compensate SABMiller’s shareholders for the UK’s droopy currency?

Europe/Russia

It’s an interesting name for a microbrewery: 32 Via dei Birrai. It reads like an address (32 Brewers Street), but 32 actually refers to the Nice Classification, an international system of classifying goods and services for the purpose of registering trademarks, where beer is listed as class number 32. It may appear a bit long-winded, however for a brewery that claims to give a new definition to tradition and provide “a new language for the boundless scenario of the brewery sector”, this is probably just as well.