Europe/Russia

A stronger ruble and consumers switching to more expensive beer options have benefited Carlsberg in the first quarter. As the Danish brewer reported on 4 May 2017, volumes in Russia and Ukraine declined 2 percent in the quarter, but net revenue in eastern Europe region grew 10 percent organically to DKK 2.3 billion (USD 340 million) thanks to consumers buying smaller but pricier smaller pack sizes following the ban on 1.5 litre PET bottles for beer.

Europe/Russia

Considering the skimpy margins at British retailers, it was no surprise really that Britain’s leading supermarket chain Tesco has increased its craft beer range by almost a third, to over 70 brands drawn from 30 UK and international brewers.

Europe/Russia

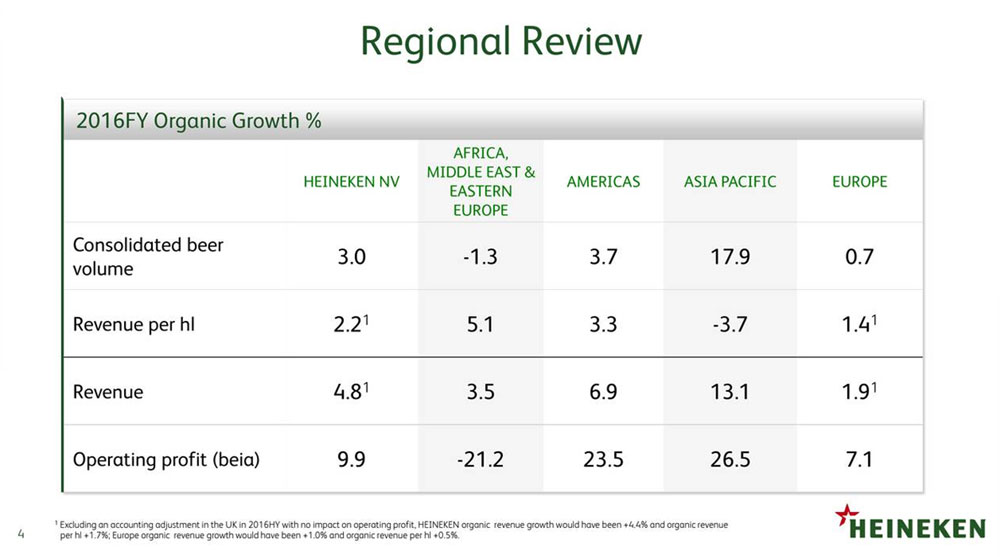

The most remarkable news coming out of Old Europe, courtesy of Heineken, is this: our ageing population trend seems to have stalled. Or it does seem as if our demographics are improving and beer consumption, after years of decline, has bottomed out.

Europe/Russia

Since the brewhouse is generally considered to be the most sacred part of the brewery, breweries generally do not open their kettles for the purpose of brewing beer for others. Some, however, allow fellow brewers to enter this hallowed space to brew collaboration beers. But letting complete strangers or perhaps even the competition do so would be absolutely inconceivable at most breweries in Germany. But there is something new brewing in Gundelfingen where there has been a brewery doing just that since 2015. The Camba Old Factory GmbH makes its brand new 20 hl brewhouse available to brewers who do not have their own facilities at their disposal.

Europe/Russia

Were they desperate for cash to fund their global expansion or plain shrewd? In any case, the move by Scottish craft brewer BrewDog to sell a 22 percent stake in the company to San Francisco-based private equity firm TSG Consumer Partners certainly took the industry by surprise.

Europe/Russia

It was a satire of the highest order. In a highly publicised move, the Budapest government in March 2017 threatened to ban Heineken’s red star logo as a symbol of totalitarianism.

Europe/Russia

Production of Budweiser Budvar beer reached a new record in 2016. Budejovicky Budvar, the Czech state-owned brewery, said on 17 March 2017 that its output rose 0.8 percent to 1.6 million hl beer, the highest volume in its 122-year history. The company stated its sales could have been higher but it had to turn down orders during the summer peak as it lacked the capacity to fill them.

Europe/Russia

News travels very slowly these days. Since 2010, Cerveja Leuven has boasted of brewing several beers in Belgian style. But only now the city of Leuven has found out. Guess what, Leuven’s councillors are not amused with those beers as they are brewed in Piracicaba, a city 150 km northwest of Sao Paulo, and have no connection with Leuven whatsoever.

Europe/Russia

Britain’s biggest supermarket chain Tesco has pulled more than half of Heineken’s beer and cider range from its shelves after the brewer tried to increase prices following the UK’s vote to leave the EU, media reported on 22 March 2017.

Europe/Russia

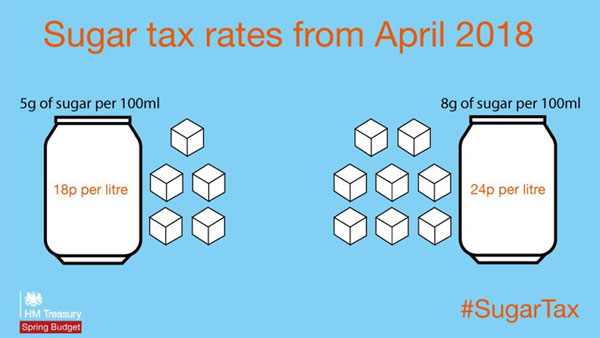

It was a day of reckoning for alcohol and soft drinks producers. On 8 March 2017 the UK government said in its Spring Budget that the traditional “sin taxes” on booze and cigarettes would not rise, but a new one is being introduced in the form of the sugar tax.