On 26 Ocotber 2011 Carlsberg announced it has appointed Dr Isaac Sheps, currently CEO of Carlsberg UK, to take over the leadership of Baltika Breweries (Baltika), Carlsberg’s Russian unit. Dr Sheps will also be responsible for Carlsberg’s operations across Eastern Europe. He will take over on 1 December 2011 and replace Anton Artemiev, the current CEO of Baltika, who will nevertheless continue to serve as a member of the Baltika Supervisory Board.

Dutch brewer Heineken on 26 October 2011 reported a 1 percent rise in net profit for the third quarter (July to September 2011), claiming that strong sales in Africa and elsewhere offset the impact of poor summer weather in Europe.

Pollaers (Foster’s), Artemiev (Baltika) and Dunsmore (C&C Group): it must be the season for golden handshakes. The Chief Executive of Irish drinks and cider group C&C (Magners, Bulmers, Tennent’s) John Dunsmore will be in line for a multi-million euro payout after he unexpectedly announced his resignation on 19 October 2011.

According to Japanese media, French group Danone has approached Japan’s Suntory Holdings about a potential purchase of the French food giant’s mineral water business, which includes the Evian and Volvic brands, it was reported on 22 October 2011.

The Bunch of Grapes, Pontypridd has been named as the first official outlet for The Beer Academy in Wales in October 2011.

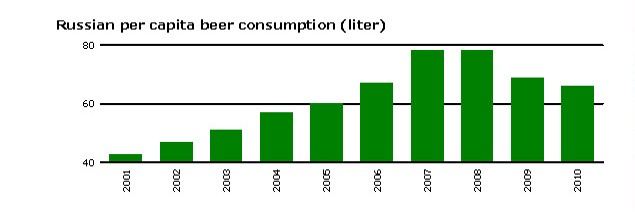

A shrewd move which should have led to some serious chin scratching in Brussels and Amsterdam. The line-up between SABMiller and Turkish Efes not only allows the two also-rans in Russia to better compete against market leader Baltika, it also adds another protective layer to SABMiller and makes the world’s number two brewer less easy to take over.

Milan does not only mean fashion – it also turns into a platform for producers, fillers and marketers from the beverage industry every two years, from wine, mineral waters, beer and carbonated beverages to juice and brandy or vinegars and oils. The average worldwide consumption of beverages amounts to over 4 billion hl, with tendency to rise. In beverage production, machines and producing lines also have to be cutting edge. Simei caters to these expectations. From 22 to 26 November 2011, visitors can see for themselves on the 90 000 m2 of the newly-built exhibition centre of fieramilano in Rho-Pero. On the occasion of the 24th edition of Simei BRAUWELT International talked with Lucio Mastroberardino, president of Unione Italiana Vini (holder of the Simei trademark since 2010).

As of October 2011, Stephen Wilkinson is Director of Sales at Ybbstaler Fruit Austria.

There seems to be an amazing lot to talk about when it comes to paper labels. The 9th international label conference, which had been organised by Austria’s paper manufacturer Brigl & Bergmeister and was held in the mountain resort of Bad Hofgastein from 12 - 14 October 2011, certainly drew a large crowd, considering that the label business is comparatively small when you look at who’s producing the labels, who is refining them, who is printing them and who is providing the technology and machinery for it all.

A temporary victory for long-suffering publicans. On 4 October 2011 the European Court of Justice (ECJ) ruled against the UK football’s Premier League stating that the imposition of national borders to sell rights on a territory-by-territory basis contravened EU laws on free trade. The court said that restricting the sale of European foreign satellite decoder cards is “contrary to the freedom to provide services”. Essentially the court agreed with Karen Murphy, a publican from Portsmouth. Ms Murphy’s lawyers had argued she was entitled to show the matches because she had paid a subscription to a Greek broadcaster and that to enforce Sky’s exclusivity in the UK was against European free trade laws.