Which planet do investors live on that they expect brewers to keep on growing bigger and ever more profitable while the world economy is entering a dangerous new phase? Shares in Heineken were sent spiralling down after Europe’s top brewer warned that demand for its beer in Europe and the U.S. will remain "challenging" this year.

While the world seems to be on the brink of another financial disaster, AB-InBev gave the markets its usual spiel: all key financial figures pointed upwards in its second quarter ended 30 June 2011. Net profit rose 26 percent to USD 1.45 billion from USD 1.15 billion a year earlier, while revenue increased 8.5 percent to USD 9.52 billion from USD 9.17 billion, said the producer of brands like Budweiser, Stella Artois and Beck’s on 11 August 2011.

Who would have thought that the spectacular growth of a brewery start-up would be helped by – indeed – Sweden’s state-owned alcohol monopoly retailer Systembolaget? Doesn’t this run counter to our long-cherished prejudice that the bureaucrats at a monopoly retailer would only like to deal with one albeit big client? Think scale, efficiencies, logistics – the whole "big is best" beer caboodle.

Businesses face the risk of seriously damaging their reputation if they do not make tax planning part of their corporate responsibility programmes, says anti-poverty charity ActionAid.

Mud sticks. In all likelihood the probe by the House of Commons select committee into Heineken’s takeover of brewer Scottish & Newcastle amid allegations that Heineken broke promises to tens of thousands of pensioners, may come to nothing. Or rather it may come to the conclusion that Heineken actually did not dishonour its pension promises. But the fact that the UK’s number two brewer Heineken is being dragged before parliament with all the ensuing negative publicity should be enough to make Heineken’s spin doctors work overtime.

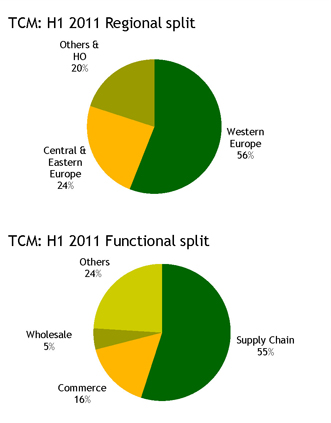

On 21 July 2011 brewer SABMiller reported a rise in first-quarter beer volumes, thanks to continued growth in emerging markets, but kept media guessing if it will top up its bid for Australia’s Fosters.

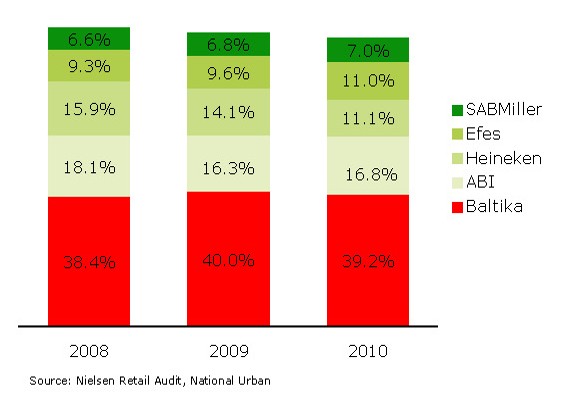

While Russians were out shopping for a bottle of vodka, Russia’s Parliament voted in a law which could change alcohol consumption quite dramatically. On 13 July 2011 the Russian Duma passed a tough anti-alcohol law which not only prevents the sale of beer at kiosks as of 2013, but also prohibits off-premise sales of beer during the night (between 11pm and 8 am) and alcohol advertising in general. For the first time, fines for drinking beer in various public places were introduced.

This autumn, the UK’s number one brewer Molson Coors will be launching three new "bloat-resistant" beers marketed to women. This will be good news for women who would like to drink beer without having to throw away a full wardrobe of size 8 clothes after a night on the town.

Not bad. Despite the German beer market declining 2 percent in 2010, Brau Holding International (BHI), the joint venture between Heineken and Germany’s Schörghuber Group which owns Paulaner brewery, managed to raise turnover and volumes. Sales were up 1.4 percent to EUR 576 million while output increased 2 percent year-on-year, it was reported.

It’s been hard for Belgians to stomach the fact that the CEO of their major concern, AB-InBev, has not deemed it a top priority to explain himself to their media. Maybe he even considered public opinion in Belgium irrelevant. After all, what’s Belgium to AB-InBev? 1.5 percent of the brewer’s total global volume. It’s taken him five years at the helm before Carlos Brito, on 7 July 2011 gave his first interview in Belgium: to the business publication Trends.