Never change a running system, that’s what computer scientists usually advise their overly eager customers. Apparently Punch Taverns, Britain’s biggest pub company with a core estate of 6,770 leased and managed pubs, thought the same – and opted for change.

… why are Bionade’s sales in decline? The lemonade for LOHAS (that’s consumers seeking a Lifestyle based On Health And Sustainability) once proved immensely popular. From its launch in 1995, when it was solely sold in health food shops, the brand grew to become the almost uncontested leader in its “better lemonades” segment. Having grown at a rate of almost 300 percent each year, Bionade sold over 200 million bottles (600,000 hl) in 2007, ranking fourth among Germany’s most popular lemonades – behind Fanta, Sprite and Sinalco. Since 2008 when turnover reached EUR 40 million, sales of the premium-priced lemonade have been in free fall: by 2010 it had dropped to about 230,000 hl, it was reported. Many wonder: what are the reasons for this decline?

Wai-wai-wait: Could it possibly be true that the most aggressive cost-cutter AB-InBev is joining the Green Panthers? Have its executives suddenly seen the light and turned environmentalists? Or have they just realised that saving on water helps them improve their bottom line? It’s a commonly held belief that companies only start caring for the environment if they can make a business case for it. And this seems to have happened at AB-InBev.

With two markets (North America and Brazil) representing about 35 percent of the global beer profit pool it came as no surprise that AB-InBev’s CEO Carlos Brito would zoom in on these during AB-InBev’s 2010 full year results presentation given on 3 March 2011. Overall, AB-InBev managed to close 2010 with full year revenue growth of 4.4 percent to USD 36.3 billion, own beer volume growth of 2.1 percent to 348 million hl, EBITDA growth of 10.6 percent to USD 13.9 billion with an EBITDA margin reaching 38.2 percent from 35.8 percent in 2009.

Our colleagues over in Belgium picked a real winner. The Flemish-language business magazine Trends named Duvel CEO Michel Moortgat “Manager of the Year 2010”. Not enough. The title “Marketing Manager of the Year 2010” went to Johan Van Dijck, who heads marketing at Duvel. This being Belgium, the Walloons could not be left out. Hence Trends’ sister publication “Trends-Tendences” chose Nicolas Lambert, Marketing Manager at Heineken’s Alken-Maes brewery as its “Marketing Manager de l’Année 2010”.

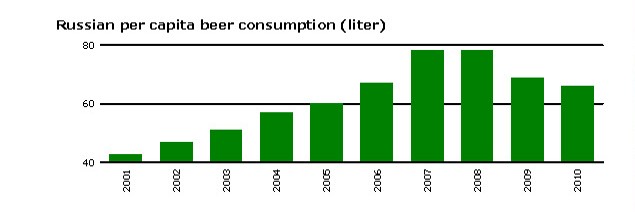

Readers will be forgiven for not watching Russia’s daily talk show “Let them speak” hosted by Andrey Malakhov, Russia’s answer to Oprah Winfrey. If they did, they would be aware of the plight of many Natashas, Tatjanas and Galinas who regularly call in to this show to tell tear-trenched stories about their husbands’ alcohol problems. Alcoholism and under age drinking in particular have taken on epidemic proportions in Russia. So much so that the Kremlin has pushed for a bill in the Duma that will classify beer as an alcoholic drink.

That’s what we call serious bad timing. Just as Belgium’s anti-alcohol debate is gathering pace AB-InBev put its first Bionade-taste-alike soft drink into the market. Although Jupiler Force, introduced on 18 February 2011, should have pleased the anti-alcohol lobbyists, many of them, women in particular, still thought they smelt a rat. Because – if it’s a soft drink that should not be confused with a beer, why on earth did AB-InBev have to call the product Jupiler Force after Belgium’s major beer seller Jupiler? Why couldn’t they slab the label Manneken Pride or Ardeur d’Ardennes on it – if they were desperate for a naff double entendre?

Words of wisdom from Jean-Francois van Boxmeer on cost-cutting. Which is another way of saying: How far can you cut into the flesh before you strike the bone? Yet you could see London’s finest and sharpest analysts get hot under their EUR 140 shirt collars. What could this possibly mean? That Heineken intends to put more money behind its brands in Europe? Indeed, that’s what Heineken’s CEO told analysts at its 2010 results meeting on 16 February 2011. Mr van Boxmeer said Heineken plans to invest in advertising to reverse a slide in sales volumes in Europe, where Heineken is the largest beer seller, a move that will hurt short-term profits in the region.

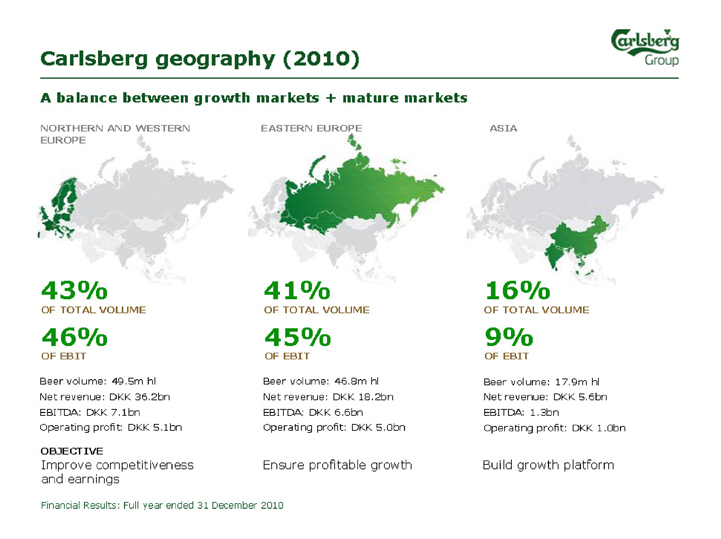

Obviously, it did not pay off for Carlsberg that it did not immediately pass the massive tax hike in Russia on to consumers. The world’s number four brewer waited until the summer before it finally raised prices. On 21 February 2011, Danish brewer Carlsberg reported a fall in fourth-quarter net profit. Net profit for the last three months of 2010 fell to DDK 301 million (USD 55 million; EUR 40.4 million) from DKK 383 million in the same period 2009. The brewer gets almost half of its earnings from eastern Europe, where operating profit dropped 56 percent in the quarter.

French spirits group Pernod Ricard on 17 February 2011 reported a 10 percent rise in first-half 2011 net profit (ended 31December 2010) to EUR 666 million (USD 903.4 million) against a year-ago profit of EUR 648 million. First-half sales for the group rose 13 percent to EUR 4.28 billion, lifted by strong growth in emerging markets, an improvement in Europe and a gradual recovery in the United States. However, Pernod Ricard’s share price fell 4.3 percent to EUR 67.61 as Pernod Ricard had missed analysts’ profits estimates. Too bad.