After the sudden death of the chief of Oettinger Brewery, Dirk Kollmar, his previous co-executive directors will continue to run the company, Sales Manager Jörg Dierig said on 7 May 2014.

It is so unreal that we have lost Joep. The news came to us like a bolt from the blue. Joep was still so active during the recent 11th Trends in Brewing in Ghent. He was really happy to spend these days in the presence of brewers, maltsters and scientists.

The sowing of spring barley in Europe is on time and well advanced in many regions. Partly, most of the work was done by the end of March. In some regions, the acreage has been reduced significantly. Drought could also be a limiting factor in some places.

The Czech beer market was stagnant overall in 2013 with consumption of 17.1 million hl, pushing the per capita level of beer down slightly to 144 litres, the Czech Association of Brewers and Maltsters reported in April 2014. While Czechs are still the global leaders in beer drinking, these numbers mask huge changes in where and what the Czechs are drinking.

Pernod Ricard is looking to sell off its Czech Becherovka brand for up to USD 200 million, according to media reports in April 2014. Becherovka, formerly Karlsbader Becherbitter, is an herbal bitter, often drunk as a digestive aid, with an alcohol content of 38% ABV - in case readers have never had it.

Apparently, Carlsberg think it does. On 3 April 2014 they announced they had entered into an agreement to acquire 51 percent of Zatecky Pivovar (“Zatec Brewery”) in the Czech Republic for an undisclosed sum.

The antitrust watchdog bared its teeth yet again and issued a total of EUR 231.2 million in fines against Carlsberg Germany, Radeberger, a host of smaller regional brewers (Bolten, Erzquell, Früh and Gaffel), the Association of Rhine – Westphalian breweries as well as against seven brewery executives. The penalties were issued on 2 April 2014.

On 28 March 2014, Nya (“new”) Carnegiebryggeriet, an 8,000 barrel brewery cum restaurant, opened in Stockholm. Behind the two-year project are Carlsberg Sweden and Brooklyn Brewery, plus some private investors. Sweden’s Minister of Rural Affairs, Eskil Erlandsson did the ribbon-cutting in the presence of Marc Jensen, CEO of Carlsberg Sweden, Brooklyn Brewery’s GM Eric Ottaway, Brewmaster Garrett Oliver and co-founder Steve Hindy.

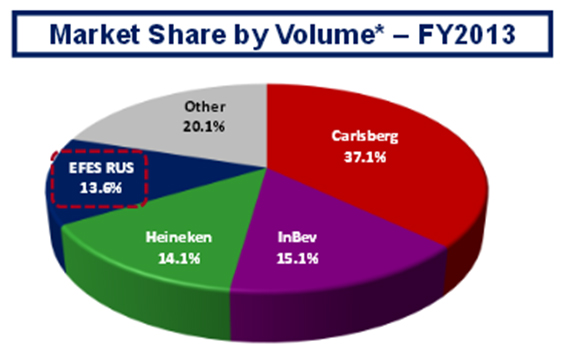

A year of brewery closures? First, Efes closed their Moscow brewery in January, now AB-InBev follow suit. On 26 March 2014 media reported that AB-InBev will shut down their brewery in Perm. It will be their third plant to go off-stream in less than two years after closing one in Kursk in 2012 and another in Novocheboksarsk in 2013. This will leave AB-InBev with six breweries, it was reported.

Although they went scotch free, having turned themselves whistleblower in the watchdog’s investigation into the German beer cartel, AB-InBev may be dragged to court after all – by German Rail (DB). In 2008, when several German brewers colluded over beer prices, according to German trust busters, AB-InBev were the exclusive beer supplier to DB. AB-InBev’s contract with DB only expired recently after six years. They have since been replaced by Bitburger Brewery (another culprit in the beer cartel case) and wheat beer brewer Erdinger.