Europe/Russia

The South Africa born Jan du Plessis, 60, is set to become chairman of two big global companies at the same time when he takes over the role at brewer SABMiller next year in addition to his current position at miner Rio Tinto.

Europe/Russia

Coca-Cola HBC, the world’s number two bottler of Coke products, on 7 August 2014 issued the warning that volumes would fall for the rest of the year, citing a “sudden deterioration” in Russia, its biggest market.

Europe/Russia

As Russia thumps Western sanctions, it has introduced a one-year ban on agricultural and food product imports from the countries that she no longer considers her friends. Moscow has already imposed bans on Ukrainian juice and dairy produce, Polish apples and Australian beef and has said it might target Greek fruits and U.S. poultry.

Europe/Russia

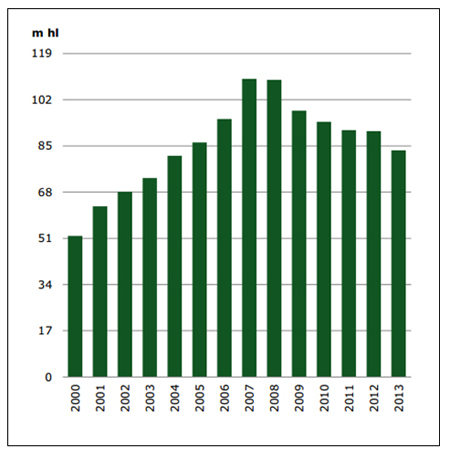

The Czech brewing industry is a mix of good and bad news. First the bad news: Czechs are drinking less beer and more of it at home. And now for the good news: they are still the world leader in beer consumption and they are drinking a larger variety of brews as microbrews move into the hospitality sector.

Europe/Russia

It took a trio of female beer experts to launch Beer Day Britain, which is hoped to become an annual festivity of the British beer industry starting in 2015. On 15 June next year, Beer Day Britain will celebrate all that is great about British beer.

Europe/Russia

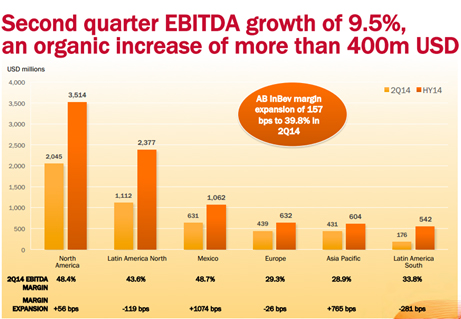

Call it bad timing. David Duchovny’s latest role is stirring up more intrigue than any episode of “The X-Files”. The U.S. actor plays himself in a beer ad for AB-InBev’s brand Sibirskaya Korona (“Sibirian Crown”), imagining how proud he would be if he were Russian. The ad was first aired on YouTube on 25 July 2014, only days after the downing of flight MH17 in the Ukraine.

Europe/Russia

Guinness brewer Diageo has discontinued the controversial Arthur’s Day celebrations in favour of a new format called Guinness Amplify, which will see a series of music events take place every weekend for the month of September throughout Ireland.

Europe/Russia

You could be forgiven for thinking that Germany is a hotbed of illegal shenanigans. In July 2014, the Germany Federal Cartel Office issued fines of more than EUR 338 million (USD 455 million) on 21 sausage makers for illegal price fixing.

Europe/Russia

It’s amazing. Another U.S. craft brewer has ventured overseas. Really, you have to admire them for their guts. It takes guts, and probably more, to want to open a brewery in Germany these days. Beer consumption is in decline, competition is fierce and U.S.-style “craft beer” largely unheard of.

Europe/Russia

SABMiller’s stigma as a tax dodger does not seem to want to go away. Four years after the UK charity ActionAid exposed the brewer of depriving poor countries of millions in revenues, the Sunday Times newspaper ran a comment on 29 June 2014 with the opening line: “You could be forgiven for thinking SABMiller’s newish boss Alan Clark has a guilty conscience.”