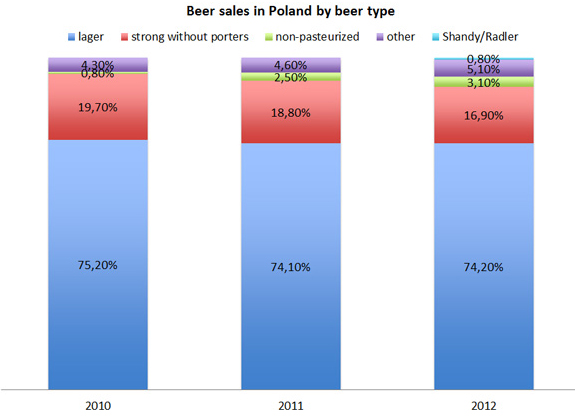

Kompania Piwowarska (KP) has stated that it expects beer sales to rise this year thanks to the 2014 Football World Cup. The brewer, which is Poland’s number one and a unit of SABMiller, produces popular brands such as Lech, Tyskie, Redds and Zubr. At the end of May 2014 KP reported that its sales dropped by as much as 9 percent in its 2013/2014 financial year (31 March 2014), while the overall beer market only declined by 2.5 percent to 37.3 million hl.

Many spring barley fields in Europe are in a good or very good shape. The drought this spring didn´t seem to have too big an effect. In certain areas, an early harvest is expected. In some countries, the acreage is significantly smaller than it was last year. The price pressure continues though.

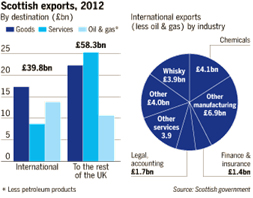

Ho ho. Finally someone from the secretive world of business has come out of the woodwork and entered the debate over Scotland’s independence. On 30 May 2014 Diageo’s CEO Ivan Menezes broke cover and reportedly said that it is “extremely important” that Scotland remains part of the EU, both for Diageo and for the Scotch whisky industry as a whole.

Homebrewers take note! On 29 May 2014, the UK supermarket group Waitrose announced that it has teamed up with craft brewery Thornbridge and home brew supplier Brew UK to find the UK’s best home brew.

The German Chancellor Angela Merkel has backed the call from the Brewers of Europe, a trade body, to end the discrimination for small European breweries exporting to the United States. The fifth round of talks between the EU and the United States on the Transatlantic Trade & Investment Partnership (TTIP) began in Arlington, Virginia, on 19 May 2014.

Call it a journalist’s occupational hazard. Sometimes our stories don’t get written. Usually, it’s either because you cannot find enough sources to back up a juicy rumour, or because the story, when published, would immediately point to its whistleblower. In my line of work this has happened a few times. But never have I had to contend with the fact that political events beyond my control would wipe out months of research.

The civil war in the Ukraine is having its effect on global brewers. The world’s number four brewer Carlsberg was forced to issue a profit warning after it swung to a net loss in the first quarter, the brewer announced on 7 May 2014.

Despite rising sales during the first quarter, AB-InBev reported on 7 May 2014 that its net profit slumped by almost 24 percent. AB-InBev said net profit fell to USD 1.4 billion in the January through March period from USD 1.8 billion in the same quarter a year earlier.

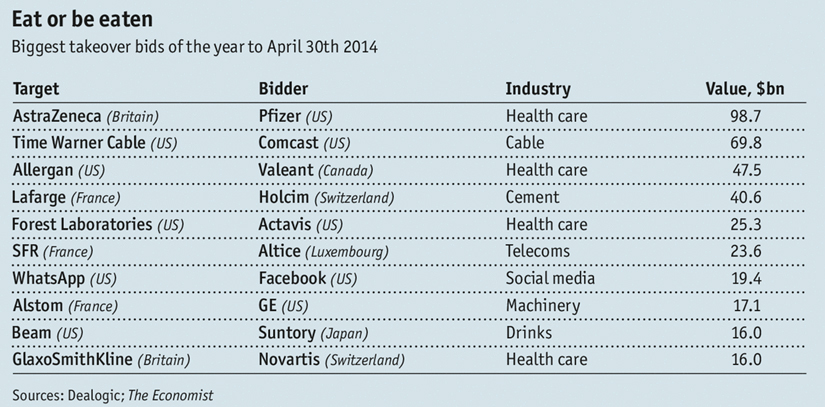

The last week in April 2014 launched a new fashion in corporate takeovers: the return of the “big deal”, as The Economist newspaper wrote on 30th April. We learnt that Pfizer and AstraZeneca, two drugmakers, Holcim and Lafarge, cement companies, and Publicis and Omnicom, advertising firms were planning to combine. Among other big deals (see table below), GE and Siemens are both bidding for Alstom, a French industrial rival. According to The Economist, there have been 15 transactions each worth more than USD 10 billion so far this year, the most since the record mergers & acquisitions rush of 2007.

When releasing first quarter 2014 figures on 24 April 2014, Heineken said it has returned to growth in its crucial Western Europe market in the first quarter, after a long period of stagnation. Organic sales - a figure which strips out the effects of currencies and acquisitions - grew by 3.4 per cent.