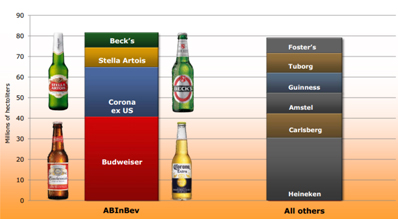

AB-InBev marginalised their rivals in 2013

These are interesting figures: Sales of Budweiser in the U.S. declined 29 percent between 2007 and 2012, says Beer Marketers’ Insights. Budweiser Select was down 61 percent over the same period, Michelob Light a staggering 70 percent. AB-InBev cannot be too pleased. However, rival MillerCoors was not spared either: sales of Miller Genuine Draft dropped 56 percent and Milwaukee’s Best Light 40 percent.

Despite the rise in craft beer sales, total U.S. beer sales fell 2.3 percent or more than 5.6 million hl between 2007 and 2012. In 2013 they barely moved: only + 0.3 percent over 2012 according to the Beer Institute. The big brewers like to blame those losses on the recession. But, as Beer Marketers’ Insights argues, this is only one of the causes. Most of the above brands have been losing ground for much longer. Which is why, once they start their descent it’s very difficult to reverse this trend. Tell that to AB-InBev. When they “inherited” the brand from the Busches, it had already been going south for ages. Fortunately for them, the overall consequences were not really dicey as the trend towards light beers benefited the rise of their other brand, Bud Light. What may give AB-InBev reason to pause is that there seems to be a shift away from light beers too, says beer Marketers’ Insights. For example, sales of Heineken Premium Light fell 37 percent between 2007 and 2012.

Budweiser’s U.S. troubles do not seem to worry AB-InBev all that much. It may hurt their pride that they have failed to best August Busch IV and his team, who had already been battling with Budweiser’s lacklustre sales. But for as long as the rise of Budweiser’s global sales makes their rival envious, they are on a jolly ride.

AB-InBev reported on 26 February 2014 that their global beer sales in 2013 declined 2.0 percent. Still, they managed to increase sales of their global brands by 4.7 percent. More importantly, they boosted revenues by 3.3 percent to USD 43.2 billion (EUR 31.3 billion) and EBITDA by 8.1 percent to USD 18.2 billion. EBIT growth was 9.3 percent to USD 14.2 billion.

If you look at profit contribution by geographical regions, the U.S. and Canada are their most profitable markets. Profits (EBITDA) in those two markets alone were USD 6.2 billion, followed by Latin America North (basically Brazil) where they earned USD 5.8 billion. Latin America South contributed USD 1.5 billion and Mexico USD 1.3 billion. In fact, profits in Mexico (Modelo) alone were higher than what they made in Western Europe (USD 1.1 billion).

For Belgium AB-InBev admitted a volume decline of 3.0 percent in 2013, for Germany a drop of 7.1 percent and for the UK a fall of 3.0 percent. What is worse, the pricing environment affected them negatively in that they saw EBITDA in Western Europe shrink 5.0 percent over 2012.

Likewise, Central and Eastern Europe (that’s Russia and the Ukraine) continues to give them a headache. In Russia, beer volumes declined 13.6 percent, while in the Ukraine they dropped 18.9 percent. The fourth quarter in the Ukraine was really bad (-41.3 percent) because of the political instability in the country. No wonder, EBITDA in the region fell 11.1 percent to USD 225 million, which makes Central and Eastern Europe their least profitable zone if measured in EBITDA margin.

Although Asia’s beer business margins leave a lot to be desired for, AB-InBev said they earned USD 546 million there in 2013, an increase of 31.5 percent over 2012.

In terms of geographical focus, AB-InBev seem better positioned than their rivals. There are only four markets world-wide where 49 percent of global beer volumes and 47.8 percent of industry profits (EBIT) are produced. That’s the U.S., Brazil, Mexico and China. AB-InBev have market leadership in the first three, while they have about a 15 percent market share in China.

Considering that the global beer profit pool (EBIT) was USD 32.4 billion in 2013 and AB-InBev’s EBIT was USD 14.2 billion, almost every other dollar (44 percent) earned in beer world-wide went into their pockets. That alone should make some of their rivals chew their hankies.