BarthHaas Report: World hop and beer market 2022/2023

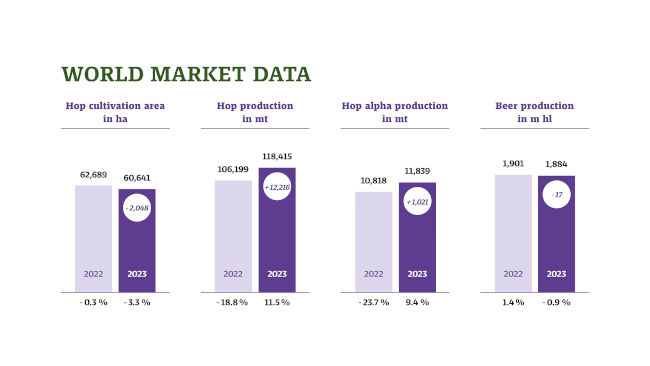

Nuremberg | On 16 July 2024, hop specialist BarthHaas presented the latest BarthHaas Report at an online press conference. It shows that the world hop acreage declined in 2023 for the second year in succession. It decreased by 3.3 percent year on year to stand at 60,641 hectares.

The USA was once again the country with the largest hop acreage worldwide, with 22,545 hectares, even though large areas there had been taken out of production (-8.9 %). It was closely followed by Germany with 20,629 hectares (+0.1 %). The Czech Republic came a distant third with 4,860 hectares (-1.7 %). In crop year 2023, the USA and Germany together accounted for 71 percent of world hop acreage and harvested a total of 75 percent of world crop volume.

Market remains oversupplied

Despite the reduction in acreage, hop production volume in crop year 2023 was higher year on year, reaching a figure of 118,415 metric tons – an increase of 11.5 percent. The yield of approximately two metric tons per hectare was within the long-term average. In addition to crop volume, alpha acid content is a crucial metric for the hop and beer industries. The mean alpha acid content of 10.0 % in 2023 was only slightly below that of the previous year. The proportion of aroma hops in both crop and alpha yield fell by three percent, while there was a corresponding increase in that of bitter hops.

Although acreage had been reduced and yields on the whole were average, the harvested alpha volume of 11,839 metric tons was 9.4 percent higher than in 2022. “The alpha balance accumulated in recent years still shows a significant market oversupply. Hop acreage must be reduced to bring production volume into line with lower demand and to return the market to something approaching equilibrium”, explains Heinrich Meier, the author of the BarthHaas Report.

Linking hop producers and brewers

In times shaped by climate change and unfavorable political and economic conditions, BarthHaas sees itself more than ever as a link between the hop producers and the brewers. Thomas Raiser, Managing Director of BarthHaas: “Only by cultivating and building on our good contacts can we identify the concerns and hardships of our suppliers and customers and respond to them.”

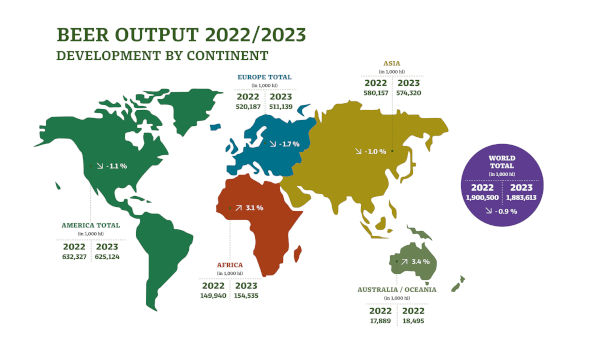

Beer production down slightly

In 2023 the brewing industry was affected by the generally difficult economic situation: Beer production worldwide fell by 0.9 percent to 1.88 billion hectoliters. The industry’s hopes of a sustained recovery were thus disappointed. “After we had managed to post modest growth in 2022 despite unfavorable conditions, we were expecting another small increase in 2023”, says Peter Hintermeier, Managing Director of BarthHaas, commenting on the development. “However, energy, raw materials, packaging, logistics, and labor costs remained at a high level, which put pressure on the brewing business in many countries.”

The German brewing industry underperformed the world market as a whole: Beer output in Germany in 2023 declined year on year by 3.3 percent to 84.89 million hectoliters. “In the world rankings, Germany remains in fifth place”, says Heinrich Meier, the author of the BarthHaas Report. “The first four places are taken by China, the USA, Brazil, and Mexico – as in the previous year. Together, the top 5 beer-producing countries account for nearly 50 percent of global production.”

The European market was down slightly: A total of 511.1 million hectoliters of beer was produced there – 1.7 percent less than in the year before. This was mainly due to falling production in the United Kingdom (-8.9 %) and Poland (-5.3 %). Compared with the member states of the European Union which saw beer output decline by an average of 2.5 percent, the rest of Europe had a better year: Here, production remained more or less stable with a decline of only 0.1 percent.

The USA recorded a marked decline in 2023; here, beer production fell by 5.6 percent to 193.0 million hectoliters. This made the United States the only beer-producing country in the Americas to see a fall in production volume. In the other two countries that are by far the biggest beer producers in the Americas – Brazil and Mexico – beer production increased in each case by one percent to 148.9 million hectoliters and 142.4 million hectoliters, respectively. In total, the countries of the Americas produced 625.1 million hectoliters of beer, representing a decline of 1.1 percent year on year.

Asian markets down on average

Production in Asia saw a similar decline of 1.0 percent overall, but with marked differences in development between the individual markets. The winners included high-volume producers such as India (+15.0 % to 29.3m hl) or Cambodia (+15.0 % to 15.0m hl), but these gains failed to compensate completely for the losses in the even larger markets of China (-0.4 % to 359.08m hl), Japan (-1.2 % to 45.3m hl) or Vietnam (-20.5 % to 31.0m hl). In total, beer output in Asia in 2023 amounted to 574.3 million hectoliters, 62.5 percent of which came from China.

In percentage terms, the second-highest growth in 2023 was recorded in Africa; here, output rose by 3.1 percent to a total of 154.5 million hectoliters. South Africa (+4.0 % to 35.1m hl) made an outsized contribution to African production volume. Strong growth was also recorded in Ethiopia (+9.5 % to 12.7m hl) and Cameroon (+13.8 % to 9.1m hl). Only Australia/Oceania grew somewhat more strongly, by 3.4 percent, but this was from a very low base, bringing its production volume to a mere 18.5 million hectoliters.

World beer market remains volatile

It is difficult to provide a forecast for the world beer market in 2024. “The brewing industry is still feeling the effects of the war in Ukraine; companies throughout the entire supply chain are laboring under sustained high costs”, says Thomas Raiser, Managing Director of BarthHaas. “Consumers in many countries are groaning under the burden of high inflation. We therefore only expect beer output to remain stable for the current year, but are unable to identify a clear trend for the future.”

Keywords

international beer market beer output beer consumption annual reports statistics hop trade

Source

BRAUWELT International 2024

Companies

- BarthHaas GmbH & Co. KG, Nuremberg, Germany