Global Beverage Closures demand

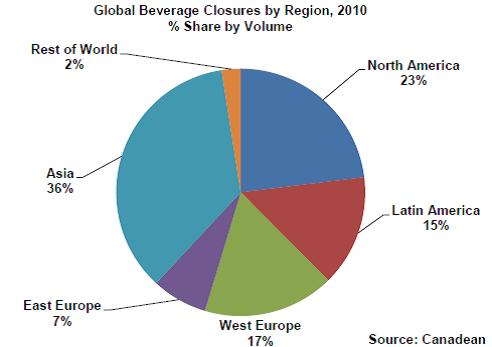

In spite of the economic slowdown in many markets over the last 2 years, beverage closure demand has continued to grow strongly, driven partly by the sustained shift towards pre-packaged beverage consumption in many developing markets. Looking at the global beverage closures market in detail, total demand across the soft drinks, dairy drinks and beer markets under review amounted to around 1055 billion closures in 2010. On a regional basis, Asia already accounts for the largest share of total annual closure volumes at 36 percent, equivalent to around 375 billion units. Collectively, the Americas combine for just under 400 billion, Europe for around 250 billion, the rest of the world around one tenth of that.

Not only is Asia already the largest market for closure sales, but it is also the fastest growing, with the annual growth rate for the period 2003 to 2015 put at above 7 percent – double the global average. The mature markets of North America and West Europe have eked out growth, the former adding around 1 percent per year to annual volumes, the latter only 0.2 percent to 2010, as demand, particularly for bottled water, has decelerated.

Source

BRAUWELT International 2011