Heineken’s unit Zywiec suffers drop in profits in 2014

What has happened here? Polish brewing group Zywiec saw a 41 percent decline in 2014 net profits to PLN 159.4 million, following an 11 percent drop in revenues and a 3.6 percent fall in volumes to 10.7 million hl, it was reported on 11 February 2015.

Last year was not a bad year for beer. Thanks to the Football World Cup, Polish beer sales would have been flat (at worst) over 2013, which saw a 2 percent drop.

True, the Polish beer market is mature; after displaying phenomenal buoyancy between 1990 and 2007/2008, it seems to have stabilized at around 38 million hl, with per capita consumption at 96 litres. Its EBIT pool is the third-largest in Europe behind Germany’s and Spain’s, according to Nomura, a bank.

But this still does not explain Zywiec’s plight. Heineken’s Full Year 2014 financial presentation could have shed some light on the situation in Poland, had the information been given in plain English rather than in that Orwellian lingo called “Financial Newspeak”.

Analysts who pressed Heineken’s CEO Jean-Francois van Boxmeer for details, were told that the market has changed “structurally”: there are only a few players left, consumption is declining, there is no “demographic expansion” (young Polish men have left to seek work elsewhere in Europe) while the commercial environment looks quite different to a few years’ ago, when there were still lots of corner stores around – since replaced by supermarkets or discounters.

In effect, said Mr van Boxmeer, “the sector has been confronted [with a] decline in demand, shifting power in the market and that has led to a profit pool that has been shrunk for all players.” If I understand this correctly, it means that whatever has happened in Poland was beyond brewers’ means. And whoever has shrunk the profit pool – it was not the brewers.

Probably sensing that these explanations alone will not satisfy the analysts, Mr van Boxmeer added a shrouded reference to another competitive dynamic, which pulled Zywiec’s numbers down: “… some actors who were smaller wanted to gain share at the detriment of pricing, … you end up in a total different situation a decade later than where you started. So that is something structural.”

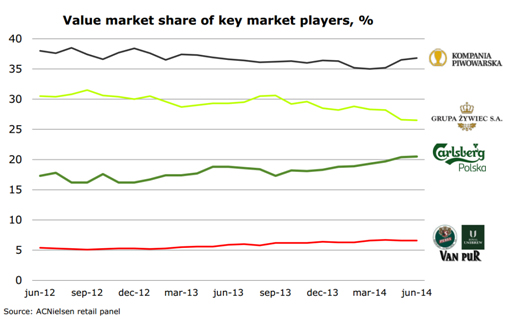

Those analysts who had been on Carlsberg’s market visit to Poland in September 2014 would have understood that the reference was to Carlsberg, the number three player in the market behind SABMiller’s KP and Heineken’s Zywiec, which has been stealing share from both Zywiec and KP through aggressive discounting.

What I wonder is this: If all these changes are “structural” – a euphemism for “not my fault” – what can Zywiec do to rejig its business? The plan for Zywiec is actually a mix (another popular term – always use a mix of tools) of “rebasing, i.e. productivity”, and restructuring.

Zywiec’s management was less prepared to resort to Newspeak. Reporting on the same day in Polish (which translates very well into plain English), it said that 2014 was “a difficult year” because of “rising price competition combined with a rise in modern trade, especially discount.” Zywiec tried to counter these trends with cost cutting plans, of which the “first results” are visible in lower fixed costs in 2014.

The outlook for 2015:“We expect that in 2015 the beer market will remain on a similar level in volume terms, but could fall slightly in value terms,” Zywiec’s management said. Cost cutting at the brewer’s five plants should continue apace.

Top three brewers control over 80 percent of Polish beer market

“Value market share” is roughly equal to market shares by volume. The Polish Government in 2014 attributed to KP, which owns such popular brands as Lech, Tyskie and ¯ubr, a 38 percent market share. Zywiec has about 30 percent. Carlsberg, with brands Okocim and Kasztelan, has circa 20 percent.

Keywords

Poland financial figures international beverage market

Authors

Ina Verstl

Source

BRAUWELT International 2015