The party is over

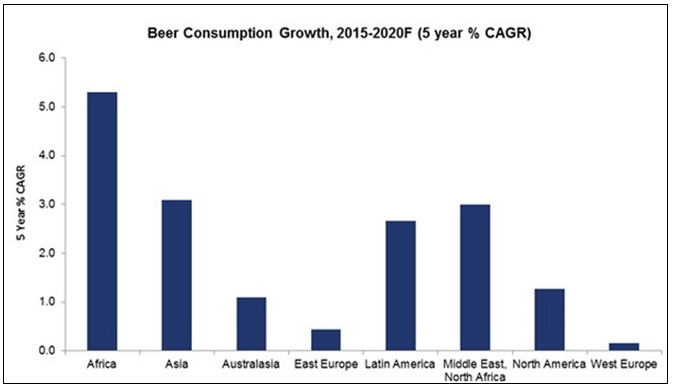

Officially at least, AB-InBev’s takeover of SABMiller is all about breaking into the African market, where SABMiller is the dominant player. But Africa’s days of buoyant economic growth seem to be over, for the time being. “Low oil prices in oil-producing countries are affecting us very obviously, like in Nigeria,” Heineken’s CEO Jean-François van Boxmeer told CNBC Europe’s "Squawk Box" on 10 February 2016.

Because of the close correlation between the general state of the economy and beer consumption, brewers rightly worry that plummeting world prices for oil, platinum, copper, coal and iron ore will leave African countries with a booming headache and consumers strapped for cash.

As if this were not enough, foreign direct investments are dwindling to a trickle because of Africa’s notorious byzantine bureaucracy and its deteriorating security situation.

Already in January 2016 SABMiller announced that it will call time on its brewery in south Sudan (opened in 2009), after its business has been hampered by an acute shortage of foreign currency, which prevented it from buying raw materials. SABMiller may have braved the civil war, which has seen more than two million people flee since fighting broke out in Juba in December 2013, but it has now come up against a major shortage of hard currency. Unless there is a miracle, the last beer is expected to leave SABMiller’s brewery, which employs almost 240 people directly and thousands indirectly, in March 2016.

Also in January, Zimbabwe’s Delta Corporation, in which SABMiller has a 23 percent stake, reported that lager beer sales dropped 14 percent in the nine months through December 2015. Like South Sudan, Zimbabwe is facing its worst-ever liquidity crisis, with both government and the private sector struggling to meet monthly wage bills.

On the whole SABMiller seems to keep up well across Africa. Revenue only declined 8 percent in the third quarter to 31 December 2015, after dropping 9 percent in so-called net producer revenue (NPR) reported for the first half of SABMiller’s financial year. Doubtlessly, falling emerging market currencies – a trend which has been exacerbated recently by the slumping oil price – have hurt the brewer’s statutory results.

Consequently, Heineken’s van Boxmeer warned that the brewer expects further volatility in emerging markets in 2016.

Africa: the outlook is – still – good

Keywords

beer consumption international beverage market statistics

Authors

Ina Verstl

Source

BRAUWELT International 2016