BarthHaas Report: World hop and beer market 2024/2025

Nuremberg | The figures were eagerly awaited. On July 22, 2025, the time had come: Heinrich Meier and Thomas Raiser presented the new BarthHaas Report 2024/2025 at an online press conference, and they did not only have positive news to report.

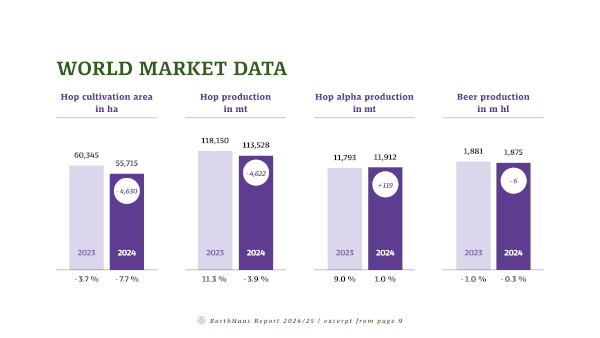

The structural change in the hop industry continued in 2024, with falling acreage accompanied by market oversupply: World hop acreage declined for the third year in succession – by 7.7 percent from 2023 to 2024 alone to stand at 55,715 hectares.

Germany returned to top place among the hop-growing countries as acreage adjustments were delayed due to existing forward contracts. In 2024, German acreage was reduced by only 1.6 percent, while the reduction continued in 2025 by further 7 percent to a total of 18.962 hectares. The USA saw large-scale idling of acreage amounting to almost 18 percent, bringing the total there down to 18,513 hectares in 2024. The Czech Republic remained a distant 3rd, with 4,845 hectares.

World crop volume shrinks

There was also a decline in global crop volume in 2024 – albeit to a lesser extent – by 3.9 percent to 113,538 mt. However, the alpha acid content in the hops increased slightly – by 1.0 percent to 11,912 mt. Last year’s global average was 10.5 percent, compared with the previous year’s 10.0 percent.

Sector concentration also continued in 2024 as part of the structural change. In Germany, a further 31 hop growers discontinued production. The average planted acreage of the remaining 1,009 farms rose by 0.3 hectares to 20.1 hectares in crop year 2024.

“The market remains structurally oversupplied and the hop industry is struggling to cope with surpluses that have largely been forward-contracted, but have not been used,” explains Heinrich Meier, author of the BarthHaas Report. “Further acreage reduction is therefore essential if the market is to return to equilibrium.”

Beers with lower hop content preferred

The declining demand for hops can be explained by changes in the beer market worldwide: “The trend toward mainstream beers and alcohol-free and low-alcohol variants continued in 2024 and in fact gained further momentum,” explains Thomas Raiser, Managing Director of BarthHaas. A decline in hop dosage can be seen even in the craft beer segment – due on the one hand to the increasing use of efficient hop products and on the other to a change toward traditional bottom-fermented beer styles requiring more moderate hop addition.

Aside from the changing trends, other factors are contributing to the fall in hop demand particularly in the traditional beer nations among the western industrialized countries. These include aging populations, competition from a considerably greater variety of beverages, and not least a decline in purchasing power in economically difficult times.

International beer market 2024 almost stable

Despite the generally difficult economic environment last year, the brewing industry fared better than expected internationally: Compared with 2023, global beer production fell only minimally by 0.3 percent to 1.875 billion hectoliters. However, this virtually stable result is no cause for complacency. Moreover, the international average hides the fact that individual markets are falling far short of expectations.

The German brewing industry underperformed the world market as a whole: Beer output in Germany declined by about one percent to 83.93 million hectoliters. “Last year Germany slipped from 5th to 6th place in the international ranking,” explains Heinrich Meier, author of the BarthHaas Report. “This is due to the fact that Russia increased its beer production by about nine percent, thereby overtaking Germany.” In recent years, the two countries had been almost neck and neck when it came to beer output. The first four places are still held by China, the USA, Brazil and Mexico, respectively. The European beer market registered a slight increase in 2024. In total, beer production increased by 1.1 percent to 514.2 million hectoliters. Declining by 1.0 percent to 339.8 million hectoliters, European Union output did noticeably less well than the rest of Europe, which grew by 5.6 percent to 174.4 million hectoliters. Aside from the increase in Russia, this growth is particularly due to the very positive development in the United Kingdom (+5.6% to 36.1 million hl).

The USA ends the year with a significant deficit

The American continent on the other hand saw beer production in 2024 fall year on year. Throughout the Americas, output declined by 1.3 percent to 617.0 million hectoliters. The decline was particularly evident in the USA, where production dropped by 4.8 percent to 184.5 million hectoliters. Output fell to a small extent in Brazil (-1 % to 147.4m hl), but rose slightly Mexico (+1.8 % to 145.0m hl).

The worst-performing continent of all in 2024 was Asia, where beer output declined by 2.3 percent to 565.4 million hectoliters. This was caused by developments in China, where production fell by five percent to 341 million hectoliters. The world’s number-one beer nation produces a good 60 percent of Asia’s output.

Beer consumption continues to rise in Africa

The world’s highest growth in percentage terms in the year under review was on the African continent. Following a moderately positive development in 2023, beer output in 2024 rose significantly by 6.7 percent to a total of 160.5 million hectoliters. South Africa, the continent’s most productive brewing nation, played a major part in this development, increasing production by 5.4 percent to 37 million hectoliters. In addition, positive developments in Nigeria (+8 % to 19.1m hl), Angola (+35 % to 16.2m hl) and Ethiopia (+8.1 % to 13.7m hl) played a significant role in this.

Australia/Oceania recorded a slight decline last year. Output dropped by 1.6 percent, remaining at a very low level with 18.2 million hectoliters.

It is difficult to make a forecast for the world beer market: BarthHaas expects beer output to remain stable in 2025. However, it will still be anything but plain sailing for the brewing industry. “Aside from the known difficult economic conditions, there is a risk that rising geopolitical tensions and trade disputes initiated by the USA will further depress consumer sentiment and increasingly complicate international trade,” says Thomas Raiser, Managing Director of BarthHaas.

The PDF version of the BarthHaas report can be downloaded from www.barthhaas.com in the Resources section.

Keywords

international beer market beer output annual reports statistics hop trade

Source

BRAUWELT International 2025

Companies

- BarthHaas GmbH & Co. KG, Nuremberg, Germany