Growing demand for European spring barley

The quality of spring barley in Europe this year is convincing, save for a few regional exceptions. Although in some major growing countries in Europe the acreage has been significantly reduced, there seems to be no shortage. Export inquiries get the market moving.

With around 1.0 m tons surplus of spring barley in the EU, supply from the 2014 harvest will last well into 2015. Nevertheless shortages in Australia, Argentina and North America will have a certain impact on the market for the upcoming harvest. There is demand for exports of winter malting barley, too, from South America, China, and North America. The price trend for spring barley continues, unaffected by the international wheat prices.

So far, the European maltsters appear less interested in the calendar year 2015 and thus the 2014 harvest. Except for marginal tonnage, their activities are limited. Their focus is on the calendar year 2016 and therefore the 2015 harvest. Currently, prices from EUR 210.00 to 212.00/ t franco Upper Rhine are being discussed for October 2015.

In August this year, the rates for October 2014 were at EUR 205.00/t.

Fob Denmark reported EUR 198.00/t for October 2015. In August, they reported EUR 185.00 to 186.00/t for October 2014. In the UK, there is talk of a similar level. The Moselle is largely ignored at the moment from a German perspective because it is too expensive. A large amount of French barley is being exported. The surplus in Europe could be marketed quickly, which will result in very low end-stocks at the beginning of the 2015 harvest.

This year in France, similar good results as last year were achieved in the harvest in a slightly extended area. Nevertheless, the impression is that this year the winter barley can show better qualities than the spring barley. Because of the early harvest of winter barley the goods were brought in still healthy before the rain. Spring barley harvested during the wet weather shows signs of Fusarium in some regions, especially in the eastern parts of France. The export surplus is still at about 850,000 to 900,000 t. In the UK, a very good quality has been reported. The protein content is slightly below average. The market is expected to have a surplus of around 450,000 tons of barley.

Denmark even speaks of an excellent harvest this year, even though the area has been reduced by around 100,000 hectares. The surplus could amount to 600,000-700,000 t, which is slightly lower than in the previous year. In Sweden, the danger of pre-germination exists due to rainfall in some regions of the country during the harvest. The market expects a surplus of around 150,000 tons of barley. Having similar results in Finland compared to last year in quality and quantity, large differences concerning the yield can be registered in the different regions. Scandinavia is assumed to have an export surplus of almost 1.0 m tons of barley.

In Germany, a very good harvest has been brought in. There is talk of a record yield. The low protein content and the high proportion of screening allowed a high selection rate. Nevertheless, very heterogeneous individual lots are reported. Before processing, special attention should be given to the germination energy and the external quality traits, advises the Braugerstengemeinschaft e.V., Munich. In the Netherlands, too, a very good quality has been reported. In Austria, the harvest was above average in most regions. Due to the positive weather in May/June this year, the winter malting barley mainly complied with the requirements for the first time.

In Poland, reports also show very good qualities except in the southwest. In this region, problems arise with the germination energy and Fusarium due to rains before and during the harvest. Very good yields and a lower protein content than in the previous year are reported in Slovakia and the Czech Republic. Here, a good brewing quality is assumed. The same can also be heard coming from Hungary. In Russia the conditions for malting barley were good as well. The best farmers could harvest up to 6 t/ha.

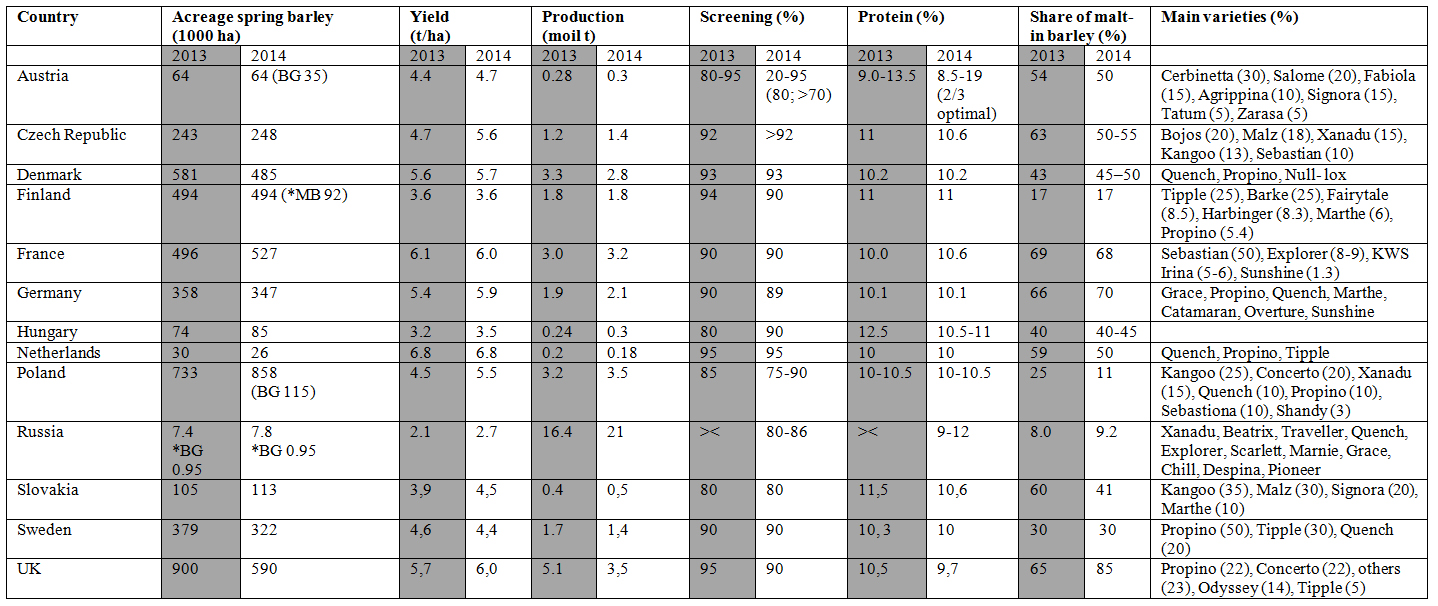

Table: Spring barley 2014 in Europe; November 2014

(* MB = Malting barley, >< = big differences)