The Americas

For the world’s number one brewer, AB-InBev, spending USD 39 million on Chicago specialty brewer Goose Island is a joke. But the deal, announced on 28 March 2011, highlights a shift in consumer preferences that matters to the USD 91 billion brewer. In the U.S., sales of mass-market beers have been in decline while those of high-end beers are growing.

The Americas

The Siebel Institute of Technology, America’s oldest brewing school, is pleased to announce their first ever Spanish-language course for professional brewers.

The Americas

This course (11 – 14 April 2011) will take an in-depth look at beer styles and flavours, providing the most in-depth training available in both "old world" and "new world" beer styles.

The Americas

Over-paid managers will throw themselves on their swords. Warren Buffett, the billionaire investor, said he rates businesses on their ability to raise prices and sometimes doesn’t even consider the people in charge. His cynical view on corporate suits and flunkies clashes with AB-InBev’s Carlos Brito, who likes to hammer home the message that the success of a corporation hinges on its managerial elites. ”Great companies are formed by great people,” not by popular products, cash flow or assets, Mr Brito told Stanford University graduates in November 2010. Who’s right? Mr Buffett or Mr Brito?

The Americas

Mr Busch must have gone through a version of hell while he was being chewed over by the world’s press following the death of his girl-friend just before Christmas 2010. On 9 February 2011 the St. Louis County prosecutor Bob McCulloch said that cocaine and oxycodone were found in Adrienne Martin’s system as a result of an accidental overdose. However, no charges will be filed. Some relief for August Busch IV.

The Americas

It could have been worse. Mexican brewer Grupo Modelo reported on 18 February 2011 that its net sales for the full year ended 31 December 2010 rose 3.9 percent to MXN 85 billion (EUR 5.1 billion; USD 7.0 billion), thanks to an increase of 4.0 percent in domestic sales. However, operating income dropped 0.2 percent to MXN 21.6 billion (EUR 1.3 billion; USD 1.7 billion) because of higher costs.

The Americas

The World Brewing Academy partnership (WBA) of the Siebel Institute of Technology and the Doemens Academy are adding several of their advanced-level brewing courses to their web-based training offerings.

The Americas

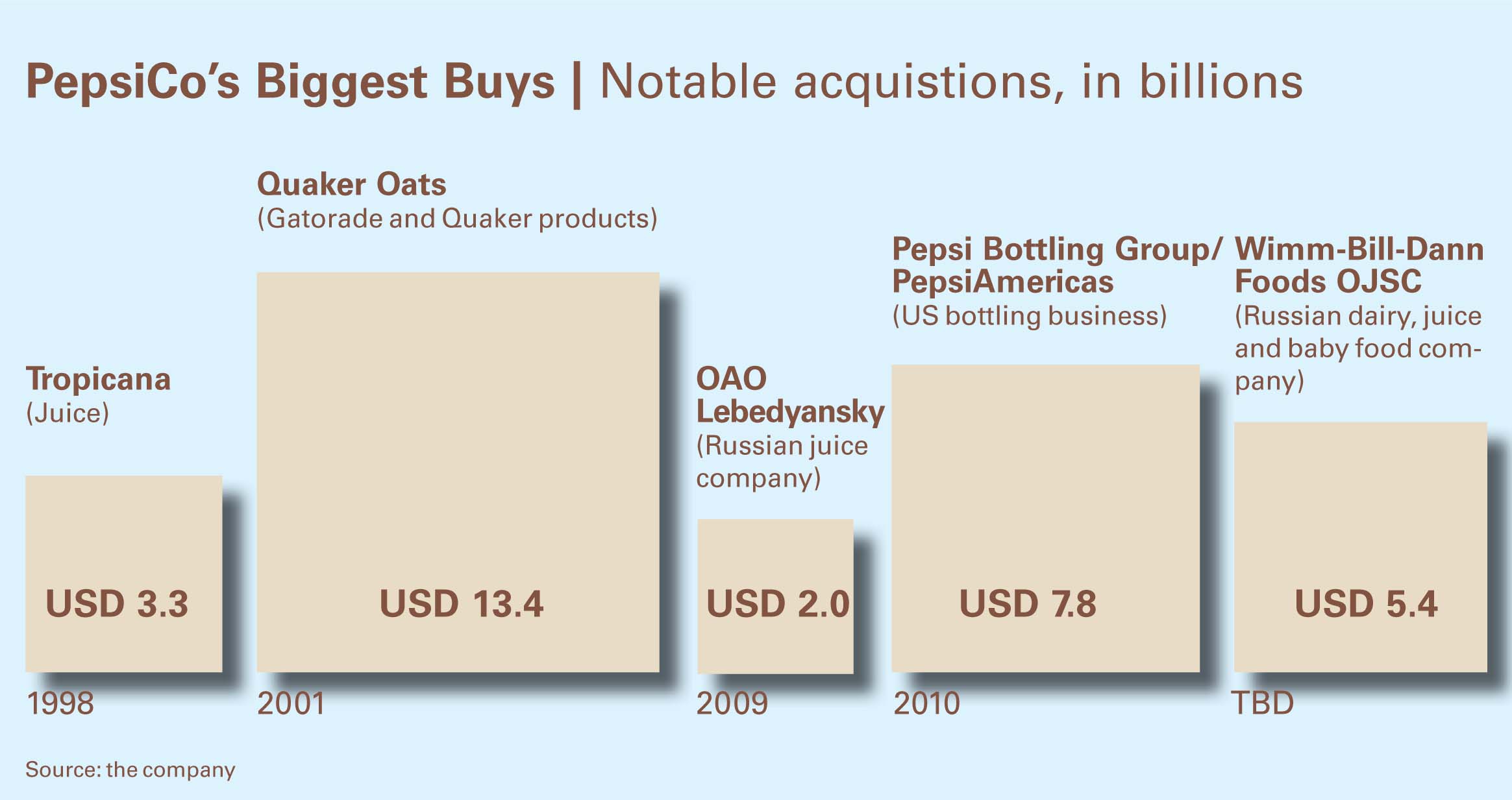

PepsiCo, Coke’s arch-rival reported on 10 February 2011 that last year net revenue grew 34 percent, while net income rose 6 percent.

The Americas

“Why should I care about the rubbish I said yesterday?” Germany’s first post-war Chancellor Konrad Adenauer allegedly retorted when asked why he had done a U-turn on certain policies.

The Americas

What have we been saying for months? That SABMiller is a likely takeover target. Coincidentally, the beverage economist Germain Hansmaennel and I discussed this possibility in our presentation at Rüdiger Ruoss’ Bündner Runde, a German beverage industry summit in Davos (report out next week in this newsletter), while two days later, on 2 February 2011, over in New York, analysts at Credit Suisse threw the idea into the open that AB-InBev could merge with SABMiller.