The four-hour Sensory Analysis Seminar is designed to train brewers and beer enthusiasts in the sensory evaluation of beer. Participants will learn to employ techniques used in professional breweries worldwide to assess the quality of ales and lagers.

Many analysts believe that AB-InBev will be keen to sit down with the controlling shareholders of Grupo Modelo to discuss an acquisition. After all, Grupo Modelo is an attractive company in an attractive market. If AB-InBev applied its cost cutting techniques to Grupo Modelo, it might be able to squeeze even more profits out of it.

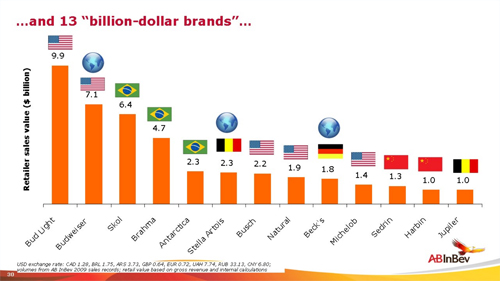

At first, only Carlsberg dared to boast about its transformation from a brewer to a Fast Moving Consumer Goods (FMCG) company. Now AB-InBev has had its public “coming-out” as an FMCG company too. Though clouded in a lot of acronyms like WCCP, OPR, ZBB, which probably only AB-InBev insiders understand immediately, being an FMCG company seems to come down to using one common business model globally in order to secure scale advantages in markets which enjoy good growth prospects. Add to that some billion dollar beer brands and a lot of data-crunching which helps reduce a complex reality to a quantifiable, predictable and calculable model of it and you begin to understand why AB-InBev’s culture stresses common sense and simplicity. Do as you are told and do not make things unnecessarily complicated.

For the first quarter ended 31 May, Constellation posted earnings of USD 49.1 million, or 22 cents a share, up from USD 6.5 million, or 3 cents a share, a year earlier. Excluding restructuring and other impacts, earnings climbed to 38 cents from 22 cents. Net sales, which exclude excise taxes, dipped 0.5 percent to USD 787.5 million.

The brewery is designed for future growth in 5–million hl modules and is highly automated. Because of its proximity to the U.S., the brewery will allow for a more efficient distribution of Modelo’s products in its export markets.

In terms of overall market shares in the U.S., AB-InBev accounts for 48.9 percent of the market, while Miller Coors – a joint venture between SAB Miller and Molson Coors – has 29.5 percent, Beer Marketer’s Insights says.

The programme includes:

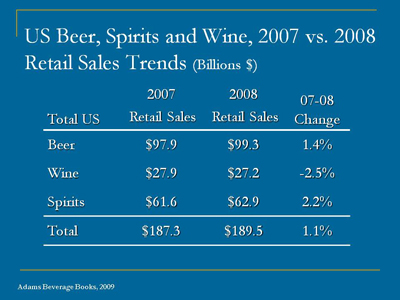

So it’s not the recession but unemployment which drives beer sales south. Brewers think that there are two major forces at work: unemployment in general, and more specifically unemployment among the 21 to 35-year-old consumer bracket which has been disproportionately hit. That category of people has a 15- to 16-percent unemployment rate in the U.S. Unfortunately it’s the self-same consumer group which has been most willing to buy premium beers.

Since 2003, the Chavez government has imposed price controls on many foodstuffs. The results have been persistent shortages and soaring inflation in a country of 27 million people: the price of food and drink rose by 21 percent alone in the first five months of 2010, reports The Economist.

Cognac-drinking consumers were historically older and more affluent, but that’s changed in the past decade as hip-hop artists have touted the spirit in popular culture. Hennessy is capitalising on that success with a social media effort for Hennessy Black, which costs USD 39.99 for a 750 ml bottle. For Hennessy, this is the first major product launch in the United States in almost 50 years. The suggested retail price puts Hennessy Black at a premium to the Hennessy VS (very special), which often sells for around USD 30, but still below the higher-end VSOP (very special old pale) and XO (extra old) versions.