Boston Beer merges with Dogfish Head in USD 300 million deal

USA – Two of the biggest names in the craft beer industry are joining forces. Boston Beer, maker of Sam Adams beer, has acquired Dogfish Head for about USD 300 million, the companies announced on 9 May 2019.

The deal combines two legacy craft brewers as they confront slowing industry sales and rising competition.

Dogfish Head’s founder Sam Calagione and his family will receive 406,000 shares of Boston Beer Company, valued at USD 314.60 per share. Additionally, Dogfish Head’s shareholders are set to receive USD 173 million in cash. In 2015, Mr Calagione had sold a 15 percent stake in his company to private equity firm LNK Partners.

This values Dogfish Head at about USD 1000 per barrel sold, which is in line with historical valuations for craft breweries (USD 700 to USD 1000 per barrel), although in some cases valuations shot up to USD 3,000 per barrel (eg Ballast Point) and even beyond that sum.

Dave Burwick, the CEO of Boston Beer Company, will lead the merged company, while Mr Calagione will join Boston Beer’s board of directors in 2020. The combined company will maintain its status as an independent craft brewery, as defined by the Brewers Association.

“This combination is the right fit as both Boston Beer and Dogfish Head have a passion for brewing and innovation, we share the same values and we will learn a lot from each other as we continue to invest in the high-end beer category,” Mr Koch said in a statement.

Messrs Koch and Calagione are both craft beer pioneers. Boston Beer, founded by Mr Koch in 1984, ranked 2nd among US craft brewers in 2019, Dogfish Head, which was founded in Milton, Delaware, in 1995, 13th. Dogfish Head is expected to reach a turnover of between USD 110 million and USD 120 million this year. It employs about 400 people, produces most of its beer at its brewery in Milton, and sells its beer in more than 40 states.

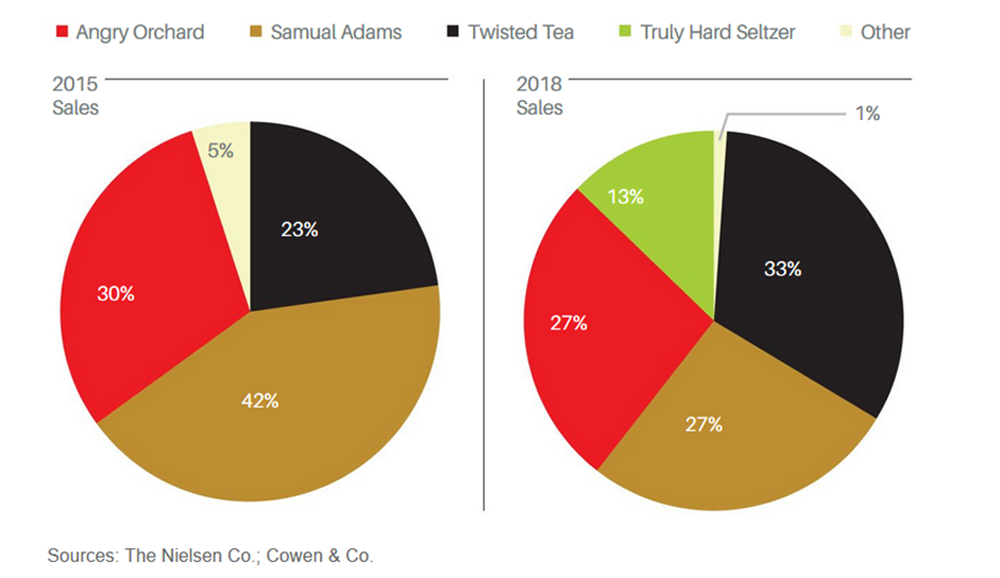

But whereas Dogfish Head managed to keep growing its beer sales (it is on track to brew 300,000 barrel/350,000 hl beer in 2019), Boston Beer has witnessed declining sales for its Sam Adams brand for several years. Still, it has managed to maintain annual turnover at slightly under USD 1 billion because of Mr Koch’s decision to branch out into Flavoured Malt Beverages (FMBs), such as hard cider and, more recently, spiked tea and seltzer.

The company launched Angry Orchard hard cider nationally in 2012, and last year returned the category to growth with Angry Orchard Rosé, a pink cider. It has been selling Twisted Tea since 2001, and Truly Hard Seltzer since 2016.

Although Boston Beer keeps it beer volume sales a secret, Nielsen data show that today beer only contributes 27 percent to Boston Beer’s total sales.

Authors

Ina Verstl

Source

BRAUWELT International 2019