Analysts expect management changes at Anheuser-Busch

Whereas in times of economic weakness anxious investors usually tend to buy into safe havens, including brewery stocks, they have passed for now on ordering up the "King of Beers" -- leaving Anheuser-Busch’s shares flat.

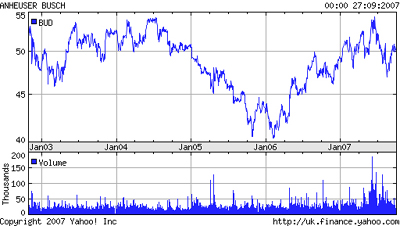

Anheuser shares, just above a 5-year low, have gained 6 percent over the last year, underperforming competitors and leading some industry observers to expect some imminent management changes in St. Louis.

Anheuser’s performance, it was reported at the end of September, compares to gains of 26 percent for Heineken, 37 percent for SABMiller, 44 percent for Molson Coors Brewing and 47 percent each for Carlsberg and InBev.

The Standard & Poor’s 500 index has gained 14 percent over the same period.

Anheuser’s problem, observers have said, stems from its reliance on the U.S., where it controls nearly half the market. A huge part of its earnings comes from the U.S., which has been a mature market since the early nineties.

In the end it did not come as a surprise that Anheuser-Busch acted as expected. A few days after the unflattering comparison was published Anheuser-Busch shuffled some of its top executives about.

According to a report by the Wall Street Journal, the brewer told employees that Dave Peacock, who had been Vice President of business operations, is swapping roles with Mike Owens, who had been Vice President of marketing.

Among other changes, Marlene Coulis, formerly Vice President of brand management will take on the role of Vice President of consumer strategy and innovation, the article said. Further, Keith Levy, formerly Vice President of sales and retail marketing, will become Vice President of brand management and geo-marketing.

Whether these changes amount to anything more than a “oh I got a new office” and will have a material impact on Anheuser-Busch’s performance remains to be seen.

Anheuser-Busch, by analyst consensus, has suffered as U.S. consumers increasingly choose wine, spirits, imported beers or craft beers over its Bud and Budweiser. Although it has sought to capitalise on these trends through distribution deals with InBev and Grolsch, among others, Anheuser-Busch has not been able to sway market opinion.