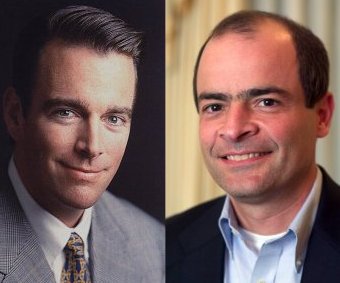

InBev and Anheuser-Busch in merger talks?

In mid-February there was a Brazilian press report saying that the two companies have held preliminary merger talks, quoting a source close to top Brazilian InBev investors. The Brazilian investors have also been behind the USD 11 billion merger between Brazilian brewer AmBev and Interbrew that created InBev in 2004.

For a long time analysts have been speculating on a merger between InBev and Anheuser-Busch which could make sense as the two companies are very complementary. InBev has extensive operations in Latin America and Europe, while Anheuser-Busch is a big player in the U.S. market. There would also be very few antitrust hurdles to overcome because of little overlap in the two companies’ major markets.

However, it’s only been recently that InBev has enjoyed a strategic advantage in the merger talks: Since the end of 2006 InBev’s market capitalisation of USD 40.3 billion has been in excess of Anheuser-Busch’s USD 37.7 billion. This would allow InBev to in fact takeover Anheuser-Busch and bargain for more favourable terms. Still analysts interviewed on the occasion reckon that InBev will have to pay up to the low USD 60s per Anheuser-Busch share.

On 14 February Anheuser-Busch’s share at the New York stock exchange rose 3.27 percent to USD 51.87, InBev’s climbed 4.62 percent to EUR 53.20 in Brussels.

Obviously, spokespersons for the two companies have had to decline to comment on the rumour.

The two brewers have had various dealings with each other over the years. In 2006 InBev and Anheuser-Busch inked an agreement that gave Anheuser-Busch exclusive U.S. distribution rights to InBev’s premium brands. In addition, InBev sold Anheuser-Busch its Rolling Rock beer brand for USD 82 million.

The companies also have a distribution deal in Canada, where InBev operates beer maker Labatt. Labatt makes and distributes Anheuser-Busch’s beer brand, Budweiser, in Canada. Canada is Anheuser-Busch’s number two market behind the United States.

It has been pointed out that an InBev-Anheuser-Busch tie-up would allow InBev to enter the Mexico market, where Anheuser-Busch holds a 50 percent stake in Modelo. Modelo, which makes the popular Corona brand, holds a 56 percent share of the Mexican market.

Mexico is home to brewer Femsa, which has irritated InBev’s Brazilian unit AmBev on its own turf. In 2006, Femsa purchased a controlling stake in Cervejarias Kaiser. Femsa has launched the Sol brand in Brazil through Kaiser in an attempt to whittle AmBev’s dominant position (70 percent market share) in Brazil, the world’s fourth-largest beer market.