Not a good start for Schincariol

While AmBev, the Brazilian unit of AB-InBev, managed to increase its sales volume of beer by 4 percent in the first quarter (the total market was up too), Schincariol saw volumes decline 5.5 percent.

True, the weather had been a little cooler and rainy in Brazil compared to the same quarter a year ago. But AmBev nevertheless managed to take advantage of industry growth and increase its market share slightly to about 69 percent.

Japan’s brewer Kirin, which has owned Schincariol since last year and hopes to turn the business around this year, cannot have been too pleased when its nearest rival Petropolis – with whom it competes for the number two slot in the market – announced that it plans to build a new brewery on Schincariol’s home turf.

Brazilian media announced in March this year that they expect a beer war in the northeastern part of the country, following Petropolis’ decision to locate its new brewery in Alagoinhas, home to Schincariol’s largest plant, it was reported.

It is in the Brazilian northeast that Schincariol dominates the market, rather than AmBev. In some cities, the Nova Schin brand is the market leader, ahead of traditional Skol and Brahma.

Since it was founded in 1994, Petrópolis has expanded its reach across the country and currently has four breweries.

Petropolis’ foray into the northeast had been widely expected, but the choice of Alagoinhas, a city of 150,000 inhabitants, Brazilian media likened to a declaration of war, especially as Petropolis will look to poaching some of Schincariol’s workforce. Local media report that Petropolis hopes to provide employment to 700 people in Alagoinhas once the plant has been built.

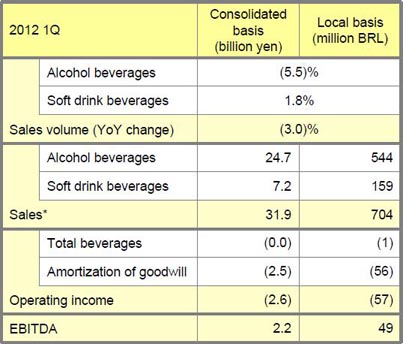

Schincariol’s 1Q 2012 figures don’t look too good