U.S. beer market achieved turnaround in 2012

While most of us were partying through the holiday season, the experts at beerinsights.com worked overtime to put together their preliminary data on the performance of the major U.S. brewers and importers in 2012. They were released on 14 January 2013 and make fascinating reading.

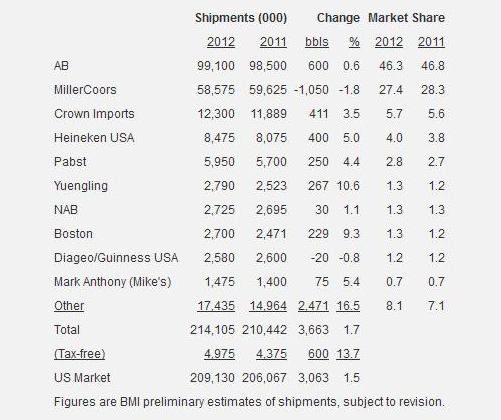

If beerinsights.com did not get its numbers wrong – and from past experience we have no reason to doubt them – the U.S. beer market finally managed its long-awaited turnaround last year. It returned to growth – 1.5 percent or 3.5 million barrels (4.1 million hl) if you include tax-free volumes (exports, military, etc) – after three years of decline.

According to beerinsights.com’s estimates, AB-InBev achieved its first gain in volume since the purchase of Anheuser-Busch by InBev in 2008. This is probably due to the success of new products, namely Bud Light Platinum and Bud Lime-A-Rita. Although AB-InBev sold perhaps 700,000 hl more beer in 2012, its market share nevertheless slipped 0.5 percent.

Beerinsights.com reckons that AB-InBev still controls a market share of over 46 percent, but this is way below its erstwhile high of 49.6 percent back in 2003. And despite its 2012 gain, AB-InBev is still 9.4 million hl short of its 2008 volume, a fact beerinsights.com could not resist rubbing in.

Surprisingly, MillerCoors was the only brewer to lose significant volume in 2012. Beerinsights.com. says it lost perhaps 1.2 million hl. This is a loss of almost 7 million hl in volume since 2008, when the joint venture between SABMiller and Coors was set up. Last year’s volume loss translates into a loss of market share of nearly 1 percent. Beerinsights.com thinks that MillerCoors’ market share has now dropped to 27.4 percent, or 2 percentage points below its 2008 market share.

Together the Big Two have had to sacrifice 5 percent in market share since 2008, beerinsights.com says.

Ranked third and fourth are two importers: Crown Imports (Corona Extra) and Heineken USA. The Corona import business has been on a roll for years. Although it lost a brand in 2012 (St Pauli), it nevertheless managed to sell more beer: plus 480,000 hl, according to beerinsights.com.

Heineken USA, like Crown, added roughly 470,000 hl in volume, but while

Crown hit a new peak in volumes, Heineken is about 940,000 hl below its 2008 peak.

As concerns craft brewers, beerinsights.com is waiting for their final shipments figure. But it thinks that craft brewers will have posted another healthy gain, driven by continued double-digit increase for the craft segment.

As the brewers’ reporting season draws nearer, it will be interesting to watch how the big players will explain these changes.