Wine down the drain

To get rid of excess wine in the U.S., the former Foster’s wine unit Treasury Wine Estates (TWE) said in July 2013 that it plans to destroy AUD 35 million (EUR 25 million) of unsellable wine in the U.S., and to dispose of AUD 40 million worth of lower-quality wine at fire-sale prices in Australia.

TWE has opted to destroy some of the wine it markets in the U.S., because selling it would further devalue the company’s brands.

Upon the announcement that the world’s second largest listed wine maker would make provisions of AUD 160 million (EUR 112 million) for 2013 to reduce excess inventories, TWE’s shares dropped 12 percent – their biggest slump since the 2011 demerger from Foster’s.

TWE also warned that wine shipments from Australia to the U.S. would fall around 12 percent this year, reducing anticipated earnings in 2014 by about 10 percent.

This announcement not only made people question TWE’s bloated evaluation of its inventory, it also led to concerns that TWE was “channel stuffing” to boost sales figures and grow market share. Credit Suisse’s analyst Larry Gandler was quoted as saying that TWE’s excess inventories in the U.S. have tripled over the past three years. Each of TWE’s top five brands in the U.S.—Beringer, Lindemans, Stone Cellars, The Little Penguin and Meridian—have lost ground, although Beringer and Lindemans posted modest growth last year.

Other investors, who declined to be named in media reports, implicitly accused TWE’s management of dodgy business practices, saying that it appeared to have turned a blind eye to channel stuffing or trade loading, which had helped disguise a deteriorating underlying performance in the United States.

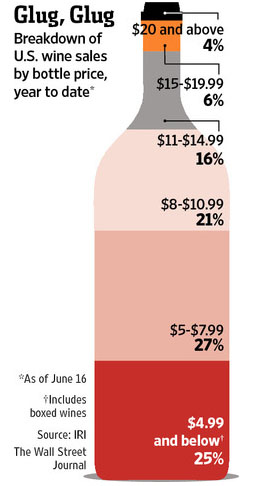

The Wall Street Journal said that TWE’s struggles set it apart from the broader wine industry in the U.S., which is posting record sales after 19 straight years of volume growth and an increased thirst for imported labels. What is more, much of TWE’s U.S. sales are in the low-price segment at a time when American tastes are turning towards more expensive wines.