Suntory of Japan to buy maker of Jim Beam whiskey

“They might as well have bombed the harbor [Pearl Harbor] again. This is a sad, sad day for America” was one of the less than kind comments on U.S. social media after news broke on 13 January 2014 that Japan’s Suntory is acquiring U.S. spirits company Beam Inc for USD 16 billion including debt. Beam Inc owns brands like Jim Beam, Maker’s Mark, Canadian Club whisky and Courvoisier cognac.

Few spirits are as American as bourbon. That’s why initial reactions in the U.S. were mostly of the jingoistic knee-jerk kind. “First Anheuser-Busch, now Jim Beam. Where is it going to end?”

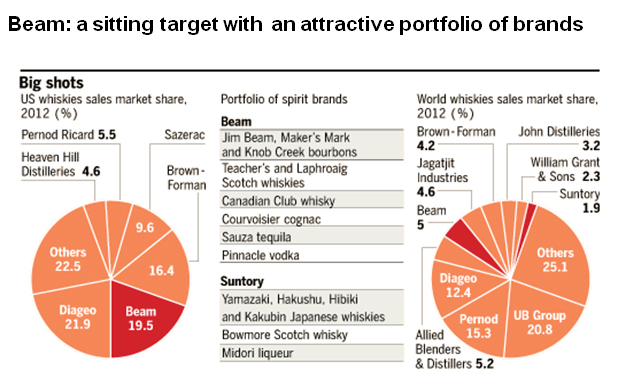

The answer is: it’s probably going to end here as there aren’t any iconic spirits brands left to buy. Suntory struck one of the biggest takeovers in the spirits industry in years, catapulting it from 15th to the third-ranking distiller globally, behind UK-listed Diageo and France’s Pernod Ricard. Nevertheless, the global market for spirits is still fairly fragmented. The four largest spirits companies have a combined 9 percent of global volume and 22 percent of dollar sales, according to Bernstein Research. The four largest players in the beer industry by contrast control 74 percent and 49 percent of global volume and dollar sales, respectively.

Americans may moan and whine that they have to look elsewhere in Kentucky if they want to continue drinking America-owned whiskey (well, there is still Jack Daniel’s from Tennessee), but this is not the first time Kentucky’s bourbon brands have been sold to foreign-owned companies. And actually it’s not even the first time a Japanese company has taken an interest in Kentucky bourbon. Kirin purchased the Four Roses brand in 2002, while Italy’s Gruppo Campari purchased the Wild Turkey brand in 2009.

Also, Maker’s Mark has had different owners over the years. The Samuels family sold it to Hiram Walker in 1981. Walker sold it to UK-based Allied Domecq in 1987, which sold it to Fortune Brands in 2005.

Patriotic American tipplers have another American to thank that Beam Inc came on the market. The sale of Beam Inc was a fate many analysts had predicted, since the unfortunate Fortune Brands, a conglomerate, announced plans to break itself up more than three years ago under pressure from the “activist investor” William A. Ackman, whose hedge fund was Fortune’s largest shareholder. Fortune Brands, which produced spirits, Titleist golf balls and Moen faucets, eventually sold its golf equipment business and spun out its home products division.

What was left of the erstwhile Fortune Brands group was Beam Inc, one of the country’s biggest producers of bourbon and the beneficiary of a resurging interest in American whiskey.

The cash deal values Beam Inc at 19 times 2014 EBITDA estimates, says Ian Shackleton, an analyst at bank Nomura. Suntory offered to pay USD 83.50 per share, which represents a 25 percent price premium for the stock. This is at the very high end of recent transactions. Obviously, single brands – such as Pinnacle and Absolut vodkas – have sold at close to 20 times EBITDA. But comparable collections of spirits brands have gone for much less.

The transaction, which still needs approval by Beam’s shareholders, is expected to close in the second quarter 2014. There are unlikely to be any regulatory issues as most of the Suntory spirits business is in Japan. It’s equally unlikely that it will lead to any material disposals, says Mr Shackleton.

There is only one U.S.-listed spirits company left: Brown Forman, the maker of Jack Daniel’s and Woodford Reserve. This will increase speculation of a bid here, although one should bear in mind that the Brown family controls the company through the high voting A shares.

The heavyweights of the business – Diageo and Pernod Ricard – face many constraints on their ability to grow through mergers and acquisitions. While the two companies had considered bidding for Beam Inc, neither ultimately moved ahead.

If completed, the deal will add not only Jim Beam, but also the pricier higher-end brands like Baker’s and Knob Creek bourbon, Laphroaig and Teacher’s Scotch and Courvoisier cognac to Suntory’s portfolio.

Founded 115 years ago, Suntory created Japan’s first distillery in 1923 using the principles of Scotch whisky production. But it has since grown into a sprawling conglomerate that spans fitness clubs, Subway restaurants, fresh flowers and golf ranges.

In recent years, Suntory has been expanding overseas to counteract a shrinking home market. Its subsidiary, Suntory Beverage & Food, bought the European soft drink company Orangina Schweppes from private equity outfits Blackstone and Lion Capital in 2009 for USD 3.84 billion, and acquired the Lucozade and Ribena brands from GlaxoSmithKline in 2013 for USD 2.1 billion. Suntory raised close to USD 4 billion when it partly listed its non-alcoholic beverages business on the Tokyo Stock Exchange last year.

Buying Beam Inc will bring Suntory’s total annual revenue from spirits to USD 4.3 billion, it was reported, and bolster the Japanese company’s presence in the U.S. market. It will also allow Suntory to push further into India, one of the world’s most promising Scotch whisky markets, where Teacher’s is one of the largest selling Scotch brands, competing closely with both Diageo’s Johnnie Walker and Pernod Ricard’s Chivas Regal.

Analysts say that they expect the new ranking of top distillers to be the status quo for some time, with little chances that one could absorb any of the others. Instead, the most attractive acquisition targets could be smaller spirits groups like Gruppo Campari, which owns Skyy Vodka and Wild Turkey bourbon, and Bacardi, which owns Dewar’s and Grey Goose.