Shares in Constellation Brands are flying high

Analysts are currently drooling over Constellation Brands, whose shares just seem to go up and up: from USD 40 in 2013 to over USD 120 in early July 2015, doubling the company’s market capitalisation to over USD 20 billion.

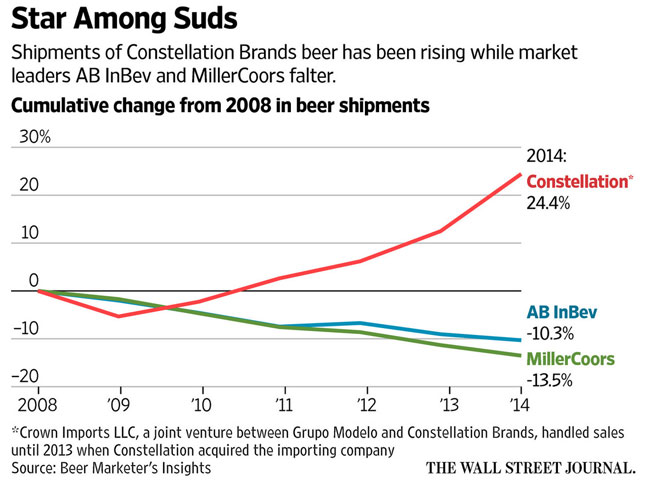

All this came on the back of increasing beer sales. Funnily enough, until 2013 Constellation Brands was not even a brewer. It was basically a winemaker with USD 2.8 billion in sales and a toehold in the beer business. It made Robert Mondavi and Clos du Bois wines and sold Corona beer in the U.S. through a joint venture with Mexico’s Grupo Modelo, called Crown Imports.

As the Wall Street Journal reminded its readers in June 2015, it might still be doing that had AB-InBev not tried to take over Grupo Modelo in 2012 for USD 20.1 billion, which got the anti-trust guys up in arms. AB-InBev was told to shed some assets to satisfy regulators. Since Crown Imports was a joint venture with Grupo Modelo, Constellation Brands was the logical beneficiary.

Initially, AB InBev struck a deal to sell Constellation Brands the ten-year rights to Modelo’s U.S. importing business. After regulators intervened again, Constellation Brands received a bigger windfall: Modelo’s Nava Brewery, ten beer brands and the rights to peddle Modelo beers in the U.S in all perpetuity. The assets were valued at USD 5.3 billion.

Thus, literally overnight, Constellation Brands became the number three brewer in the U.S. by volume.

Constellation Brands’ annual sales have increased to USD 6.03 billion since 2013, with beer contributing 53 percent of sales. The beer division’s operating profit rose to USD 1.02 billion from USD 448 million in 2013, dwarfing the operating profit of USD 674.3 million from wine and spirits. The company’s total beer shipments in 2014 reached an estimated 14.4 million barrels (16.8 million hl), according to Beer Marketers Insights.

Shipments of Corona alone have increased to 7.8 million barrels (9.1 million hl), making it the top import and fifth-best selling U.S. beer. And shipments of Modelo Especial have more than doubled over the five-year period to 4.5 million barrels (5.2 million hl), helping it become the U.S.’s ninth-biggest beer brand in 2014, reckons Beer Marketers Insights.

This put Constellation Brands into a tight spot with the U.S. Justice Department. When acquiring Modelo’s U.S. beer business, Constellation Brands agreed to produce 100 percent of the beer they sell by June 2016. But the brewery only makes 8.4 million barrels of beer – about half of Constellation Brands’ U.S. sales. So AB-InBev have helped them out by contract brewing the rest of the volume needed.

The logical solution was to expand the Nava brewery, which turned into a difficult task for a company with about 70 years of winemaking experience but none in brewing. Because Constellation Brands had to change tack in the planning stages to provide for an even greater capacity.

By the latest count, Constellation Brands’ ongoing expansion project stands to cost them more than USD 2 billion, CEO Rob Sands noted during an appearance in Mexico City on 16 June 2015. That’s USD 500 million more than what he had estimated back in March.

Of the USD 2.27 billion in total investment, USD 1.65 billion is destined for the expansion of the brewery, while USD 625 million is being pumped into the glass plant.

The expansion of the brewery and the glass plant will create 3,500 jobs during the construction phase. The project is expected to create 2,500 direct jobs and 700 indirect jobs once it is completed.

The brewery’s capacity will be expanded from 10 million hl per year today to 25 million hl annually by 2017.

At the same time, Constellation Brands are searching for a site to build a second brewery in Mexico, nearer to California, which currently accounts for 25 percent of the company’s volume. The brewery, once it comes on stream in 2018, would make at least 10 million hl beer, according to company executives, but could eventually expand to produce 24 million hl.

No wonder, analysts believe that Corona’s boom isn’t likely to slow down, in fact predicting that Constellation Brands’ beer sales will keep posting an annual growth rate of at least 6 percent for the next decade. What’s more, on 9 April 2015 Constellation Brands said that they would be paying dividends – something they never did before.

Seeing plenty of beer and dollars come their way, they are probably all calling for free rounds of Corona.