AB-InBev buys two acclaimed craft brewers

In case you wondered why AB-InBev shortly before Christmas last year clinched deals with two more U.S. craft brewers – Four Peaks in Arizona and Breckenridge in Colorado – the answer is: “It’s the geography, stupid!

After Goose Island (Chicago), Blue Point (New York), 10 Barrel and Elysian (Northwest) and Golden Road (California), AB-InBev has now added Arizona’s largest craft brewer Four Peaks and one of Colorado’s oldest craft beer companies, Breckenridge Brewery, to its stable of craft beer brands.

AB-InBev’s distributors will be pleased. Save for a few regions, AB-InBev’s craft beer portfolio is beginning to look truly national, including brands from both the West Coast and the East Coast, the Midwest and the Southwest.

Arizona’s Four Peaks and Breckenridge seem to perfectly fit AB-InBev’s acquisition pattern: they are both well-known, mid-tier breweries that have deep footprints in their respective regions. Add to that cult status and smallish volumes – meaning that AB-InBev will not have too much hassle when integrating the brands into its own house – and you can see why AB-InBev would have been keen to snap them up.

Four Peaks, which started in 1996, is expected to have sold about 80,000 hl beer in 2015. The brewery’s flagship Scottish-style ale called Kilt Lifter accounts for more than 60 percent of sales.

Breckenridge, which was founded in 1990, was also on track to produce 80,000 hl beer in 2015. It has since transpired that Breckenridge was forced to sell because one of the partners wanted out.

Its President Todd Usry, who oversaw the construction of the new farmhouse brewery in Littleton for two years before its May 2015 opening, said that shortly after its completion, his partners from the four-year-old Breckenridge-Wynkoop joint venture approached him and said they were not interested in overseeing a company as large as Breckenridge was becoming. So he had to seek a buyer for the brewery which is the 50th-largest craft brewer in the U.S. and distributed in 35 U.S. states.

Terms of the transactions weren’t disclosed. In the past, AB-InBev paid USD 38.8 million for Goose Island, USD 24 million for Blue Point, an estimated USD 50 million for 10 Barrel Brewing and USD 60 million for Elysian. Compared with the USD 110 billion AB-InBev is prepared to spend on taking over SABMiller, these sums are Mickey Mouse money.

Even if these craft beer acquisitions won’t move the sales needle much for AB-InBev initially, at least the world’s biggest brewer is proving to the analysts that it is aware of the success of the category and is acting accordingly. In 2014, U.S. craft brewers generated almost USD 20 billion in retail sales and accounted for 11 percent of the total beer market.

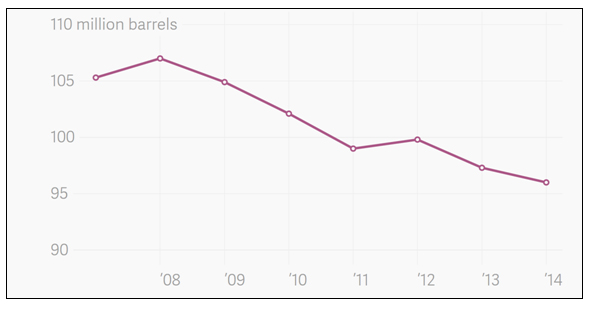

It’s a worry: AB-InBev beer sales in U.S.

Keywords

USA acquisitions international beverage market mergers

Authors

Ina Verstl

Source

BRAUWELT International 2016