Punters don’t open their wallets for BrewDog’s US crowdfunder

It does not look like BrewDog’s latest crowdfunding scheme is a hit with US investors. In August this year, Scottish brewer BrewDog launched a USD 50 million campaign to help pay for its new 300,000 hl brewery in Columbus, Ohio, which is slated to go on stream in 2017. The company is also planning to open a brewpub in any American city where at least 500 people invest in the company’s Equity for Punks USA crowdfunding campaign.

This time BrewDog is selling 1,052,632 shares of its Common Stock. The offer is open to anyone who wants to invest, anywhere in the world, as long as it is legal in the investor’s country. Shares cost USD 47.50 each and the minimum investment is two shares (USD 95).

However, after raising USD 1 million during the first three days of its campaign, BrewDog admitted it has managed to secure only USD 3 million of its initial goal to date, according to a press release issued in November 2016. The US crowdfunder is scheduled to run until February 2017.

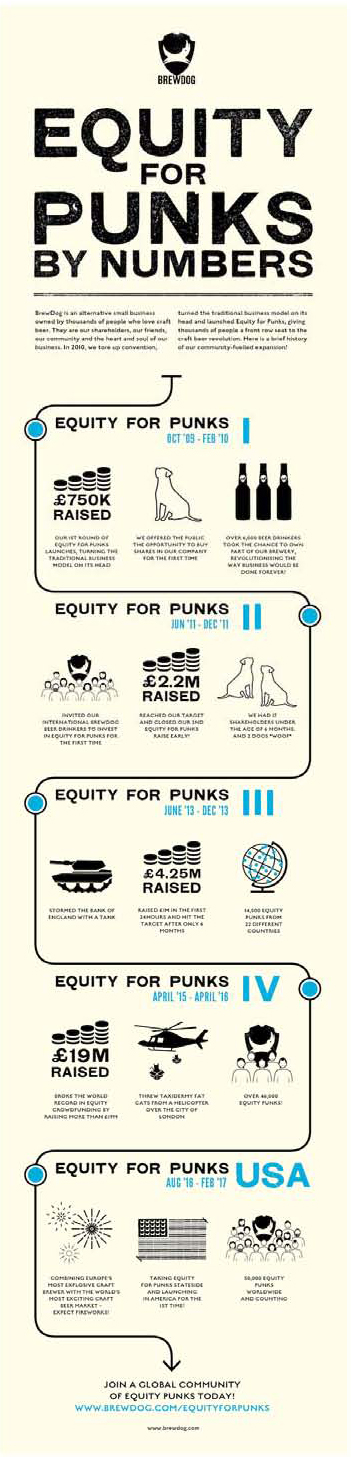

Ever since starting out in 2007, BrewDog has refused to take on bank loans. Instead, it has relied on crowdfunding for its expansions. Thanks to several crowdfunding rounds in the UK since 2009, BrewDog has so far collected over GBP 26 million (USD 33 million) from the likes of you and me.

The company calls its fundraising system “Equity for Punks” and holds investor parties with beer tastings and music. Investors serve as ambassadors; they tell their friends because it’s good for their wallets, but also because they care.

Investors do not have dividends to look forward to due to BrewDog’s policy of reinvesting all profits. Selling the shares is difficult, too, because the stock is not listed on an exchange. Presently, investors can only trade stock once a year on Asset Match, a website that facilitates dealings in private companies.

Contrary to what ill-minded rivals think, BrewDog will not sell out to a Big Brewer in order to return money to its punk investors. When questioned last year, James Watt said: “I’d rather shoot myself in the head than sell to a Big Brewer.” A flotation on the stock exchange would provide investors with a potential exit, but a listing does not appear imminent. Mr Watt admitted that a float might eventually be part of the plan, but it could just be a partial float.

Nonetheless, people buying BrewDog shares are far less likely to be investing for profit than to support a company they care deeply about.

Not so in the US, yet, it seems.