Taproom sales rise to over 2.7 million hl in 2016

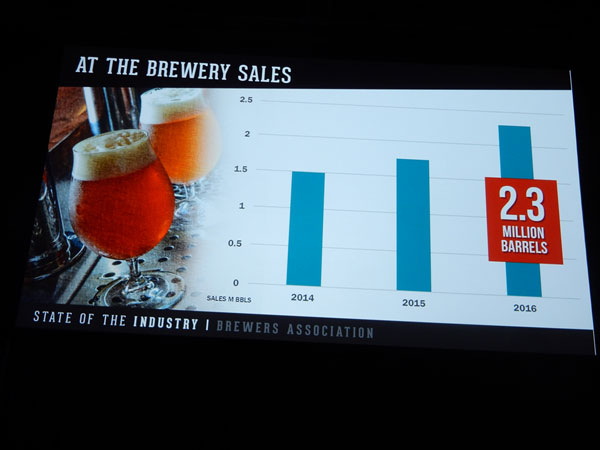

No wonder, distributors across the US are rallying behind state legislators to limit taproom sales at craft breweries. As the Brewers Association reported at its annual industry gathering, the Craft Brewers Conference, which was held in Washington, DC, from 10 to 13 April 2017, “at the brewery sales” rose to around 2.3 million barrels (2.7 million hl) in 2016.

That’s roughly 10 percent of total craft beer sales which stood at 24.6 million barrels last year. Whether this estimate is correct or too low (in our view) is beside the point here.

Considering that craft brewers on average make between USD 700 and USD 800 (that’s USD 1,000 per barrel minus taxes and costs) on a barrel of beer in their taprooms, this easily adds up to nearly USD 1.8 billion in profits going straight to the brewers. Unsurprisingly distributors are not amused by this as a lot of beer and even more profits seem to pass them by each year.

Craft brewers are reluctant to disclose their taproom volumes. But any visit to Asheville, North Carolina, a city of 88,000 people that sports 22 local and three national craft breweries - Sierra Nevada, New Belgium and Oscar Blues – will drive home the point that they must be sizeable. And this is despite the fact that several don’t even do food. Instead, like New Belgium, they have an independently operated food truck parked outside where punters can buy their snacks to eat inside.

At New Belgium they explain their refusal to serve food by saying that they do not want to take business away from the city’s restaurants. But this does not really stand up to reason. At Sierra Nevada, both beer and food is served at the brewery restaurant and taproom, which seats nearly 400 people. When I visited their place midweek in April it was already packed out straight after opening at 11 am. Does operating their own restaurant hurt their business in Asheville? Several visits to bars in the area suggest no.

As Oscar Wong, who founded Asheville’s oldest craft brewery Highland Brewing Company in 1994, said, he currently sells about 10 percent of his 40,000 barrel in annual production at his taproom. Although his original business plan foresaw that he would only brew beer and sell it to distributors, he reluctantly had to give in to his employees who pushed for a taproom. He admitted that profits from taproom sales are far better than what he can make from selling his beer to distributors. His business plan will undergo another rewriting when he will turn his taproom into a restaurant – not wanting to be left out from this action.

Mr Wong was fortunate in that he could adjust his business plan as his brewery grew. Other craft brewers are not so lucky. With sales of craft beer continuing to rise in a national beer market that has been more or less flat for years, distributors and the Big Brewers are turning to legislators in an effort to curb craft beer’s growth.

This year alone, two headline-grabbing bills wound their way through the state legislatures of Maryland and Nevada, which would have seriously hurt or ruined craft brewers’ business plans in those two states.

In Maryland, a bill was passed in April 2017 which actually raises the annual barrel limit for taprooms from 500 to 2,000, with the potential for brewers to purchase 1,000 additional barrels from wholesalers. However, it also requires taprooms to close at 10 pm every day of the week, including weekends, which somewhat counteracts the leniency granted, as breweries, which are already open and previously enjoyed longer opening hours, are grandfathered into the new hours set by the local jurisdiction.

In Nevada, proposed legislation would have forced craft brewers to tear up their business plans altogether. Hitherto brewpubs could produce 15,000 barrels of beer. If they reached that number, they had to stop production. Then two bills were introduced to Nevada’s legislature, one which would have raised the cap on beer production in Nevada, another which would have raised the cap slightly but only allowed two venues per company.

After a media outcry, a compromise was struck in April 2017. Brewpubs will not be limited to two locations, thus giving them the potential to open an unlimited number of locations statewide. The bill also raises the volume cap from 15,000 barrels to 40,000 barrels per year and ups the retail limit from 2,000 barrels to 5,000 barrels a year, despite there being no current limit on retail sales.

Many craft brewers fear that the regulatory environment could get a lot worse for them in years to come. Mr Wong does not agree. After all, councils have come to see that taxes from the beer business are good for the community. Plenty of craft brewers will hope that he is right.