Slower growth for craft beer sales – yet again

While insiders are still debating which factors contributed to craft beer’s mid-single digit increase in 2016, news has come in that in 2017 growth could be even slimmer.

Volume sales of craft beer rose only 2.5 percent from January through May, according to market-research firm IRI Worldwide. Bigger craft brewers, including Stone and Lagunitas, have seen sales rise, but Boston Beer, Craft Brew Alliance and Gambrinus were among those reporting sales drops over the same period. Most likely, the proliferation of craft breweries has started eating into the bigger craft brewers’ sales.

Making matters worse, that strange breed, the beer consumer, is seemingly losing his appetite for the stronger brews which, let’s not forget, boosted the rise of craft beer in the first place.

Market research firm Nielsen found that 45 percent of drinkers consider beers under five percent ABV to be ideal craft beers. That may explain the rising popularity of Gose beers and golden ales like Firestone Walker’s 805 (4.7 % ABV), New Belgium’s Dayblazer (4.8 % ABV) and Goose Island’s Summertime Kölsch (5.1 % ABV). They have seen sales increase more than 50 percent since last summer, according to Bump Williams Consulting.

If there is really a shift towards more “sessionable” craft beer styles, then craft brewers are facing two problems: One, as craft brewers churn out more lower-alcohol products, they are fully entering the Big Brewers’ territory. Competition will increase. And two, the economics of moderate alcohol craft beers will be no match for the Big Brewers’ margins. Plenty of craft brewers will have a hard time trying to charge super-premium prices for their weaker brews. What this will mean for their profit margins, we dare not imagine.

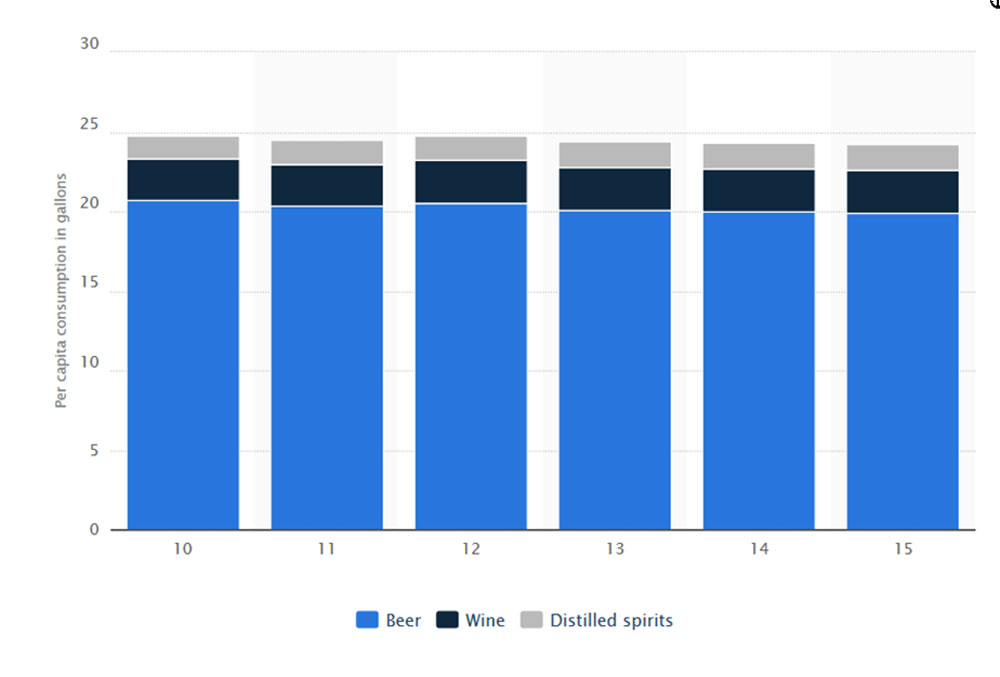

Moreover, even if craft brewers were to ingratiate themselves with consumers by offering those lower alcohol content beers, this does not mean that consumers will start swilling more beer. Instead, wine’s share of the overall alcohol market has jumped from 15.8 percent to 17.1 percent since 1999, while spirits sales have soared from 28.2 percent to 35.9 percent in the same span, according to the Distilled Spirits Council in the US. At the same time, beer’s share of the alcohol market has dropped from 56 percent in 1999 to 47 percent in 2016.

It seems that US consumers have no problems with alcohol as such. It’s just that they increasing prefer to drink other tipples.

As the US beer writer Jason Notte recently commented: “For much of the past decade, overall beer sales have been flat or have fallen – and now craft beer is feeling some of the effects of that stagnancy. Of all the issues facing craft beer, the most frightening, and perhaps most acute, is that drinkers may not want more of a specific beer segment or style. They may just want less beer.”