Beer sales are down, especially among fickle millennials

Blame it on the consumers. In 2017, US beer sales may drop again. Worse still, craft beer’s growth could slow down further.

Investment bank Goldman Sachs recently downgraded the stocks of two major brewers - Boston Beer Company, the maker of Sam Adams beer, and Constellation Brands, the third-largest beer company in the US, best known as the importer of Corona Extra and Modelo and the owner of craft brewer Ballast Point - due to sluggish sales.

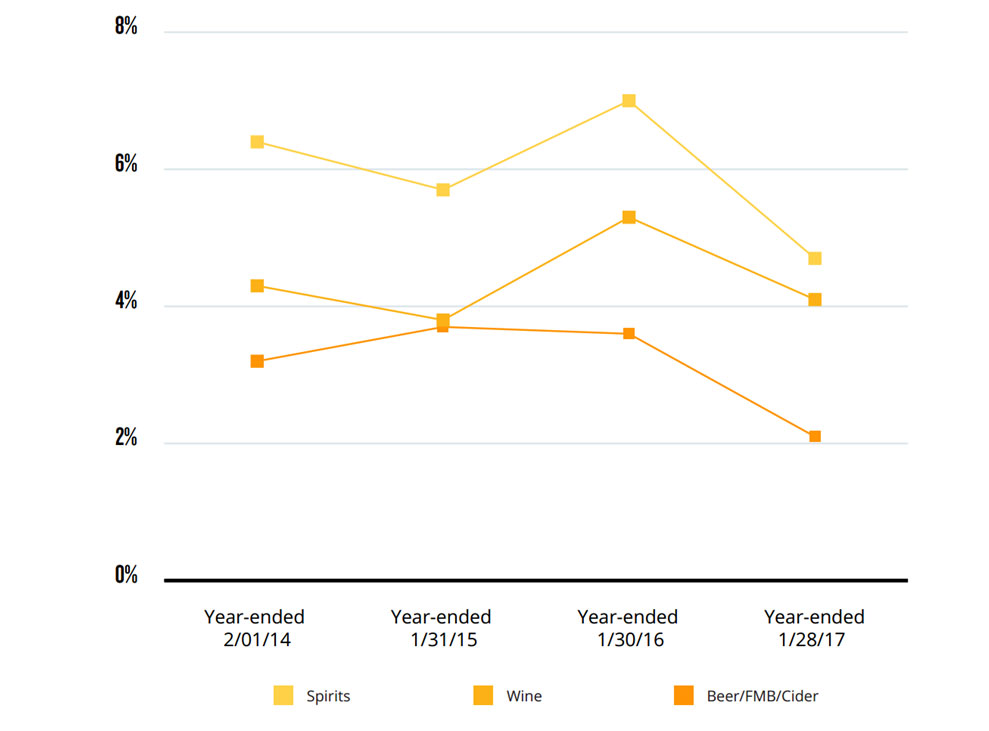

Apparently, younger consumers are not drinking as much beer as they used to. Goldman’s research suggests a shift away from beer to wine and spirits amongst those aged 35 to 44.

The beer business seems to be fizzling elsewhere too. According to the 2016/17 Barth Report, global beer sales declined 0.2 percent in 2016 (or slightly over 3 million hl), even though the global gross domestic product (GDP) increased 3.5 percent in 2016. That’s surprising as in the past economic growth correlated with increased alcohol consumption.

China saw its beer production drop 11 million hl to 460 million hl in 2016, while the US lost three million hl over 2015 and Brazil five million hl according to Barth.

China’s decline in beer production is the most acute as its domestic brewers have had to deal with a decline of nearly 50 million hl beer since 2013 when sales peaked at 506 million hl.

Apparently, it’s not just wine and spirits that are catching the attention of millennials. Let’s not forget the growing legalisation trend of marijuana in the US. Research suggests that more and more people turn to weed over alcohol.

Goldman Sachs is predicting a sales decline in the overall US beer market in 2017 and, as a result, both Boston Beer and Constellation Brands have seen a drop in their respective share prices.

Fortunately, latest data from the Brewers Association suggest that craft beer grew five percent in the first half of 2017. But even craft is slowing down. The segment was up eight percent during the first half of 2016.